Will Coronavirus Wreck The Classic Car Market?

In August 2019, we suggested how it might be a good time to thin out the classic car collection. Now vintage automobile prices are moving lower, which could result in a sharp correction.

With an economic depression unfolding in the second quarter, the classic car market could see downward pressure. Understanding how deep a correction would be is anyone's guess at the moment, but what is evident is that a record number of Americans were just laid off and will need to sell assets to build cash. Some of those assets include, as this piece is centered around, classic cars, as well as art, wine, etc...

To show automobile prices, we are sourcing Hagerty Market Rating, which provides a variety of classic car indexes.

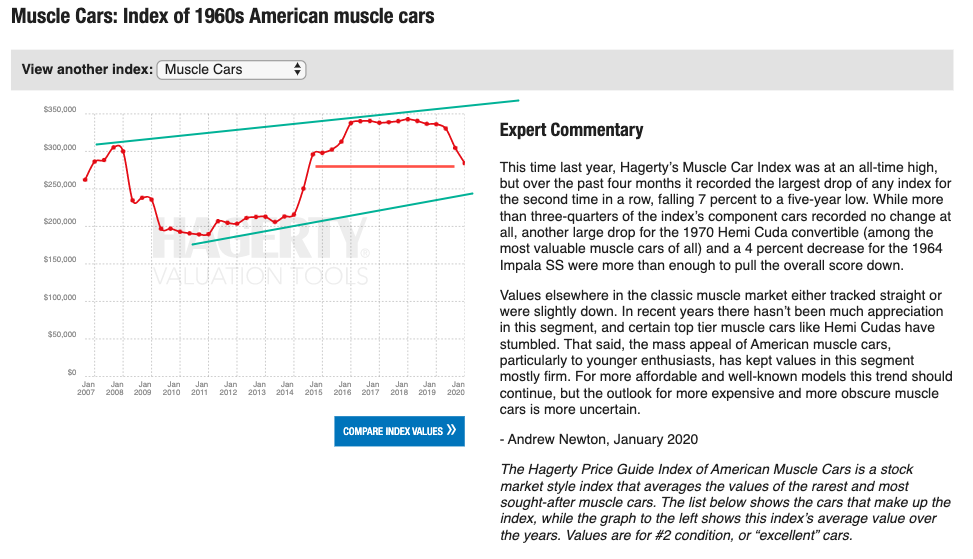

Hagerty's Muscle Car Index appears to have "recorded the largest drop" of any automobile index for the "second time in a row, falling 7 percent to a five-year low" in January, said Hagerty valuation editor Andrew Newton.

"While more than three-quarters of the index's component cars recorded no change at all, another large drop for the 1970 Hemi Cuda convertible (among the most valuable muscle cars of all) and a 4 percent decrease for the 1964 Impala SS were more than enough to pull the overall score down," Newton said.

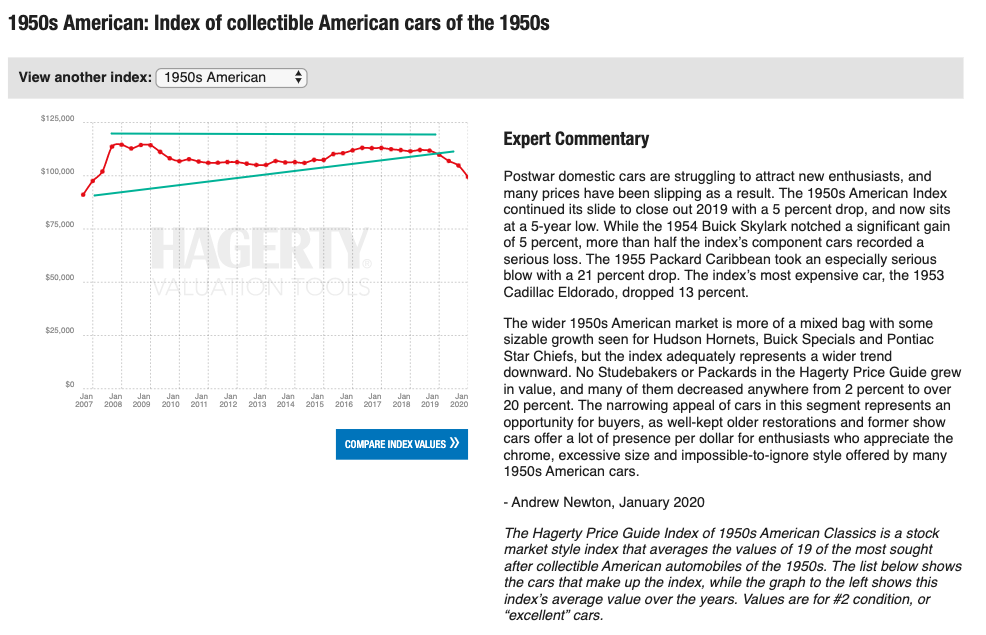

Next is 1950s American Hagerty Index that slumped 5% in 2019, and now sits at a 5-year low in January.

"The 1950s American Index continued its slide to close out 2019 with a 5 percent drop, and now sits at a 5-year low. While the 1954 Buick Skylark notched a significant gain of 5 percent, more than half the index's component cars recorded a serious loss. The 1955 Packard Caribbean took an especially serious blow with a 21 percent drop. The index's most expensive car, the 1953 Cadillac Eldorado, dropped 13 percent," Newton said.

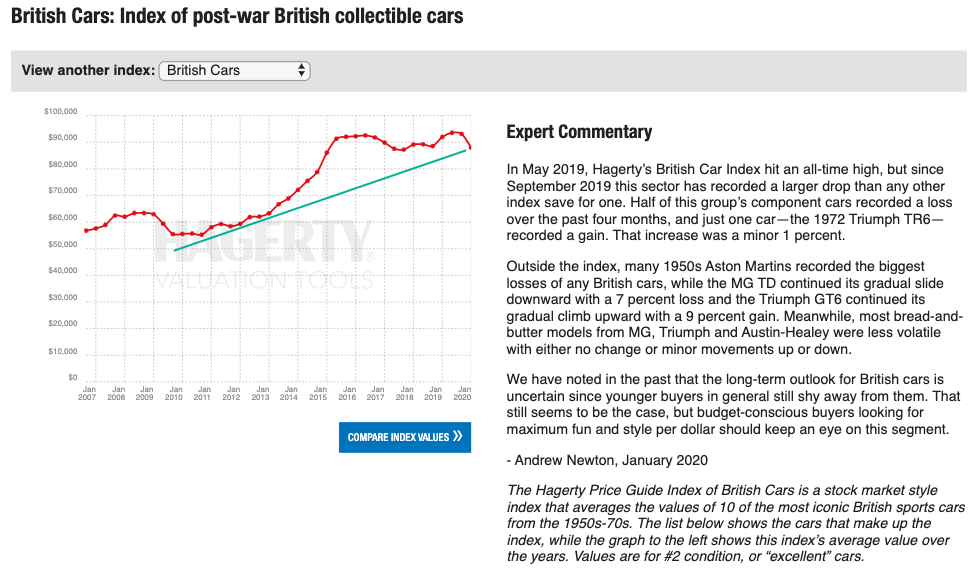

Hagerty's British Car Index remains at an all-time high but has hit resistance over the last several years.

"Half of this group's component cars recorded a loss over the past four months, and just one car—the 1972 Triumph TR6—recorded a gain. That increase was a minor 1 percent," Newton said.

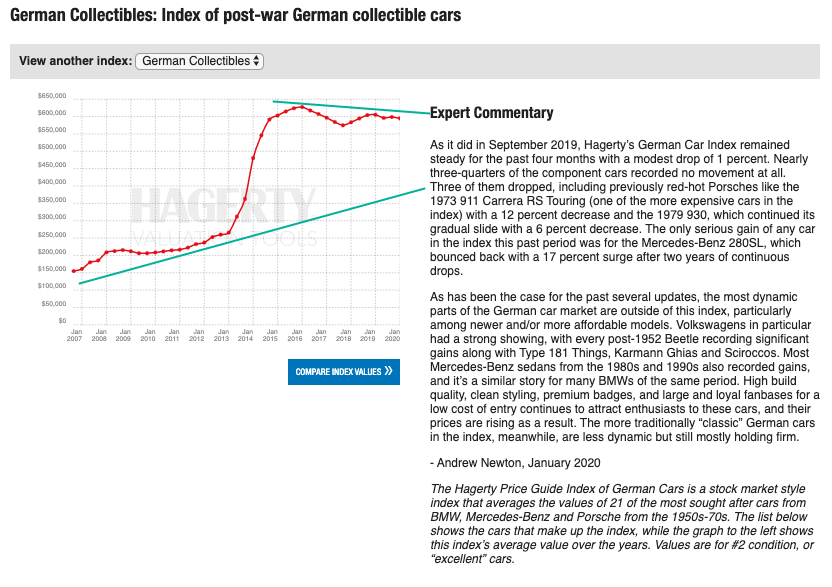

Hagerty's German Car Index remains slightly off the all-time high.

"Nearly three-quarters of the component cars recorded no movement at all. Three of them dropped, including previously red-hot Porsches like the 1973 911 Carrera RS Touring (one of the more expensive cars in the index) with a 12 percent decrease and the 1979 930, which continued its gradual slide with a 6 percent decrease. The only serious gain of any car in the index this past period was for the Mercedes-Benz 280SL, which bounced back with a 17 percent surge after two years of continuous drops," Newton said.

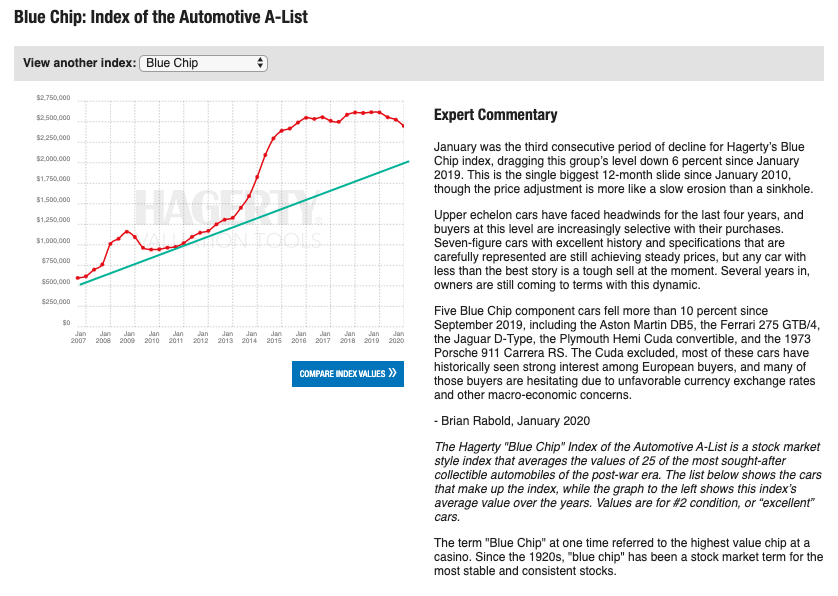

Hagerty's Blue Chip Index, consisting of the top 25 most sought-after post-war era cars in the world, was down 6% in January over the prior 12 months, one of the most significant slides since January 2010.

"Upper echelon cars have faced headwinds for the last four years, and buyers at this level are increasingly selective with their purchases. Seven-figure cars with excellent history and specifications that are carefully represented are still achieving steady prices, but any car with less than the best story is a tough sell at the moment. Several years in, owners are still coming to terms with this dynamic."

"Five Blue Chip component cars fell more than 10 percent since September 2019, including the Aston Martin DB5, the Ferrari 275 GTB/4, the Jaguar D-Type, the Plymouth Hemi Cuda convertible, and the 1973 Porsche 911 Carrera RS. The Cuda excluded, most of these cars have historically seen strong interest among European buyers, and many of those buyers are hesitating due to unfavorable currency exchange rates and other macro-economic concerns," said Hagerty valuation editor Brian Rabold.

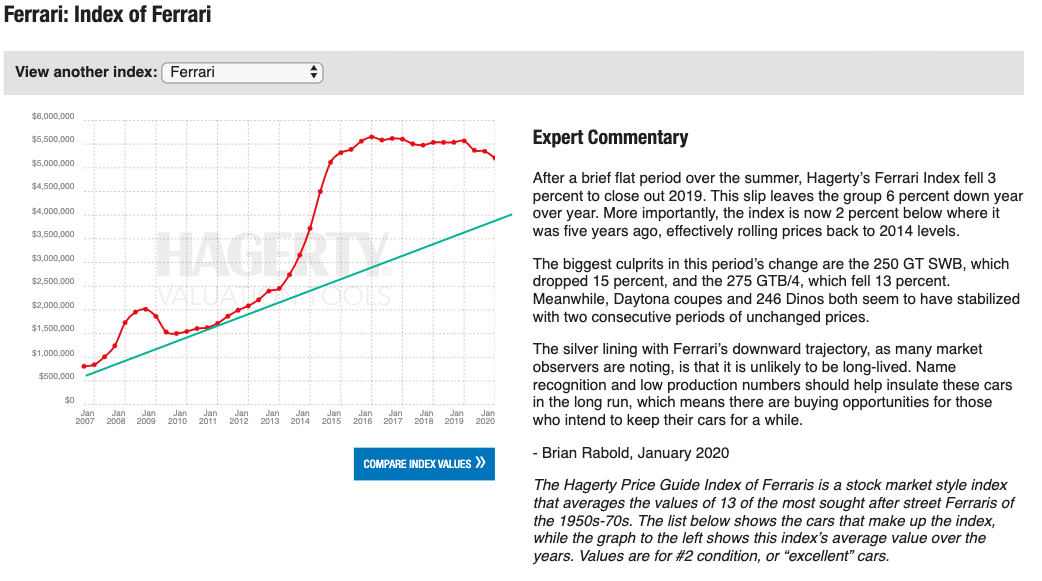

Hagerty's Ferrari Index "fell 3 percent to close out 2019. This slip leaves the group 6 percent down year over year. More importantly, the index is now 2 percent below where it was five years ago, effectively rolling prices back to 2014 levels. Ferrari Index," Rabold said.

"The biggest culprits in this period's change are the 250 GT SWB, which dropped 15 percent, and the 275 GTB/4, which fell 13 percent. Meanwhile, Daytona coupes and 246 Dinos both seem to have stabilized with two consecutive periods of unchanged prices," he said.

With classic car auctions, shows, and meets canceled for the first half of the year because of the COVID-19 pandemic, this is an unprecedented period to own classic cars as the global economy stumbles into a recession, if not depression, which could result in a sharp correction in the overall classic car market in 2020.

https://ift.tt/3aDqX4K

from ZeroHedge News https://ift.tt/3aDqX4K

via IFTTT

0 comments

Post a Comment