Berkshire Hathaway Reports Record $50 Billion Q1 Loss, Cash Pile Hits $137 Billion

Berkshire Hathaway, the diversified, cash-rich investment vehicle/conglomerate controlled by Warren Buffett reported a record $49.7 billion loss - that's $30.65 per Class A share equivalent, compared with $21.66 billion, or $13,209 a share, from Q1 2019 - the largest quarterly loss in the conglomerate's history.

As the coronavirus wiped more than three years' of gains from the US equity market in March, both Berkshire's investment portfolio and wholly-owned subsidiaries were "negatively impacted".

And like most of its peers, Berkshire can't reliably predict when business conditions will return to normal.

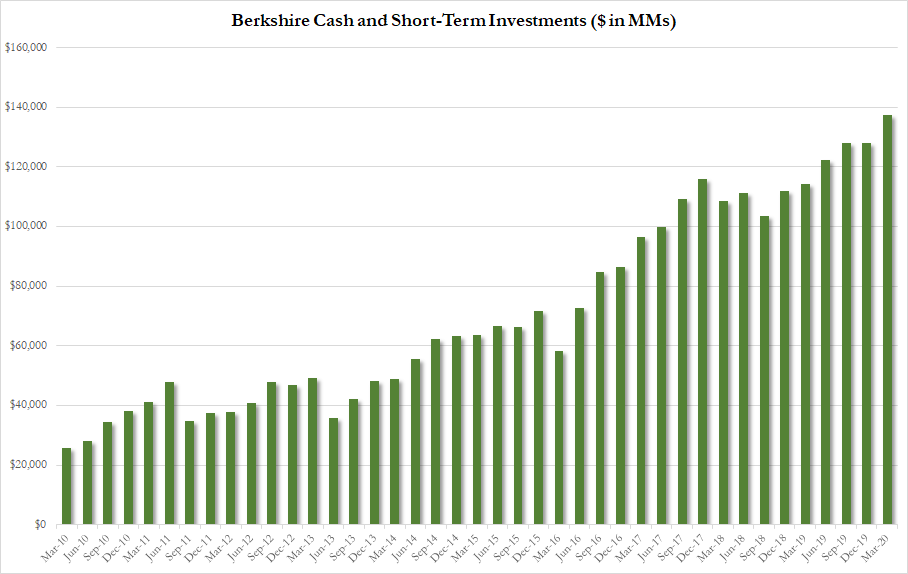

But perhaps the most notable development is the continued increase in Berkshire's massive cash pile to $137 billion. It's a sing the famed investor mostly focused on building its massive cash pile to its new record as the coronavirus slowdown started to hit the US economy. For those who have lost count, that's an almost $10 billion increase from the end of 2019, while Buffett spent just $3.5 billion buying back Berkshire shares, while portfolio managers also adjusted their positions.

A couple of weeks ago, Munger told WSJ's 'Intelligent Investor' columnist Jason Zweig in an interview that Berkshire would be sitting this crisis out. "The phone is not ringing off the hook," Munger said - a reference to how the US government and Wall Street came knocking in 2008 to ask the Oracle of Omaha to step in and save the American economy (a favor for which Berkshire was handsomely rewarded). Munger said Berkshire "would shutter some businesses" which seems at odds with the fact that the conglomerate's Q1 operating income climbed YoY. Of course, that figure likely masks the vast differences in performance among Berkshire's subsidiaries.

Instead of stepping up to save the world, Buffett and Munger have been quietly tending to their cash pile and waiting for the next big opportunity to present itself.

Here are a few highlights courtesy of Yahoo Finance:

- Q1 operating earnings: $5.871 billion, up from $5.555 billion last year ($5.56 billion expected by analysts

- Q1 investment gains: -$54.517 billion, down from $15.498 billion last year

- Q1 net earnings per A share: -$30,652, down from $13,209 last year

- Q1 net earnings per B share: -$20.44, down from $8.81 last year

More from Reuters:

- IN THE FIRST THREE MONTHS OF 2020, BERKSHIRE PAID $1.7 BILLION TO REPURCHASE SHARES OF CLASS A AND B COMMON STOCK

- BERKSHIRE HATHAWAY INC SAYS IT ENDED Q1 WITH $137.3 BLN CASH AND EQUIVALENTS

- BERKSHIRE OWNED $63.8 BILLION APPLE AAPL.O SHARES AS OF MARCH 31, COMPARED WITH REPORTED $73.7 BLN AS OF DEC 31

- BERKSHIRE OWNED $20.2 BILLION BANK OF AMERICA BAC.N SHARES AS OF MARCH 31, COMPARED WITH REPORTED $33.4 BLN AS OF DEC 31

- BERKSHIRE OWNED $9.9 BILLION WELLS FARGO WFC.N SHARES AS OF MARCH 31, COMPARED WITH REPORTED $18.6 BLN AS OF DEC 31

- BERKSHIRE OWNED $17.7 BLN COCA-COLA CO KO.N SHARES AS OF MARCH 31, COMPARED WITH REPORTED $22.1 BLN AS OF DEC 31

- MOST OF CO'S BUSINESSES NEGATIVELY AFFECTED IN SECOND HALF OF MARCH AND THROUGH APRIL DUE TO CORONAVIRUS

- BERKSHIRE HATHAWAY- CANNOT RELIABLY PREDICT WHEN BUSINESS ACTIVITIES AT CO'S NUMEROUS AND DIVERSE OPERATIONS WILL NORMALIZE

Underscoring the impact from the outbreak, Berkshire's 10-Q mentions COVID-19 31 times.

As WSJ reminds us, Berkshire’s quarterly earnings are especially volatile "due to an accounting rule that went into effect in 2018 requiring companies to include unrealized investment gains or losses in their net income. Berkshire holds large stock investments, and their quarterly changes in value can have a big effect on Berkshire’s net income."

Berkshire's money managers explained away the unrealized ~$55 billion loss in Berkshire's stock portfolio as "largely meaningless," since Berkshire isn't planning on liquidating any of its positions.

Investment gains/losses from periodic changes in securities prices will continue to cause significant volatility in our consolidated earnings. We believe that investment gains/losses, whether realized from sales or unrealized from changes in market prices, are often meaningless in terms of understanding our reported consolidated earnings or evaluating our periodic economic performance. We continue to be

Notably, the unrealized loss from Q1 more than offsets the $53.7 billion unrealized gain Berkshire reported for Q4 2019.

However, despite the immense headwind created by the coronavirus during the second half of the quarter, Berkshire still managed to report an increase in operating earnings.

Operating earnings, which exclude some investment results, climbed to $5.87 billion from $5.56 billion for Q12019. Buffett and his No. 2, Charlie Munger, have long insisted that the operating earnings line is more reflective of the company's actual performance.

As yields plunged to record lows during Q1, Berkshire's cash holdings climbed to a record

Read the 10-Q below:

BERKSHIRE HATHAWAY INC 1Q20... by Alastair Williamson on Scribd

https://ift.tt/3b11kuR

from ZeroHedge News https://ift.tt/3b11kuR

via IFTTT

0 comments

Post a Comment