Beijing On Edge: China's 2nd Largest Property Developer Plummets Amid Fears Of Imminent Liquidity Crisis Tyler Durden Fri, 09/25/2020 - 21:20

Is China's housing bubble - the main "wealth effect" for hundreds of millions of middle class Chinese - finally about to burst?

On Friday, trading in onshore bonds of China Evergrande, China's second largest and the world’s most indebted property developer, was halted after reports it was seeking government help to stave off a cash crunch caused the price of its shares and debt to tumble, and sparking a crisis of confidence among creditors who’ve lent the world’s most indebted developer more than $120 billion.

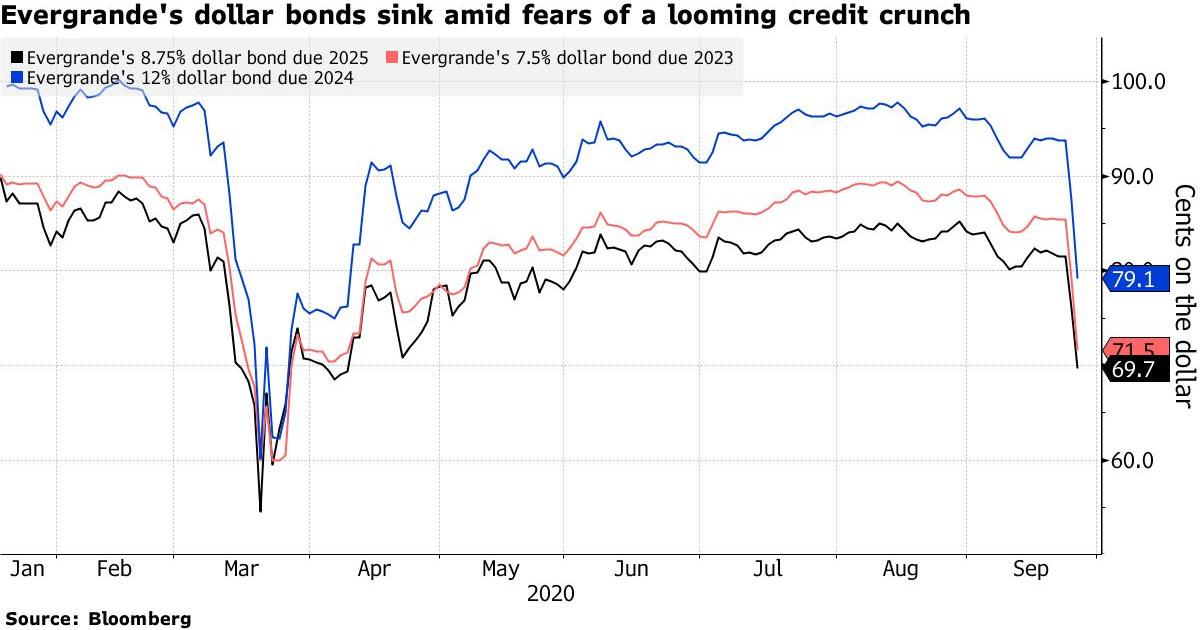

As Bloomberg reports, long-simmering doubts about the property giant’s financial health exploded to the fore on Thursday, following reports it had sent a letter to Chinese officials warning of a potential cash crunch that could pose systemic risks. The news sparked a furious liquidation in the company's bonds that continued into Friday, sending the price of Evergrande’s yuan note due 2023 down as much as 28% to a record low. Losses in the company’s dollar bonds spread to high-yield debt across Asia.

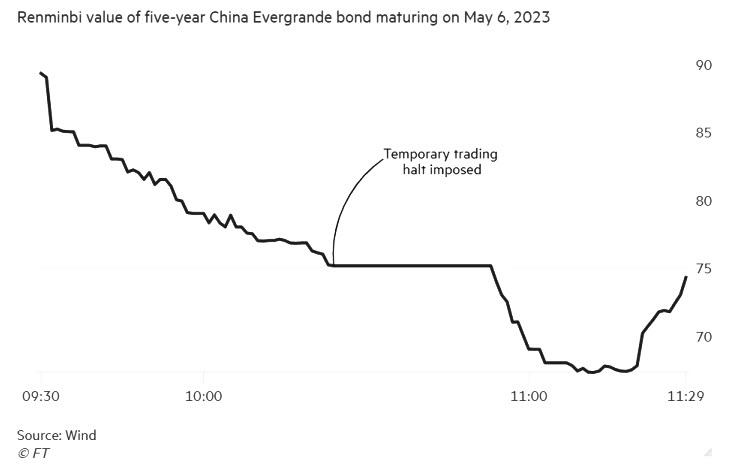

The selloff was so intense that according to the Financial Time, it forced the Shanghai stock exchange to suspend trading in Evergrande bonds for half an hour on Friday morning, due to "abnormal fluctuations", which is a polite euphemism for "selling."

The crash in Evergrande shares and bonds was sparked after a letter, purportedly from the company, circulated on Chinese social media on Thursday requesting support for a previously planned reorganization from the provincial government in Guangdong, where Evergrande is based. In the purported letter dated August 24, the FT reports that Evergrande asked the Guangdong government to approve a plan to float its subsidiary Hengda Real Estate on Shenzhen’s stock exchange through a merger with an already listed company (another eerie similarity to the Nicola SPAC-reverse merger). Evergrande reportedly added that a failure to complete the reorganization would pose "systemic risks."

In response, and in continuing its most sincerely imitation of Trevor Milton, the company said in a filing to Hong Kong’s stock exchange late on Thursday that the documents "fabricated and pure defamation" and that it had reported the matter to China’s security authorities.

"There are rumors circulating on the Internet about the reorganisation of Hengda Real Estate. The relevant documents and pictures are fabricated and are pure defamation, causing serious damage to the Company’s reputation. The Company strongly condemns such acts and has reported the case to the public security authorities.”

Just to be safe, reports that Evergrande also asked its employees to post on social media platform WeChat a statement saying the letter was fake, according to the FT.

The full-blown attempt at deflecting investor skepticism proved woefully insufficient, however, and resulted in a wholesale puke in the company's publicly traded securities, with Evergrande shares falling 9.5% to the lowest level since May at the close of trading in Hong Kong.

Alas, where there's smoke there is usually fire - especially in an economy that has been ravaged by the coronavirus pandemic - and on Thursday rating agency S&P poured fuel on the fire when it cut its outlook on Evergrande’s B+ credit rating outlook from stable to negative.

"Evergrande's short-term debt has continued to surge, partly due to its active acquisition of property projects," it said. "We had previously expected the company to address its short-term debt, especially given the tough economic climate."

Making matters worse, there is a near-term trigger that could catalyze a full-blown debt and liquidity crisis and which is further spooking investors. As part of an agreement Evergrande struck with some of its largest investors, the company raised about 130 billion yuan ($19bn) by selling shares in Hengda and needs to repay investors if fails to win approval for a backdoor listing on the Shenzhen stock exchange by Jan. 31.

This is a problem because that amount represents 92% of Evergrande cash and cash equivalents of 142.5 billion yuan in. And since the fate of the company itself is suddenly determine by its stock price - a reverse merger appears very much unlikely if Evergrande can't stabilize its stock price - the possibility of a toxic feedback loop emerges, where the lower the stock price drops, the more aggressive the selling, the more likely a terminal liquidity event occurs and forces the company to demand a shareholder-liquidating bailout. S&P agrees, saying that Evergrande will have to repay a portion of its investments in Hengda, even as it sought to contain the panic by adding that the risk of a liquidity crunch was "still low for now." We'll check back in a week.

Though it’s unclear why Evergrande has yet to win approval for its listing plan, Bloomberg speculates it may relate to China’s efforts to tame sky-high home prices and restrain fundraising by developers. Regulators have been using a wide range of policy levers since 2016 to deter speculative home-buyers, curb expensive land prices and restrict lending to residential builders.

Evergrande has said it won’t raise new funds through the listing in Shenzhen, but the transaction could allow the company to achieve a higher valuation and thus easier access to future financing. Its stake sale to strategic investors in 2017 implied a valuation of about 425 billion yuan for the unit, which holds most of Evergrande’s real estate assets. That’s almost three times higher than the market value suggested by the developer’s existing shares in Hong Kong. Chinese property developers trade at about 12 times projected earnings on average in Shanghai and Shenzhen, compared with about 5 times in Hong Kong.

In yet another red flag, Bloomberg reports citing five sources that at least five Chinese banks and two trust firms held emergency meetings on Thursday night to discuss their Evergrande exposure and access to collateral. Among them was China Minsheng Banking Corp., whose exposure to Evergrande exceeds 29 billion yuan. And since this is China, where once a default cascade begins it may never end, reader will recall that Minsheng Bank, also known as "China's JPMorgan" was itself in crisis last spring when it missed a bond payment in January 2019 and sought money from its employees to avoid collapse.

But while Minsheng may be stable for now, Evergrande is anything but especially after at least two of the banks that were present in the emergency meetings decided to bar the company from drawing unused credit lines, effectively capping the company's liquidity just as it will desperately need access to every incremental yuan. The developer had credit lines of 503 billion yuan as of June 30, of which 302 billion yuan were unused, according to Bloomberg.

“Regardless of the authenticity of the letter, we think the situation may have prolonged negative impact,” Manjesh Verma and Stella Li, credit analysts at Citigroup, wrote in a report. "It increases concerns among various investors and lenders and hence increases difficulty in funding access and refinancing."

Meanwhile, the FT notes that analysts have long been concerned that any issues at Evergrande could ripple through China’s financial system: "Evergrande is a significant source of systemic risk,” said Nigel Stevenson, an analyst at GMT Research. "There are huge debts in the listed parent company that will ultimately need to be refinanced."

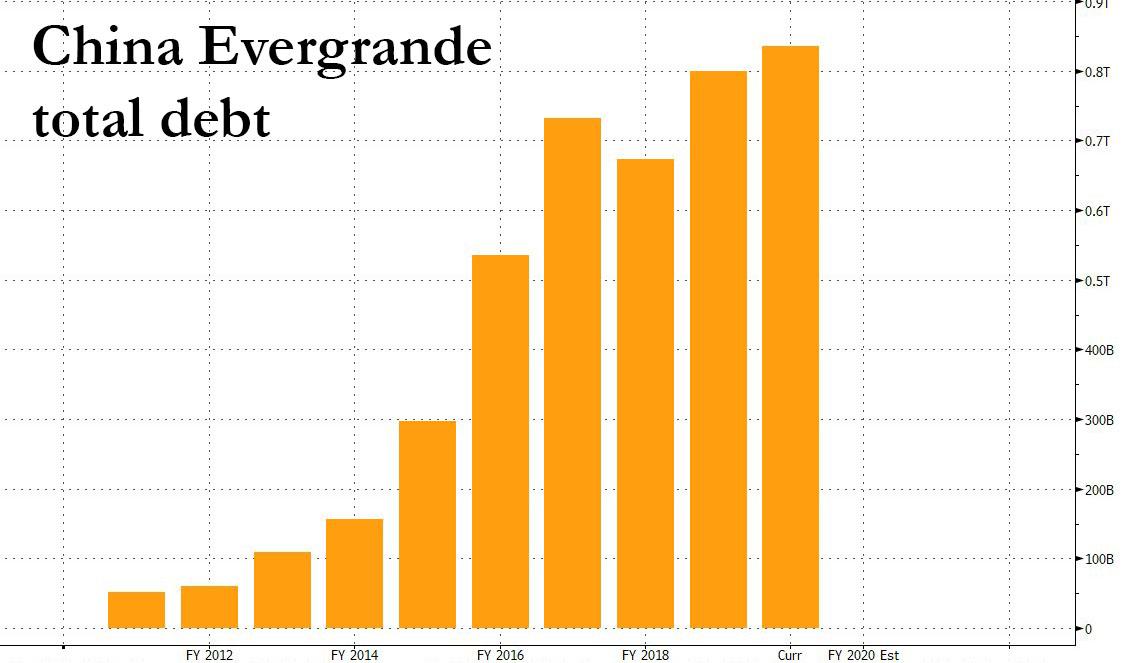

Just how huge are the debts? One look at the chart below should answer all questions on why the second most important Chinese property developer is also a systematically important company for a country where the bulk of household wealth is not in the stock market but in real estate.

As Bloomberg adds, Evergrande has long been viewed as a poster child for highly leveraged companies in China, where corporate debt swelled to a record 205% of gross domestic product in 2019 and has likely climbed further this year as firms increased borrowing to tide themselves over during the pandemic. Evergrande has tapped banks, shadow lenders and the bond market in recent years to expand beyond the property industry into businesses ranging from electric cars to hospitals and theme parks –- areas that often align with Chinese President Xi Jinping’s policy priorities.

The core problem that Evergrande has faced as it unleashed this historic debt issuance spree, is that it did not expect the coronavirus to cripple the Chinese economy. Following the coronavirus pandemic, investors have sharpened their focus on China’s heavily indebted property developers, which have huge volumes of outstanding debt held by foreign entities (amusingly enough, FTSE Russell just announced Chinese government bonds will be included into its flagship World Government Bond Index from October 2021, as China can never find enough greater fools to whom it can sell even more Evergrande debt).

Amid the economic slowdown, Evergrande this month was forced to slash the price of its properties in China by 30%. The company has said the discounts were a "normal sales strategy" for September and October. Just one problem: those two months are a peak time for home sales in China, which means that Evergrande is lying. Again.

* * *

One big variable surrounding the future of Evergrande is whether Beijing will merely swoop in and bail it out if it is unable to repay creditors. While the Chinese government has a long history of bailing out systemically important companies to maintain financial stability, policy makers have in recent years sought to instil more market discipline and reduce moral hazard. Case in point, as part of China's spotty efforts to rein in risk, authorities have recently nationalized indebted conglomerates such as HNA Group, Anbang and Tomorrow Group. They’ve also introduced new rules for financial holding companies, including Evergrande, that impose minimum capital requirements and other restrictions meant to reduce the threat of systemic blowups.

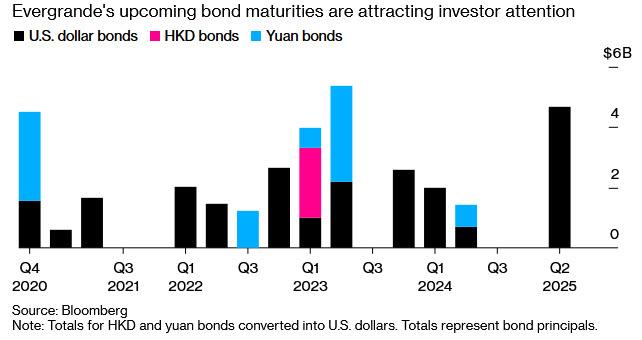

In any case, every ponzi scheme eventually comes to an end, and unless Evergrande can find a way to continues it unprecedented debt expansion, it is facing a brutal debt maturity schedule...

... which sees billions in existing yuan and dollar bonds set for repayment. If the company remains locked out of capital markets, if it can't restore access to its line of credit, and unless it can complete its reverse merger, it just may be over for Evergrande, and also for China's gargantuan housing bubble.

https://ift.tt/2G8bpMY

from ZeroHedge News https://ift.tt/2G8bpMY

via IFTTT

0 comments

Post a Comment