The Real Reason The Oil Rally Has Fizzled Out Tyler Durden Tue, 09/01/2020 - 22:35

Submitted by Simon Watkins, of OilPrice.com

One of the themes that is emerging as we review investment candidates is the era of oil growth, which is at least going to take a substantial pause, if it is indeed, not totally in the rear view. Company after company has told us that “maintenance capex” is all they are allocating at current oil prices. An example of this mindset is Parsley Energy, (NYSE:PE) which reduced its capex budget by 50% year over year. This new era of growth restraint has implications for the world energy market that isn't reflected in the energy structure at present.

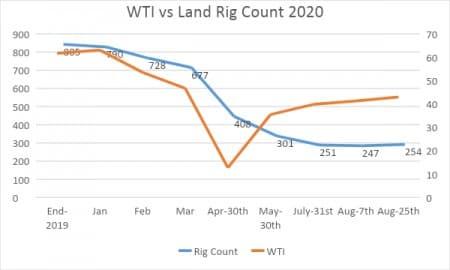

Drilling and fracking each picked up slightly from the week prior. Hence the question I pose about seeing the bottom in activity. We saw a bump similar to this once before this summer, and then each category fell back into decline for a month or so. I am not betting that we'll see another boost this week, as the trading range for WTI just isn't supportive enough for a big activity inflection.

I remain committed to my previously established targets for shale exit production ~5 mm BOEPD. The next way point will be the EIA-914 on Monday.

Why are we where we are?

That's a question I've been wrestling with regards to the pricing of WTI. Oil has definitely plateaued in recent weeks, after a nice run in the spring and early summer. A brief investigation reveals one likely source of the lack of volatility.

The answer could be hedging. Using a trading strategy known as a Strangle, funds, and large institutions with exposure to commodities-oil in this case, can limit this with puts and calls. A put gives you the right to sell WTI-for example at a future price, while a call gives you the right to buy at a different price, thus limiting the impact of volatility on your position.

Source Hedging on this scale has a potential to result in a big dislocation in the market. In a recent WSJ article Marwan Younes, chief investment officer of Massar Capital Management commented: ‘’Hedging has the consequence to push prices back within that range. Historically, long periods of calm in financial markets have tended to end with a burst of volatility. It feels like we have two tectonic plates building up energy. The day it gives way will be a fairly eventful day.’’

This is an interesting idea that is supportive of my general diatribe about oil going higher and breaking out of this range. Particularly as regards Younes final line that I have italicized. We need a catalyst for this to happen, and it’s hard to say just what that will be.

I don't trade futures contracts. I just don't have the attention span or the temperament to stay that focused on the market. I figure the money I am missing out on in a success case, is more than compensated for by sleeping fairly well at night, and consuming less Maalox.

Under-investment in supply, “Chickens” are coming home to roost

Paul Sankey is a well-known securities analyst, formerly with a big firm-Mizuho, and now on his own. I’ve followed him for years. Sankey has some interesting ideas that coincide with my own. Chief among them is the idea that the oil market is approaching a precipice of supply short-fall that will simply be breath-taking when its full effects land out.

Sankey Research

Sankey ResearchAnother area of agreement between us is that years of under-investment in replacing barrels from aging Brown-field developments will ultimately constrict supply and drive prices higher.

Focusing mainly on the decline rate of shale and the lack of new drilling, I’ve made the point repeatedly in OilPrice articles that the shale miracle in the U.S. is over. Here is a link to my most recent writing on this topic. Shale was thought to be impervious to decline by many. Some of us (speaking of myself here) always knew better as we understood the short-decline nature of the rock. Now companies are taking write-offs on shale as they did deepwater assets a few years ago, meaning there are reserves we thought would be available in the years ahead that will now be uneconomic.

The short-lived era of the U.S as “swing-producer” for oil has ended.

Why “war-premiums” for oil don’t last

One thing we should be able to agree on is that the world currently assumes unlimited supplies of crude oil, now the norm thanks to overproduction the last few years, will continue to be the base case going forward.

Is the world right? Obviously you know I don't think so, but we are certainly getting mixed signals right now. It is worth noting when a giant hurricane that shuts down 80% of the GoM's producing and refining capacity doesn't move the market even a little higher it speaks strongly to the markets confidence about future supply.

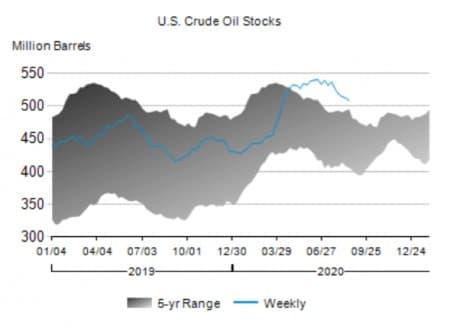

As noted in the EIA graphic below, last week we edged down still further toward the 500 million barrels mark in inventories, and still crickets from the oil market. It should be noted that this represents about a 30 day supply at current consumption rates.

We think that the +/- 3-mm BOEPD supply/demand gap will accelerate as the year closes, and these inventory draws will continue.

EIA-WPSR

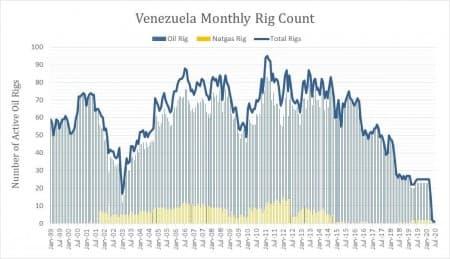

EIA-WPSRI have previously identified several hot spots that could explode at any time, creating an instant inflection for oil. You know them well. Iran, Venezuela, Iraq, Libya are all experiencing severe economic and social disharmony for various reasons, but no one is shooting at one another taking a war-premium completely out of the price. Should we be so complacent?

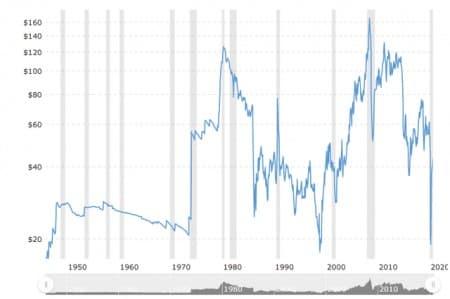

One interesting aspect of a war-premium is that it doesn’t last for long. History tells us the sharp spikes in price due to conflict are short-lived, and oil driven higher by conflict reverts quickly to its previous range. The world continues to spin on its axis, infrastructure that may be damaged or destroyed is quickly rebuilt, and importantly no one goes without. A good example is the recent attack on Saudi oilfields in 2019 by Iran. Oil spiked to $80 from $60 overnight, and quickly fell back to $60, and then to $50, and then to $40. Fear comes out of the market as rapidly as it enters.

Macrotrends

MacrotrendsWhat the chart above tells us is that war premiums soon fade. Take the spike circa 1990 when the U.S. led coalition began the response to Iraq's invasion of Kuwait. A brief spike to $80 was quickly followed by a rapid collapse to the mid-$30's and over most the next decade to a low below $20. It then took another 10 years for oil to peak again, this time in the financial collapse of 2008.

One takeaway from this chart is that wars are over so quickly these days (Afghanistan excepted), that they don't have much prolonged impact on the perception of supply security.

Much more important are key producer decisions to restrict production. For example the Arab oil embargo of the early 1970's led to a 30-year uptrend that was only broken when they opened the taps in 1998. A decision they quickly regretted when the oil price crashed. A "V" shaped rebound led to nearly another 20 years of higher prices, until in 2014, OPEC again opened the taps. This seems to be a mistake they are unable to stop making as they did it again earlier this year.

In short while a shooting war changes the dynamic briefly, decisions by producers have a much more pronounced effect on oil prices.

Your takeaway

Inflation is on the horizon. It's been ages since we had to worry about generally rising prices. The full effects of the dynamic imposed by the virus, lower employment, business failures, etc. have led governments around the world to print trillions of dollars to provide liquidity. A lesson perhaps learned in 2008 when governments were slow to provide this under-pinning to world markets. The net effect of this is always inflation.

Last week the Chairman of the Federal Reserve, (Fed) Jerome Powell reinforced their position on employment vs inflation making a change to their historic stance of combating inflation. In this speech Powell let it be known that it will let inflation run...to a degree, in support of putting people back to work. Up to this point the Fed had established an arbitrary 2% limit for inflation before it would move proactively to tighten the money supply to drive it down.

This is bullish for oil prices and oil equities in general, telling us we are on the right track with our overall thesis of higher oil prices. Interest rates will stay down hurting savers, but commodities and equities will rise. Oil is a commodity.

https://ift.tt/3jCkPyN

from ZeroHedge News https://ift.tt/3jCkPyN

via IFTTT

0 comments

Post a Comment