Crude Crashes In Early Asia Trading On European Lockdowns, Goldman Warning Tyler Durden Sun, 11/01/2020 - 18:25

WTI just tumbled to a $33 handle in early trading (after being above $40 just 3 days ago) as demand fears (European lockdowns) and supply concerns (Libya ramped up its production) combined to spark anxiety about the energy complex outlook.

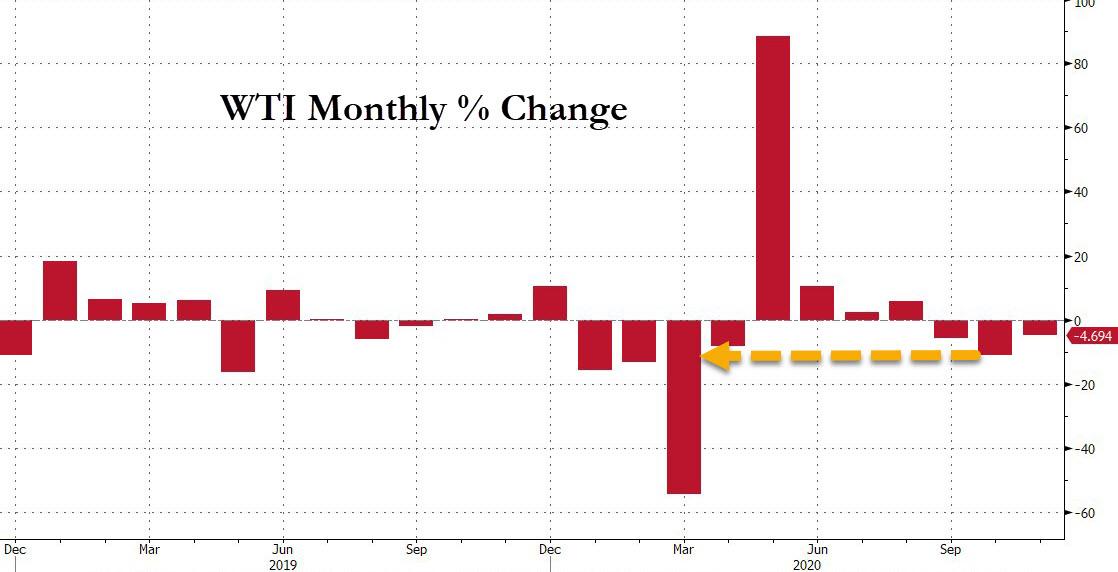

Dec WTI Futs are down over 5%...

This is the lowest front-month oil price since May...

... and follows the worst month for WTI since March.

Additionally some have suggested that waning odds of a Biden victory are also perhaps adding to supply concerns as the end of fracking is delayed.

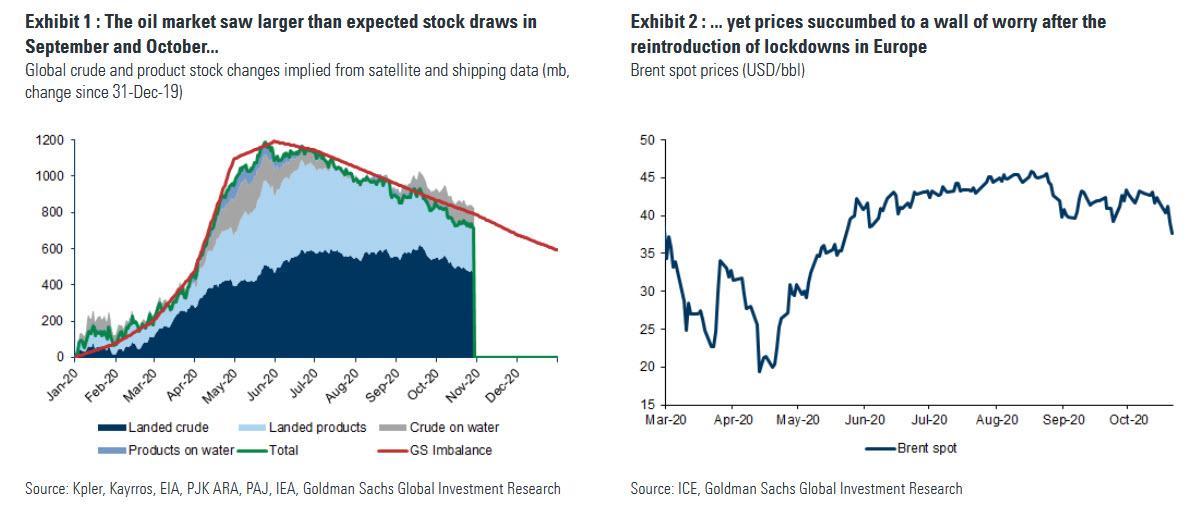

Late on Sunday, Goldman published a new piece titled "Lockdowns rattle patient bulls" in which the bank appears to be tempering its bullish outlook on the black gold, writing that the price drop is due to "the uncertain path of the second COVID wave, the still high level of excess inventories and the lack of corporate hedging which all leave the market unanchored."

So after succumbing to a wall of worry, what now for oil prices according to Goldman:

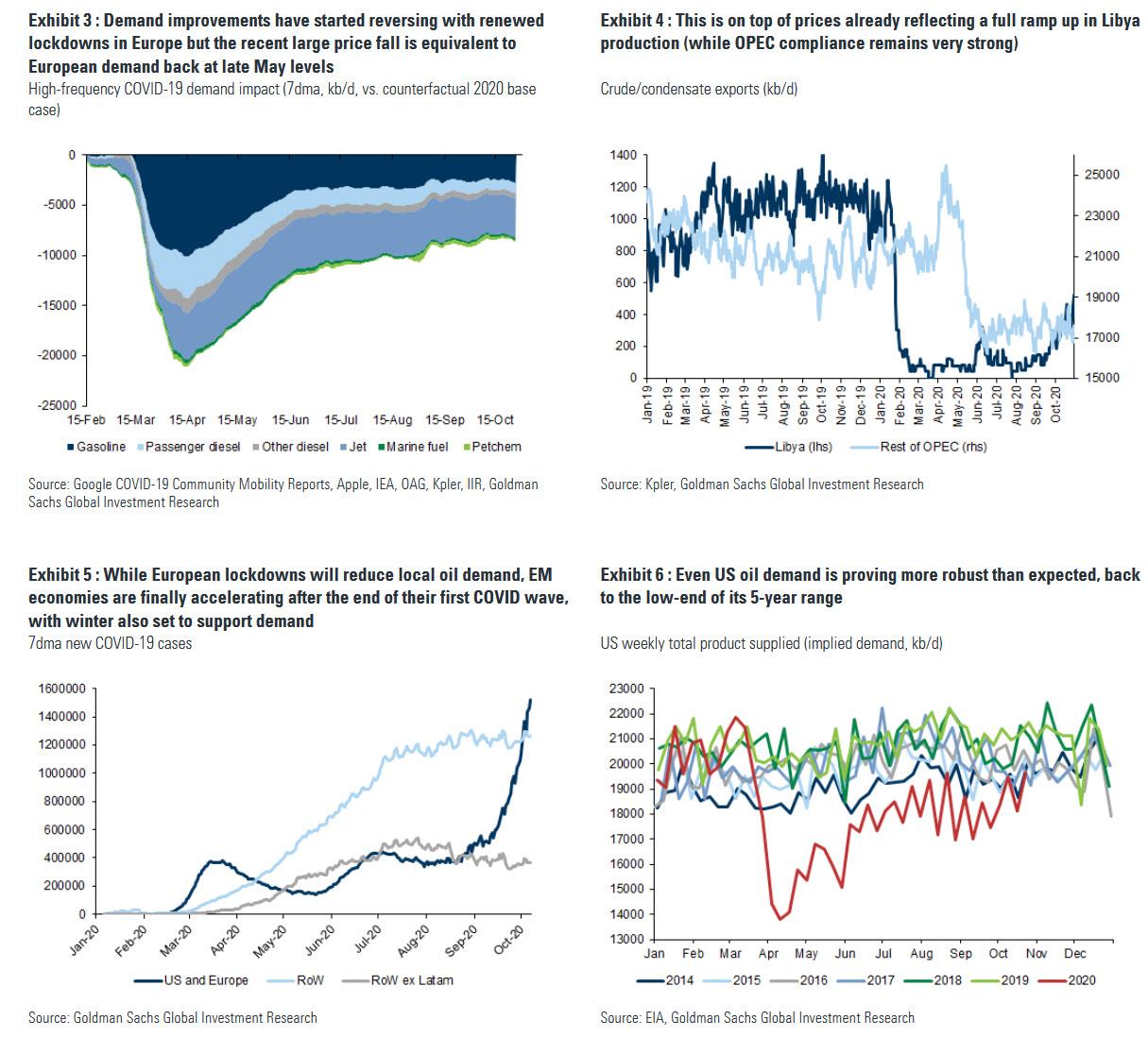

We estimate that the move lower in prices since last Friday is equivalent to a downward revision of demand expectations by 2 mb/d in Nov-Dec and by 0.5 mb/d in 2021 (c. 0.7% of global GDP). This is in addition to the 1.2% strengthening of the broad USD TWI and also assumes Libya already producing at 1mb/d. Such a demand repricing into year-end is equivalent to European consumption falling to May levels, when stricter lockdowns were just ending. While this is an already aggressive repricing - with new lockdowns less restrictive and potentially inflecting the likely virus spread in a few weeks - virus uncertainty, lockdown headlines and the aftermath of the US election all point to further price volatility through November and potential near-term downside.

Fundamentally, however, we estimate that the oil market can likely stay in an average deficit through the winter given the current deficit starting point (-2.5 mb/d) and with rising heating (+0.5 bm/d) and EM demand which is coming out of its first COVID wave (+ 1 mb/d inc. China) helping absorb the hit from European lockdowns. In fact, high demand uncertainty and the lag in fundamental oil data leads us to expect that OPEC+ will likely delay its 2 mb/d production ramp-up past January when it meets in a month, which would help secure a large deficit through 1Q21 then the rest of 2021 given this delayed ramp-up.

While the recent price gyrations have little fundamental consequences in the short-run given the inventory buffer, sustained low prices would have binding economic impacts over the long-run for supply. This sets the stage for a material rally above current forwards when the recovery in demand owing to vaccines and record-large fiscal stimuli faces supply under-investment and a changed shale reaction function. For example, we estimate that Dec-21 Brent prices of $41/bbl currently reflect through 2021: (1) a full linear return of Iran production of 2 mb/d, (2) OPEC+ increasing output by 2 mb/d in January then July and (3) demand of 95.5 mb/d for all of 2021, only 2 mb/d higher than current levels.

Such pessimism driving speculative length likely below the April lows is ultimately the offset to higher expected price volatility. From current levels, a rally of Dec-21 Brent prices to our $65/bbl forecast at the current level of spot price volatility (40%) would generate a 1.4 sharpe ratio. While our initial recommendation for our long Dec-21 Brent trade recommendation proved untimely, this still remains our preferred macro expression for oil's inevitable 2021 rally. Our second lower beta implementation remains a Jun-21 vs. Jun-22 Brent timespread trade, which will benefit from our expected deficit through 1H21.

* * *

Finally, with the 2020 presidential election looming - and with many claims and counterclaims about a president’s impact on the oil industry - OilPrice.com's Robert Rapier thought it might be of interest to review the history of U.S. oil production and consumption over the past 50 years.

Here are the highlights from each president’s term in office.

Richard Nixon was inaugurated as the 37th president on January 20, 1969. When President Nixon took office, U.S. oil production was nearing a peak after over 100 years of increasing production. Imports made up 10% of U.S. consumption. In 1970, U.S. oil production reached 9.6 million barrels per day (BPD) and began a long, steady decline.

Richard Nixon began his second term on January 20, 1973. U.S. oil production had declined to 9.2 million BPD while consumption had increased by 3 million BPD from the first year of Nixon’s first term. As a result, oil imports would more than double during Nixon’s presidency, and American citizens would learn the danger of the dependence on imports with the OPEC oil embargo of 1973.

Gerald Ford was inaugurated as the 38th president on August 9, 1974 after Nixon resigned in disgrace. During President Ford’s term in office, domestic oil production continued to decline. U.S. oil consumption and imports continued to grow, and both were at all-time highs during Ford’s last year in office.

Jimmy Carter was inaugurated as the 39th president on January 20, 1977. Recent trends in consumption, production, and imports all reversed themselves during President Carter’s term. Consumption fell by 2%, U.S. production increased by 6%, and imports—after initially rising to record highs during his first year in office—were a fraction of a percentage lower at the end of his term than during Ford’s last year in office. Factors beyond Carter’s control—such as the Iranian Revolution and the Iran–Iraq War—heavily influenced the oil markets.

Ronald Reagan was inaugurated as the 40th president on January 20, 1981. Oil consumption continued to decline during most of President Reagan’s first term, and oil production crept back to levels that had not been seen in a decade. Oil imports fell by 35% during his first term.

Ronald Reagan began his second term on January 21, 1985. The trends from his first term all reversed themselves, as consumption rose 10%, domestic production fell by 8%, and oil imports increased by 49%.

George H. W. Bush was inaugurated as the 41st president on January 20, 1989. Consumption fell slightly during his term, but domestic production fell even more—down 12%. Imports increased by 19%, back above 6 million BPD for the first time since the 1970s.

Bill Clinton was inaugurated as the 42nd president on January 20, 1993. During his first term, consumption increased by another 7%, domestic production fell by 10%, and imports increased by another 23%—exceeding 7 million bpd for the first time in U.S. history.

Bill Clinton began his second term on January 20, 1997. His second term trends were almost identical to those of his first term. Consumption rose by another 8%, domestic production fell by another 10%, and imports increased by an additional 21%. Consumption and oil imports were at all-time highs, and production had fallen 40% from the 1970 production peak.

George W. Bush was inaugurated as the 43rd president on January 20, 2001. During his first term, consumption climbed above 20 million BPD for the first time in the nation’s history. Imports also reached new highs, above 10 million BPD. Domestic production continued to fall.

George W. Bush began his second term on January 20, 2005. During Bush’s second term, consumption began to decline as the nation entered a recession and oil prices reached record highs. Imports fell back to below 10 million BPD. The decline in domestic production continued, albeit at a slower rate of decline than during his first term. This marked the first trickle of oil production from hydraulic fracturing, which would make a major impact during the terms of the next two presidents. During Bush’s last year in office, the level of imports reached just over 50% of U.S. consumption.

Barack Obama was inaugurated as the 44th president on January 20, 2009. The economic sluggishness initially continued, but the impact of hydraulic fracturing began to be felt in President Obama’s first year in office. In a reversal of the long decline that began in 1970, crude oil production would rise all four years of Obama’s first term.

President Obama began his second term on January 21, 2013. The fracking boom caused oil production to accelerate until 2015. But then overproduction led OPEC to initiate a price war that ultimately crashed prices and production. Production began to decline in 2015, but 2016 — the last year of Obama’s second term — was the first year of his presidency that annual oil production declined.

Between 2009 and 2015 oil production had increased by 4.4 million BPD. This was the fastest increase in oil production in U.S. history, and marked the largest increase in oil production during a single term of any president. If natural gas liquids (NGLs) are included, the gains during Obama’s first seven years were 6 million BPD. U.S. net imports of finished products like gasoline turned into net exports during Obama’s second term, and next imports of finished products plus crude oil fell by over 6 million BPD.

Donald Trump was inaugurated as the 45th president on January 20, 2017. Oil production had declined during President Obama’s last year in office as the average annual price of West Texas Intermediate (WTI) fell to $43.34/bbl. But in 2017 that rose to $50.79/bbl, and then to $65.20/bbl in 2018. Oil production followed prices higher. During the first three years of President Trump’s first term, annual U.S. oil production gained 3.4 million BPD. Net imports of crude oil and finished products turned into net exports in late 2019. U.S. oil production eclipsed the previous 1970 peak (although if you include NGLs, that peak was eclipsed in 2013).

But then the Covid-19 pandemic crushed oil demand. Now, less than a month before the election, U.S. oil production is at 10.5 million BPD — a significant decline from the 12.2 million BPD of 2019.

The net impact of the past 50 years of U.S. presidents was a long, slow decline of oil production that was only reversed when the hydraulic fracturing revolution began.

U.S. oil production didn’t fall under Bush and rise under Obama based on the policies of these presidents. Production behaved according to policies that had been put in place years earlier, and in accordance with the behavior of oil prices in previous years. Jimmy Carter experienced a rise in oil production because the Alaska Pipeline—approved by Nixon—was completed while Carter was in office. Obama and Trump experienced a rise in oil production following years of climbing oil prices — which led to a fracking boom.

Presidents publicly fretted for decades about the loss of energy independence for the U.S. They tried many different approaches to solving this problem—from serious intervention in the energy markets to letting the free market solve the problem. Many billions of dollars were spent on programs with the intent of eliminating dependence on foreign oil.

Yet in 1969, Americans depended on oil imports for 10% of their consumption, and in 2008 that number had risen to over 50% of consumption. That trend was only reversed when fracking caused U.S. oil production to surge.

Thus, a president may have some impact on U.S. oil production, but it is mostly a factor of influences well beyond their control.

https://ift.tt/3815JQF

from ZeroHedge News https://ift.tt/3815JQF

via IFTTT

0 comments

Post a Comment