Futures Flat, Global Stocks Mixed In Thin Thankgsgiving Trade Tyler Durden Thu, 11/26/2020 - 08:12

Global stocks held near record highs on Thursday, with US equity futures flat due to the Thanksgiving holiday while the rally in European stocks paused, as recent vaccine progress and hopes for further stimulus - whether monetary or fiscal - kept markets bullish.

While US cash equities are closed for the Thanksgiving holiday, S&P futures were flat after fading modest overnight gains, however Nasdaq futures were well in the green, as cyclical companies including banks and energy firms which have benefited the most from the post-vaccine surge retreated while more defensive tech shares gained.

Markets also took a boost from minutes from the latest Fed minutes which showed that officials discussed how the central bank’s asset purchases could be adjusted to provide additional support to the economy. The minutes said policymakers may give new guidance about its bond-buying “fairly soon”.

“2021 is going to be a year of economic catch-up,” said Samy Chaar, chief economist at Lombard Odier. “When you keep the pandemic contained and under control, economic activity catches up very quick.”

Recovery sentiment turned cautious Thursday, however, as the virus toll continued to rise in Europe and the U.S., leading German Chancellor Angela Merkel to call on Europe’s ski resorts to close this winter. The task of a global vaccination comes with logistical problems, all while the virus gains ground and economic recoveries wobble.

"Question marks still surround the speed of a global roll-out and the proportion of populations willing to be vaccinated," Geir Lode, head of global equities at the international business of Federated Hermes, wrote in a note to clients. “These factors, combined with a second consecutive week of rising jobless claims in the U.S,, appear to have brought the rotation into value and back-to-work stocks grinding to a halt for now."

"The market’s very much looking forward to 2021 and the time when vaccines will be rolled out and economic activity can get back to normal,” said Kiran Ganesh, a multi-asset strategist at UBS, adding that the equities rally is "particularly driven by the rotation trade away from large caps and towards small caps, away from the U.S. and towards Europe, and away from technology and towards some of the cyclicals."

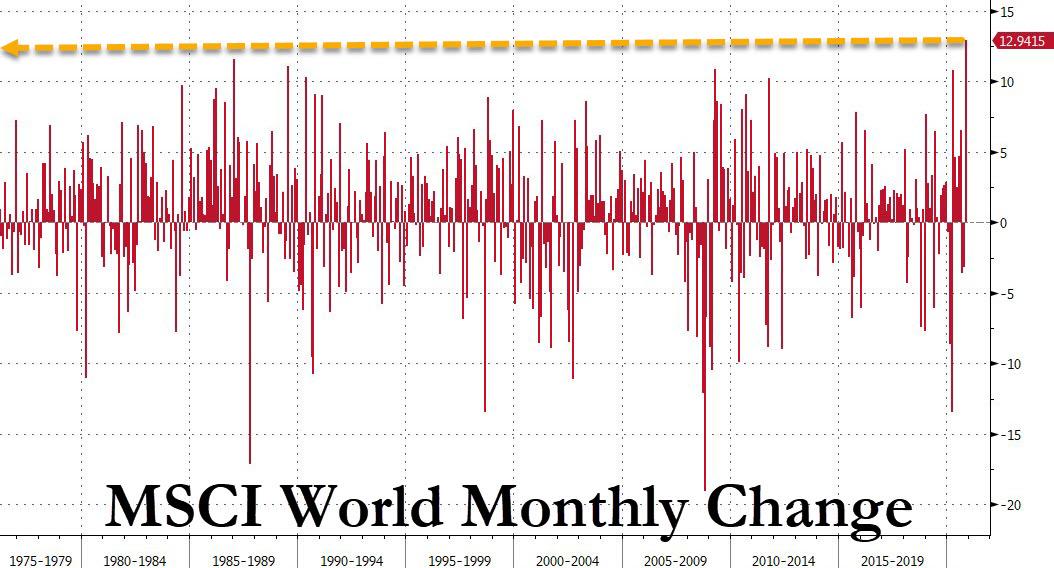

The MSCI world equity index rose to a record high on Wednesday and held close to it on Thursday, up 0.1% on the day as markets shrugged off the latest rise in U.S. jobless claims. Global stocks are having their best month on record in November, boosted by a slew of positive vaccine announcements and hopes that Biden’s administration will deliver more economic stimulus and political stability.

Europe’s STOXX 600, which is also having its best month on record, up 14.4% in November, was down 0.1% on the day. European equities traded a narrow range in a quiet morning, with a few central bank speakers and minutes from the ECB’s October meeting the only scheduled events of interest. Gains in tech, travel and healthcare stocks were offset by losses in banks, oil & gas and autos. The UK's FTSE 100 and Spain's IBEX laged European peers. In France and Germany, consumer confidence plunged in November under new lockdown restrictions, challenging the idea of a quick return to normal in the euro zone’s two biggest economies. German Chancellor Angela Merkel told parliament that lockdown measures will be in place until at least the end of December and possibly longer.

Earlier in the session, Asian stocks gained, led by the communications and IT sectors, after falling in the last session. Most markets in the region were up, with Indonesia's Jakarta Composite advancing 1.4% and Thailand's SET rising 0.9%, while Australia's S&P/ASX 200 slid 0.7%. The Topix added 0.6%, with SoftBank and Nintendo contributing the most to the move. The Shanghai Composite Index rose 0.2%, driven by Ping An Insurance and Yangtze Power.

Emerging-market stocks resumed gains after a one-day drop, suggesting the remains intact even as trading slows due to the U.S. Thanksgiving holiday. The MSCI Inc. measure of developing-nation equities moved to within 50 points of its 2018 high, a level that was only surpassed before the global financial crisis. Foreign-exchange markets were mixed, with Asian currencies and the Turkish lira rising, while eastern European currencies and the South African rand fell

In rates, Treasury futures edged higher with the cash market closed, with traders off for Thanksgiving holiday in the U.S. A deluge of data on Wednesday brought the first back-to-back rise in weekly U.S. jobless claims since July and a widening trade deficit. In Europe, bunds and gilts bull-flattened gently while peripheral and semi-core spreads widened slightly to core, with Italy underperforming.

In FX, Bloomberg dollar index drifts higher, back into the green. NOK and SEK are the worst G-10 performers. EUR/USD fades an early push up to 1.1941, cable trades at the lows.

In crypto, Bitcoin plunged over 10% on the session amid a sudden bout of overnight selling.

In commodities, crude futures slumped with WTI dropping ~1.5% having failed to breach $46 overnight, Brent drops back on a $47-handle after running into resistance near $49 during Asian trade. Spot gold grinds higher near $1,814/oz. Base metals trade well, with LME copper outperforming

There is nothing on today's calendar with the US closed for holiday.

Top Overnight News from Bloomberg

- Sweden’s central bank surprised markets with a bigger-than- expected expansion of its asset purchase program, amid signs the Covid crisis will do more damage to the largest Nordic economy than previously feared

- Trillions of euros in spare cash sloshing through the euro zone have made it cheaper for investors to access funding for one week as opposed to one day for the first time

- The U.K. Debt Management Office will continue selling inflation-linked debt tied to the flawed Retail Price Index even after plans were announced to move away from the benchmark, according to Chief Executive Officer Robert Stheeman

- The European Central Bank should consider wiping out or holding forever the government debt it buys during the current crisis to help nations recover and restructure, a top Italian government official said

- Chancellor Angela Merkel urged Germans to do more to rein in the coronavirus to avoid the “worst-case scenario” of an overburdened health care system

- China’s imports of U.S. goods under the phase-one trade deal slowed last month after hitting a high in September, leaving the full-year target well out of reach

- China will maintain normal monetary policy for as long as possible and keep macro leverage ratio basically stable, PBOC says in its quarterly policy implementation report

A more detailed look at Global Markets courtesy of NewsSquawk

Major European bourses see a mixed session thus far (Euro Stoxx 50 Unch) as the non-committal tone and holiday-thinned trade from Asia-Pac reverberates into Europe on US Thanksgiving. Sectoral performance have more of a defensive bias, with Healthcare, Utilities and Staples among the top gainer, whilst cyclicals reside at the bottom of the pile but IT bucks the trend. The oil and gas sector is the laggard as the crude complex pulls back following its recent rally ahead of next week's key energy meetings, whilst Financial names also sees losses on account of lower yields. Thus, UK's FTSE 100 (-0.6%) narrowly underperforms regional peers with its heavy-weight banking and energy names hampering performance. Travel & Leisure names continues to be underpinned on vaccine hopes, with easyJet (+2%) and Air France-KLM (+1.4%) trading firmer. In terms of individual movers, Volkswagen (-1.8%) sees more pronounced losses than some peers amid reports that the Co. and Audi are to face prosecution in India under charges of cheating & conspiracy.

A non-committal tone was evident for most of Asia-Pac trade following the indecisive lead from the US where stocks were rangebound heading into the Thanksgiving holiday and after a deluge of mixed data releases. ASX 200 (-0.7%) was led lower by an unwinding of yesterday’s outperformance in cyclicals and with sentiment clouded by frictions with Australia’s largest trading partner after China alleged there were environmental quality issues concerning Australian coal in which AUD 700mln worth is stuck on ships being delayed from entering and unloading at Chinese ports. Nikkei 225 (+0.9%) shook off the initial caution to outperform its regional peers on supportive measures with the Japanese government to extend its employment subsidy program until end-February and the virus loan application period to end-March, while KOSPI (+0.6%) was kept afloat after the BoK maintained its Base Rate at 0.50% as expected and upgraded its GDP growth forecasts for 2020 and 2021 as it anticipates an export-driven recovery. Hang Seng (+0.1%) and Shanghai Comp. (+0.2%) lacked firm direction with the mainland tentative amid ongoing trade uncertainty after the Trump administration granted ByteDance a new 7-day extension of the divestiture order directing it to sell to TikTok by December 4th, while the Peterson Institute for International Economics also noted that China total purchases of US goods during the first 10 months of the year, were less than half of the annual commitment under the Phase 1 deal.

In FX, hot on the heels of dovish FOMC minutes and ahead of the ECB account that is tipped to follow a similar path, the Riksbank has exceeded or confounded expectations by expanding and extending its QE remit by Sek 200 bn for an extra 6 months through the end of 2021. Two Board members entered reservations, but the accompanying statement and updated (downgraded) economic forecasts supported the policy action – see 8.30GMT post on the headline feed for full details and our snap analysis. Predictably, Eur/Sek rebounded in response from a low around 10.1200 to circa 10.1770 before paring back, albeit no more so in percentage terms than Eur/Nok between 10.5130-5740 parameters, as the Norwegian Krona tracks a retreat in crude prices.

- DXY - The Dollar remains on the back foot in wake of, if not directly due to the aforementioned Fed release, as the Committee committed to provide further guidance on bond buying and could enhance stimulus via increasing the pace, moving down the curve or maintaining the size and current maturity profile, but continue purchases for a longer period. However, the index has survived another attempt to test y-t-d lows (91.740 from September 1st) and is trying to regain a foothold above the 92.000 handle within a 92.091-91.844 range in thin US Thanksgiving holiday trade.

- JPY - Contrary to month end rebalancing models signalling a strong Greenback sell vs G10 counterparts, bar the Yen, Usd/Jpy is capped below 104.50 and a key Fib retracement level at 104.67, but the headline pair faces even bigger option expiry interest at the 104.00 strike (1.7 bn) ahead of the NY cut and more Japanese inflation data in the form of Tokyo CPI.

- AUD/EUR/CAD/NZD/GBP/CHF - All narrowly mixed against the Buck and holding in fairly familiar ranges, with the Aussie reclaiming 0.7350+ status following mixed Capex data and Euro consolidating above 1.1900 having reached another new November pinnacle, but not able to breach 1.1950 in advance of the latest ECB minutes and remarks from chief economist Lane before Schnabel. Elsewhere, the Loonie pivoting 1.3000 without further impetus from oil awaiting rather stale Canadian average weekly earnings and the Kiwi is straddling 0.7000 after in line NZ trade data and reflecting on potential changes to the RBNZ mandate to incorporate house prices that are running hot. Meanwhile, Sterling is still eagerly and anxiously looking for Brexit updates, as Cable continues to hit a brick wall into 1.3400 where latest heavy offers are said to have been layered from 1.3390 through 1.3385 to 1.3380, and the Franc is hovering above 0.9100.

In commodities, WTI and Brent front month futures see a session of losses in what seems to be a retracement from the recent rally, which was fueled by optimism OPEC+ will extend current cuts despite the recent vaccine news lifting the outlook for the complex. News flow for the complex has remained light throughout early European hours, but source reports later on in the day cannot be dismissed given the preparatory OPEC meetings in the run-up to the main even at month-end. Market expectations (as things stand) are widely skewed towards the second tranche (7.7mln BPD cuts) being extended through Q1 2021, a view also backed by Goldman Sachs, ING and UBS, despite positive vaccine noise and amid rising production in Libya. Recent sources also noted OPEC+ are still leaning towards a rollover of the current tranche notwithstanding the recent oil price rally, with Russia likely to agree to this if necessary, however, enthusiasm for cuts is not universal. WTI briefly dipped below USD 45/bbl (vs. high 46.09/bbl), whilst Brent Feb hovers around USD 48/bbl after hitting resistance at USD 49/bbl. Elsewhere, spot gold and silver saw a bout of upside, albeit modest, heading into the European cash open amid thinned conditions and a distinct lack of newsflow. The precious metals have since waned off best levels with spot gold ~1815/oz (vs. low 1806/oz) whilst spot silver hit highs just shy of USD 23.50/oz (vs. low 23.19/oz)

DB's Jim Reid concludes the overnight wrap

Happy Thanksgiving to our US readers. Let’s hope you have better things to do than read this though. Ahead of the holiday, US equities fell back from their record highs on Tuesday as a deteriorating situation on the coronavirus and weak economic data served as a reality check to the surge in risk assets we’ve seen in recent days. By the close, the S&P 500 had fallen -0.16% and the Dow Jones was down a larger -0.58%, as the latest data showed weekly initial jobless claims in the US rose more than expected for a second week running, up to 778k for the week through November 21. Furthermore, data on personal income for October showed an unexpectedly large -0.7% fall (vs. -0.1% expected), which will add to fears that the US economy is losing momentum as the number of Covid-19 cases continues to rise throughout the country heading into the winter. Even as the equity rally took a pause, the VIX volatility index fell -0.4 pts to its lowest closing levels (21.3) since February 21. That was the initial Friday sell-off before the S&P 500 fell a further -33% over the next 21 trading sessions.

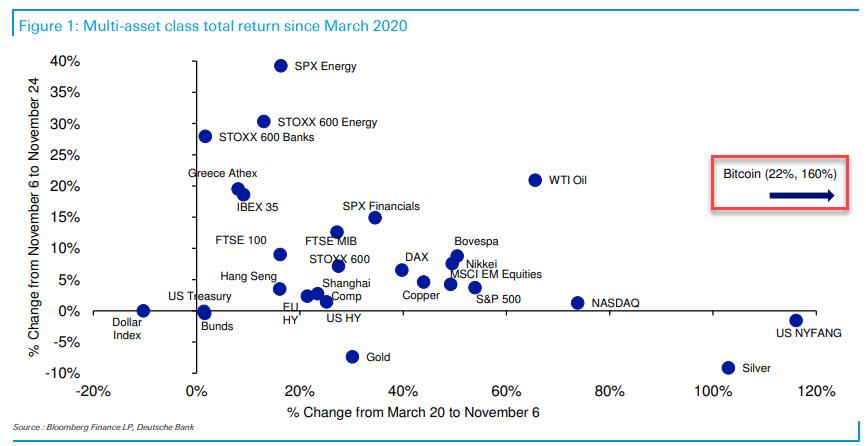

With the economic picture showing signs of weakness, big tech got a renewed bid again with the NASDAQ Composite +0.48% to reach its highest-ever closing level thanks to decent performances from Amazon (+2.15%), Apple (+0.75%) and Tesla (+3.35%). Even as tech outperformed yesterday, they still have massively lagged cyclicals over the past 2.5 weeks as our CoTD yesterday (link here) shows. The chart looks at a scatter of asset class and sector returns from after the Pfizer/BioNTech vaccine news against their returns from March 20th to November 6th. Energy and bank stocks of the top level sectors have led the charge post the vaccine news, even as they paused for breath yesterday.

Other safe havens showed signs of strength too, with core sovereign bonds in Europe rising as yields on bunds (-0.5bps) and gilts (-1.2bps) fell back, whereas their counterparts in southern Europe such as 10yr Italian (+0.3bps) and Greek (+1.7bps) debt rose. In equities, however, southern Europe outperformed the rest of the continent, with Italy’s FTSE MIB (+0.72%) and Spain’s IBEX 35 (+0.26%) both outperforming the STOXX 600 (-0.08%). On the other hand, yields on 10yr Treasuries (+0.2bps) rose slightly to 0.882%.

Asian markets are trading mostly higher this morning with a few indices at multi-year highs. The Nikkei (+0.88%), Hang Seng (+0.23%) and Kospi (+0.70%) are up while the Shanghai Comp (-0.01%) is flat and the ASX (-0.70%) is down. Futures on the S&P 500 are up +0.19% ahead of the holiday. Meanwhile, the BoK at its monetary policy decision today kept the interest rates unchanged while revising GDP forecasts upwards by 0.2pp for both this year and next. Elsewhere, Bitcoin is down -5.38% this morning following its spectacular run so far this year.

The minutes from the Federal Open Market Committee’s November 4-5th meeting were released last night. The committee viewed current asset valuations as “moderate” when taking low interest rates into account. The participants noted that “immediate adjustments to the pace and composition of asset purchases were not necessary” but, “they recognized that circumstances could shift to warrant such adjustments.” There was a more pertinent discussion of updating forward guidance on their bond-buying strategy “fairly soon”, ensuring that any additions in the Central Banks’ securities holdings would taper and end before the federal funds rate was raised. There was some discussion on the facilities that the Treasury department has since shut with officials at the meeting “emphasizing the important roles” the lending programs played “in restoring financial market confidence and supporting financial stability”. With these programs closed, the central bank could act more aggressively if financial conditions do worsen going forward.

In terms of the latest on the virus, it feels a little like summer again with case count news easing in Europe and worsening in the US. Yesterday, France’s 7-day running tally of infections fell to its lowest levels since October 9, while general hospitalisations and ICU usage continue to fall. Geneva and other Swiss cities are said to be reopening restaurants from December 10 onwards, while non-essential shops will reopen from this weekend. On the other hand, Germany has decided to extend its partial lockdown for at least 3 weeks to December 20 and has tightened restrictions on private gatherings. The German government has also indicated that they expect wide-ranging restrictions to stay in place until early January, particularly for restaurants and hotels. Meanwhile, New York saw its daily case numbers rise above 6,000 for the first time since April and California reported over 18,000 new cases, well over the 15,400 daily record from this past weekend. While mass gatherings have been largely discouraged by local governments, there still seems to be quite a bit of mobility ahead of today’s holiday and we will learn the impact of this in the first couple of weeks of December, just ahead of Christmas travel. Across the other side of world, South Korea reported 583 infections in the past 24 hours, the highest since March.

Here in the UK, the main headlines yesterday surrounded the government’s latest spending review, where the OBR forecast that the budget deficit in 2020-21 would climb to a peacetime record of 19% of GDP, while public sector net debt would reach 105.2% of GDP. Though the government was eager to advertise the funds being spent on infrastructure and tackling Covid-19, one of the key takeaways was the likely fiscal consolidation in the years ahead, with the announcements including a public sector pay freeze in 2021-22 and major cuts to the overseas aid budget. The UK is seemingly looking to fiscally consolidate, which is brave at this point but with no election for 4 years one can understand the political motivation. On Brexit, the OBR’s forecasts assumed that there would be a trade deal reached with a smooth transition to the new arrangements, but if there were a no-deal outcome, that could reduce real GDP next year by an extra 2% relative to their central forecast.

Speaking of Brexit, with just 5 weeks today until the transition period comes to an end, there’s still no sign of progress on the key issues in the trade negotiations. In a speech to the European Parliament yesterday, Commission President Ursula von der Leyen said that “I cannot tell you today, if in the end there will be a deal”, and although she said that there’d been “genuine progress” on a number of issues, the three usual stumbling blocks of the level-playing field, fisheries and governance remained. It’s still not obvious from where or from whom the compromises will come, and the BBC’s Europe Editor Katya Adler tweeted yesterday that EU sources had said that the talks weren’t going well. There is a story on Bloomberg this morning where the French foreign minister is accusing the UK of dragging its feet with Barnier apparently also suggesting there is little point in him coming to London unless the UK is prepared to give ground. So tension are mounting.

Wrapping up with yesterday’s other data, the second estimate of US GDP growth in Q3 was maintained at an annualised growth rate of +33.1%. Meanwhile, the preliminary October reading for durable goods orders showed a stronger-than-expected +1.3% rise (vs. +0.8% expected). US home sales rose to an annualised rate of 999k in October, which was actually slightly lower than the upwardly revised 1002k the previous month. And the University of Michigan’s final consumer sentiment index for November fell a tenth from the preliminary reading to 76.9, having been 81.8 the previous month.

To the day ahead now, and it’ll likely be a quieter one because of the Thanksgiving holiday in the US. Otherwise, we’ll get the minutes of the ECB’s October meeting, remarks from the ECB’s Lane and Schnabel, as well as the Euro Area’s M3 money supply data for October. There’ll also be a decision on interest rates from the Riksbank.

https://ift.tt/2J1HwzT

from ZeroHedge News https://ift.tt/2J1HwzT

via IFTTT

0 comments

Post a Comment