Sweden Unexpectedly Expands QE By 40% Tyler Durden Thu, 11/26/2020 - 10:25

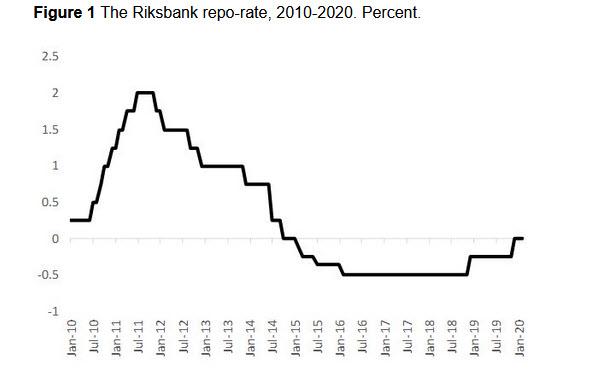

Back in 2017, Sweden made a mistake: the Governor of the Swedish Riksbank, Stefan Ingves, described the use of negative interest rates an "experiment" never tried before, and with inflation in the Scandinavian country surging, he said that the experiment was officially over, with the Riksbank beginning a hiking cycle in late 2018 which pushed the Swedish repo rate back to 0 last December, and making another trip into negative rates virtually impossible without the Riksbank's reputation suffering a terminal hit.

While the impact of the negative rates on the domestic inflation rate was small (and in fact probably contributed to wholesale deflation as we have shown previously), the effects of negative rates on the housing market - where prices exploded amid the ultra-loose conditions making housing unaffordable, and on household debt levels are large. As a result, imbalances which had already begun to materialize before the Global Crisis have worsened. Real estate prices rose rapidly, contributing to rising wealth inequality (and yes, a central bank was explicitly at fault), while household debt reached record levels. Ironically, even though the exchange rate of the Swedish krona has depreciated by more than 10%, with no major impact on the domestic rate of inflation.

In short, as Professors Fredrik Andersson and Lars Jonung wrote in May, Sweden's negative rates "created an economy with signs of ‘overheating’. However, this is likely a short-run gain. The Riksbank will face a major challenge to calibrate its policy during the next downturn."

Their conclusion on Sweden's negative rates experience was simple: "Don’t do it again!"

There is just one problem: when the Riksbank resumed tightening and pushed rates back to 0%, both its and Europe's economy were recovering, and it seemed there was limited risk from another contraction. And then the covid pandemic hit, crippling both Europe - which is facing a double dip recession following the latest round of lockdowns - and Sweden's economy.

And since the world's oldest central bank could not cut rates again without risking a huge reputational and credibility blow after it triumphantly ended its "negative rates experiment" several years ago, eager to halt the dramatic appreciation in the Swedish Krone which is up more than 6% YTD, the central bank had just one option: expand QE even more.

Which is precisely what the Sweden’s central bank did this morning when it surprised markets with a bigger-than-expected expansion of its asset purchase program, and said there’s room to deliver more stimulus between scheduled meetings. Specifically, the Riksbank announced that it was expanding its quantitative easing program to 700 billion kronor ($82 billion), which is 200 billion kronor more than its earlier target. With economists at SEB predicting a 100 billion-krona QE expansion, while most others expected no change in policy, the krona immediately sank up to 0.5% against the euro although it remains dramatically higher YTD.

Meanwhile, the key interest rate was kept at zero, as expected, and will probably stay there in "the coming years," the bank said, clearly not willing to risk reversing on its promises to not go back to NIRP.

And since it no longer has the capacity to cut rates "for years" absent a complete economic crash, the Riksbank not only expanded its QE target, but also said it will step up the pace of asset purchases next quarter, as the Executive Board also decided to step up the quarter-on-quarter pace of its purchases during the first quarter of 2021, committing to buy SEK120bn over that quarter, which means QE will only keep rising as long as negative rates remain off the table.

The surprising decision to expand the asset purchase program prompted "reservations" from two Executive Board members advocating for later action: Breman advocated that the program should instead be expanded by SEK100 billion during the second half of 2021; Floden thought that the Riksbank should pledge that monetary policy will remain expansionary as long as necessary without deciding now on purchase sums for the second half of 2021. Their opposition to the QE expansion was duly noted... and ignored.

At the press briefing, Governor Stefan Ingves said the extra 200 billion kronor in QE won’t be put toward reinvestments, but also assured markets that the Riksbank will continue to reinvest in bonds affected by its program.

"If the world changes, if there’s turbulence for various reasons and if we conclude that we need to do something between meetings, we will do so," Ingves said during a virtual press briefing in Stockholm on Thursday.

As Bloomberg notes, and confirming the above, "Ingves has repeatedly underscored his preference for asset purchases over rate cuts to support the economy. The Riksbank ended half a decade of negative rates almost a year ago, and Ingves has shown a reluctance to delve below zero again, amid financial stability concerns."

Alas, Sweden shows just what happens when a central bank is virtually out of ammo, and worse - it main policy tool, interest rates, is now limited to the zero lower bound. Meanwhile, the country is now bracing for a dark winter as the pandemic spreads, intensive-care beds fill up and curbs on movement increase. The government has already warned that the next few months will be tougher on the economy than first feared.

Fearing that much worse is yet to come, the Riksbank tried to pretend as if it never said all those bad things about "experimental" negative rates, knowing full well it will have no choice but to go NIRP again, sooner or later. As a result, the Riksbank said the repo rate "can be cut if this is assessed to be an effective measure, particularly if confidence in the inflation target were to be threatened." The irony, of course, is that years of negative rates did nothing to boost inflation to hit the target; instead what NIRP did is create a massive housing and debt bubble, which the Riksbank scrambled to shortcircuit before everything came crashing down.

And now it faces a dismal dilemma: reflate the biggest asset and credit bubble ever (which even the Riksbank has admitted is it own doing), ensuring that the next crash - when it comes - will be truly devastating, or step back and allow the economy to crumble. Meanwhile, inflation remains well below the Riksbank’s 2% target, coming in at just 0.3% in October.

The Riksbank’s surprise decision to expand its stimulus program came just two weeks before the European Central Bank is expected to unveil more support measures.

"We are neighbors with an elephant and when the elephant moves it affects us,’ Ingves said. “I can’t comment on what they’ll do and in what way, but basically everything the ECB does to keep the euro zone economy running and to bring up inflation is good for Sweden as well."

“But what they’ll do and how, we’ll have to see further ahead, because we are not party to that decision-making process,” Ingves said.

Well, Stefan, we can tell you: the ECB will almost certainly expand its emergency pandemic QE by hundreds of billions in December, as today's ECB minutes hinted.

Meanwhile, In Thursday’s statement, the Riksbank cut its forecast for gross domestic product this year and now sees a contraction of 4%, compared with 3.6% previously. The rebound in 2021 will also be smaller than earlier thought, with growth seen at 2.6%, compared with the 3.7% seen earlier.

* * *

But going back to the problem at hand, the Riksbank revised down its growth forecasts to -4.0% (compared to the -3.6% forecast in September) for 2020 and 2.6% (3.7%) for 2021. At the same time, inflation will remain below the bank’s 2% target throughout the forecast period, which extends into 2023. The Riksbank expects unemployment to peak at 9.4% in 2021—a 0.2pp upward revision from the September MPR—before falling back subsequently.

Looking ahead, the MPR reiterated that the "possibility of a repo rate cut cannot be ruled out" although to do that and to crush what little credibility it has left, would require a true economic shock. The Riksbank cited the exchange rate, how fast the supply side of the economy recovers, and the pass-through of the repo rate to interest rates in the broader economy as factors it will consider when assessing the usefulness of an interest rate cut, clearly forgetting its admission as recently as 2018 that NIRP was an "experimental" mistake.

https://ift.tt/3l3Drbe

from ZeroHedge News https://ift.tt/3l3Drbe

via IFTTT

0 comments

Post a Comment