Your Last Minute Election Night Preview: Here's All You Need To Know Tyler Durden Mon, 11/02/2020 - 20:28

Yesterday we published a lengthy election cheat sheet looking at what happens on and after November 3.

Due to popular demand, and since there have been some notable changes in the past 24 hours, we update this preview as well as present some new data that will be relevant to keep track of tomorrow's events.

But first, here is how to follow the news on Election Day.

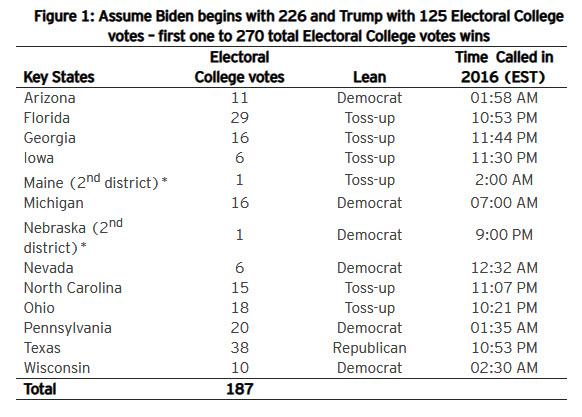

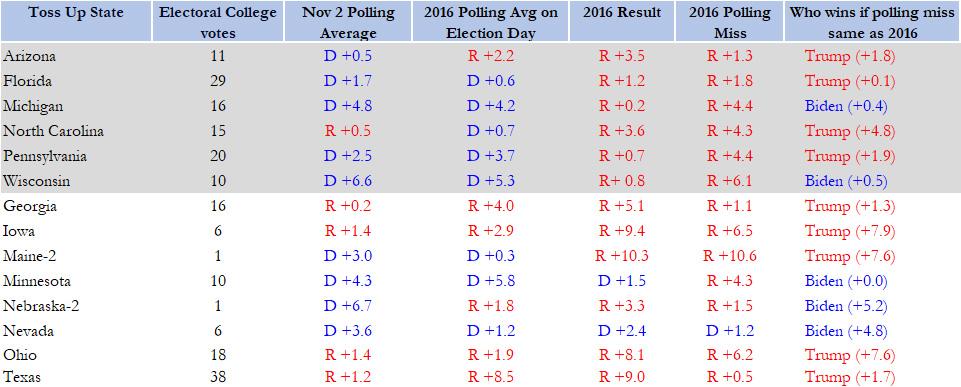

The table below shows the states that are considered toss-ups or have a slight lean according to forecasters (“likely” and “safe” states are likely to go as expected, which gives Biden 226 Electoral College votes and Trump 125 Electoral College votes). As different states below are awarded to each candidate, add the Electoral College votes to their total. The first candidate to 270 Electoral College votes wins the Presidency. Times which these states were called on election night in 2016 are also included, though these times can and will likely vary this year.

Florida and Pennsylvania are perhaps the two most important states to watch as no Republican has won the Presidency without winning Florida since 1924 and it is a must-win for Trump – without it the path for him to reach 270 Electoral College votes diminishes significantly. Meanwhile, as we reported last night, Pennsylvania is considered by FiveThirtyEight to be the most likely “tipping point” in the election and should Biden lose it, he will become the underdog. It is another state which Trump likely needs, but is also critical for Biden. If Biden wins Florida or Pennsylvania, he is very likely to win the election and if he wins both it is almost certain he gains the 270 Electoral College votes.

Additionally, Iowa, Ohio and North Carolina are states Trump won in 2016 and he needs to retain some combination of them – though not necessarily all of them – to win. If he loses all three, it is likely Trump has lost.

Here are a few tips from Bank of America:

- Be wary of exit polls: The track record of exit polls is tenuous at best. In 2004, exit polls showed John Kerry winning the popular vote by 51% to 48% only to ultimately lose by the same margin. Similarly, there were major flaws in the 2016 exit polls which substantially underestimated the number of white working-class voters while overestimating the number of college-educated white voters, leading to bias results favoring Hilary Clinton. Pollsters claim they have fixed the issues ailing Election Day polls but the better mouse trap is yet unproven. Moreover, there has been unprecedented surge in early voting (both in person and mail-in) with over 70mn votes cast nationwide to-date and there is a major skew in voter day preference by party. Admittedly, pollster are aware of this issue and will enhance their methodology by polling at large and early voting centers but nevertheless this creates greater uncertainty in their estimates.

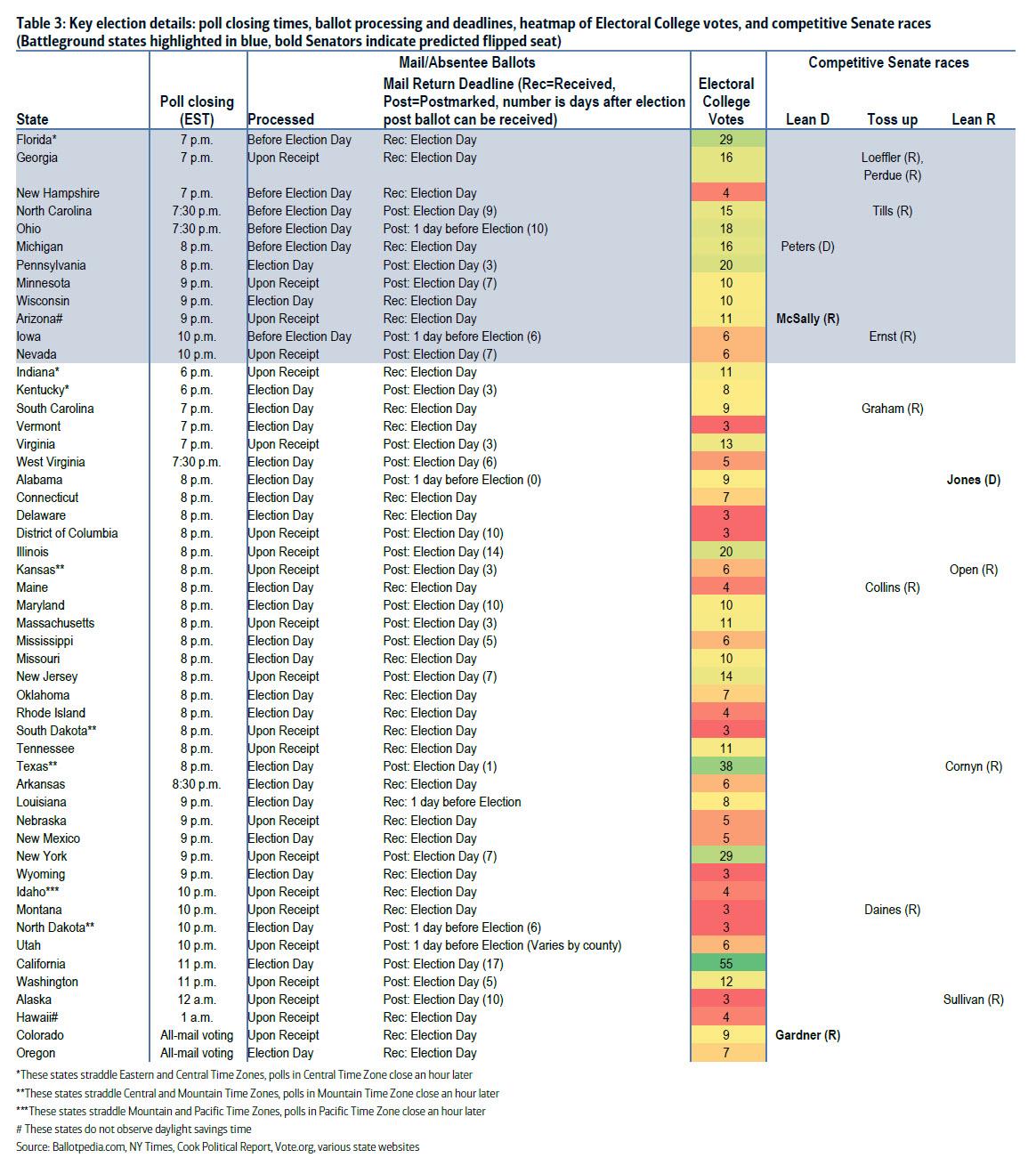

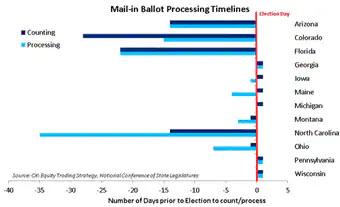

- Brace for head fakes: Results from battleground states should begin to trickle in just after polls close within each state (Table 3). First battleground states to report will be Florida, Georgia and New Hampshire where polls close at 7pm EDT (polls in Florida’s panhandle will close at 8 pm), followed by North Carolina, Ohio and Michigan, Pennsylvania, Minnesota, and Wisconsin. Type of ballots reported first will vary across states. For example, according to reporting done by the Upshot blog of the New York Times, battleground states such as Florida, North Carolina, Ohio, Arizona, and Iowa will report early in-person and processed mail-in votes first. Meanwhile, Georgia, Michigan, Pennsylvania, Minnesota, Wisconsin, and Nevada will not follow any specific order. Getting a clear sense of who is winning will be difficult given the large number of early voting by mail and absentee ballots and different rules around processing ballots, which we discuss below.

- Key demographics: In 2016, President Trump was able to tip the election by winning the older and suburban vote. A post-mortem of the 2016 election by the Pew research center showed that Trump won the age groups 50-64 and 65+ by a margin of 6 and 9 points, respectively and edged out the suburban vote by 2 points. During the 2020 election cycle, polls have shown President Trump consistently running below his 2016 election numbers in these key demographic groups. In this context, keep an eye on results coming out of suburban areas such as Maricopa County in Arizona and Peach County in Georgia and older leaning regions such as Sumter County and Pinellas County in Florida. Results in these regions could prove to be a canary in the coalmine.

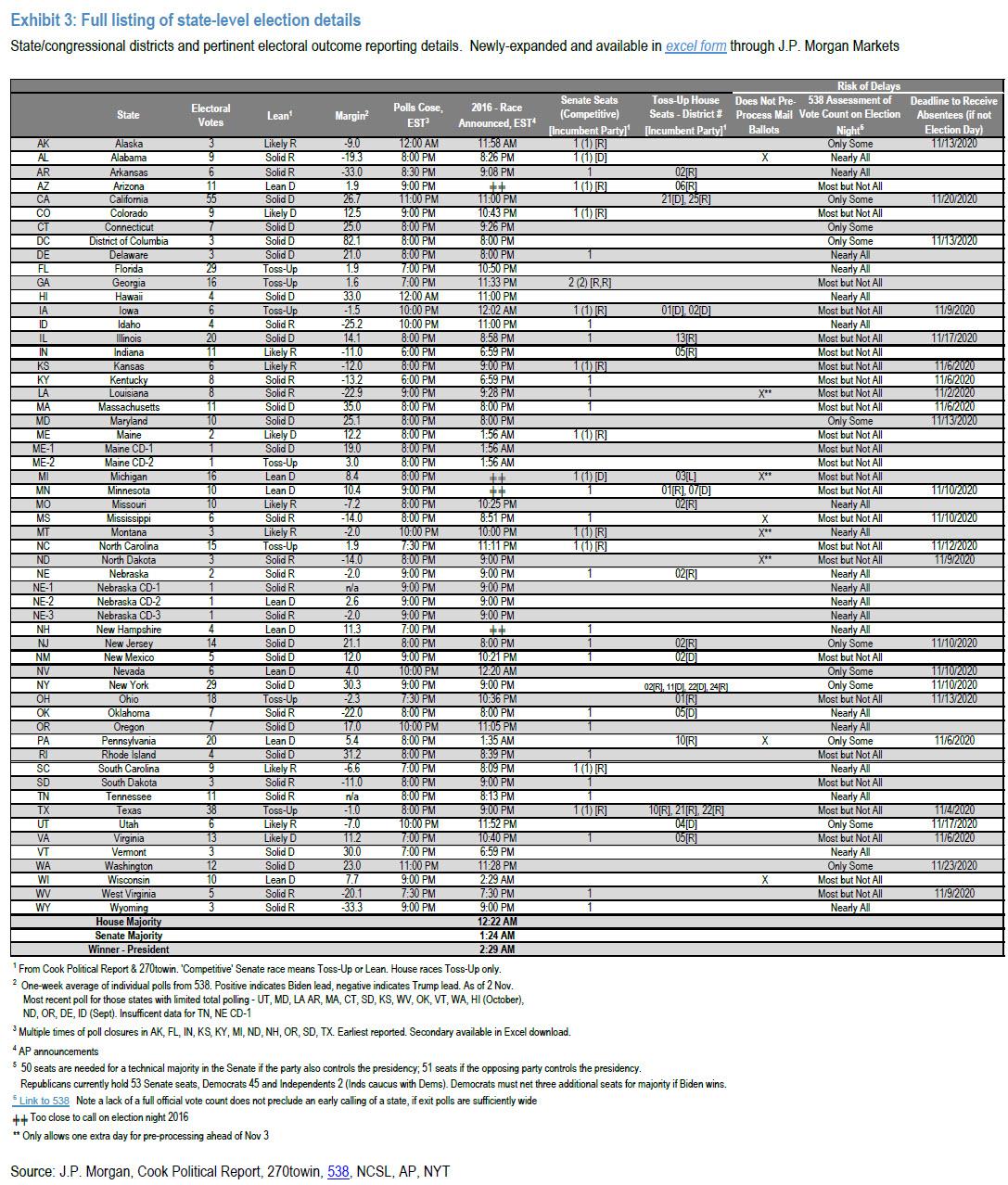

Below we present a BofA cheat sheet summarizing the key election details including poll closing times, ballot processing and deadlines, heatmap of Electoral College votes, and competitive Senate races (Battleground states highlighted in blue, bold Senators indicate predicted flipped seat).

As Reuters expands, here is what to expect in some of the most bitterly contested states :

Blue Mirage

Florida and North Carolina allow election officials to begin processing mail-in ballots weeks before Election Day, and the results of those counts are expected to be released as soon as polls close on Nov. 3. If both states follow that schedule, it is likely that Biden will appear to be ahead initially, as the latest Reuters/Ipsos opinion poll shows that people who already have voted in Florida and North Carolina support the Democratic challenger by a more than 2-to-1 margin over the president. In both states, a majority of people who plan to vote in person on Election Day support Trump. A blue mirage is not expected to last long in either state. Experts say they expect Florida and North Carolina to finish counting most of their mail-in and in-person ballots before the end of the night.

Texas, Iowa and Ohio - which Trump won easily in 2016 but polls show could be competitive this year - also allow early processing of mail ballots, so could show a similar blue mirag. All three states are expected to finish counting most ballots on Nov. 3.

Red Mirage

In Pennsylvania, Michigan and Wisconsin, mail-in ballots cannot be counted until Election Day. While Michigan did recently pass a law that allows many cities to start processing mail-in ballots, such as opening ballot envelopes, the day before the election, they cannot begin to count votes. Because mail-in ballots typically take longer to count than ballots cast in person, the initial results could skew Republican. Then, some experts say, expect a “blue shift” as election officials wade through the piles of mail-in ballots. Pennsylvania and Wisconsin may be slowed by their lack of experience with high volumes of mail-in ballots. About one in 20 votes in the two states were cast by mail in the 2018 congressional election, compared to a quarter of Michigan’s votes and about a third of Florida’s.

Pennsylvania’s vote counting could go on for days. Democrats in the state recently won a victory in the U.S. Supreme Court to allow officials to accept mail-in ballots up to three days after the election as long as they are postmarked by Nov. 3. “Something I’m prepared for on election night is for Pennsylvania to look more Republican than it may actually be, whoever ends up winning the state,” said Kyle Kondik, a political analyst at the University of Virginia’s Center for Politics. Ballots in Wisconsin and Michigan must arrive by Election Day, although litigation is under way over whether the states should count ballots that arrive late if postmarked by Nov. 3.

When could the Presidential election be called?

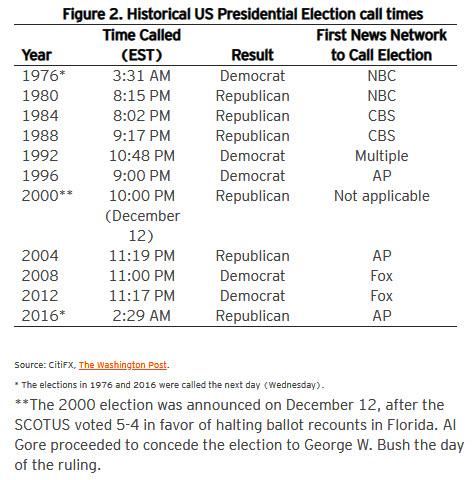

Traditionally, most Presidential elections are called by midnight of Election Day (see chart below) but there are few exceptions including the 2000 contested Bush-Gore election and the 2016 Trump-Clinton election. These are also the only two elections in over 130 years in which the Electoral College winner was not the winner of the national popular vote (that is the loser in both those elections received more national votes than the winner).

As a reminder, the 2000 election came down to Florida’s 25 Electoral College votes as the deciding factor (and Bush only won the state by 537 votes). The 2016 election came down to Michigan, Wisconsin and Pennsylvania which Trump won by around 77,000 votes (0.05% of all votes cast in 2016).

The obvious message here is that the timing of the results is conditional on how close the election is. Given current election forecasts, polls including in swing states, it is possible that the election results could therefore be known before midnight IF Biden in actuality is going to win by a significant margin. Even if Biden wins, a smaller margin of victory could see delayed results.

One other item to note is that there could be greater care in calling the winner by the major news networks. Traditionally, AP gives the official “call” though other news networks compete to be the first. However, given the polarized climate and concerns around contested elections, networks could be especially cautious before proclamations.

Closing Gap

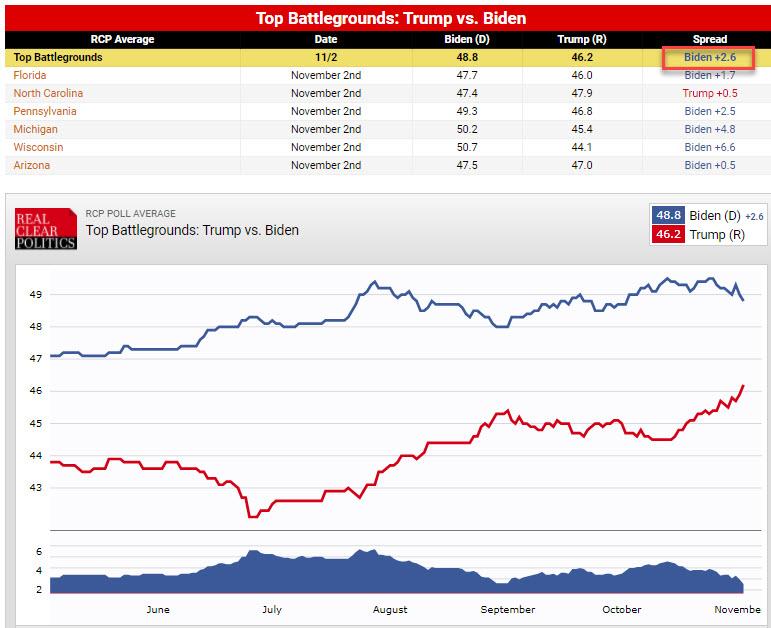

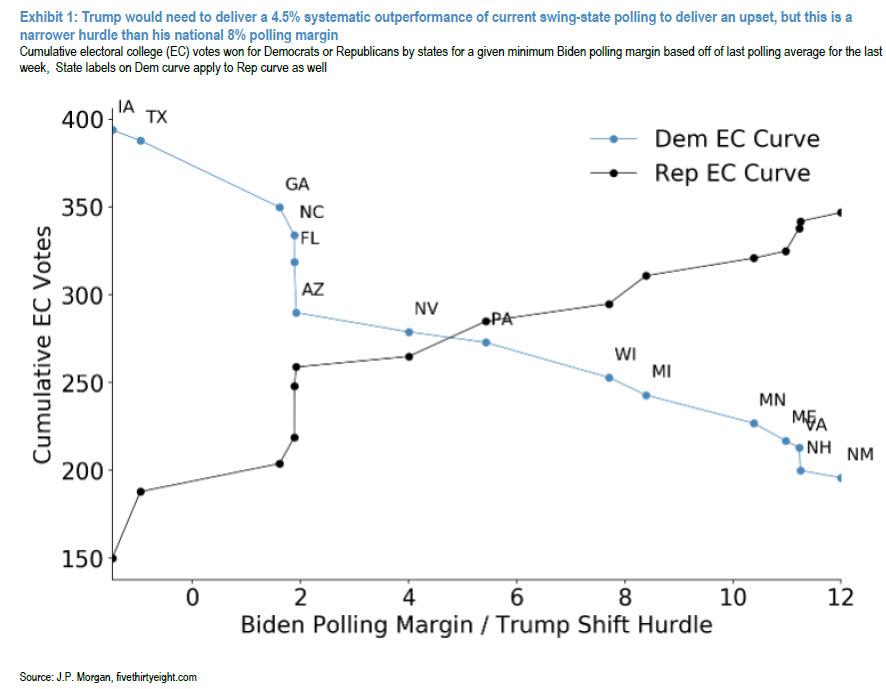

One key development of note in the past 24 hours has been the continued shift in Trump's favor in a number of swing state polls, which has narrowed the polling margin error difference separating a decisive early Biden victory and a potentially delayed slog towards certainty. This can be seen in a number of states that have more closely clustered around the 1.6-1.9% polling margin in favor of Biden (GA, NC, FL, AZ), which together count for 71 Electoral College Votes (26% of those needed to win). Furthermore, the spread in battleground states has collapsed from over 5% on Oct 13 to half that as of the final polling this evening, at 2.6%

This matters because if we re-run the analysis we conducted over the weekend where we assume the same polling errors in 2020 as in 2016, Trump will win comfortably with 279 votes, and take Florida, Pennsylvania, Arizona and North Carolina.

As the following chart from JPMorgan shows, Biden's shrinking lead in the polls is indicated by the unusual steepness of the Electoral College curve just before the 2% margin. The exhibit presents cumulative electoral college votes according to polling margin – to give an idea of which states are important to watch to determine which final outcome is most likely. Put in plain English, a systematic polling error of less than 1.6% should give high certainty of a decisive Biden victory assumed tomorrow evening. A systematic polling error of greater than 1.9%, however, will likely push the tipping point states towards those known to likely have delayed results (PA, WI, MI).

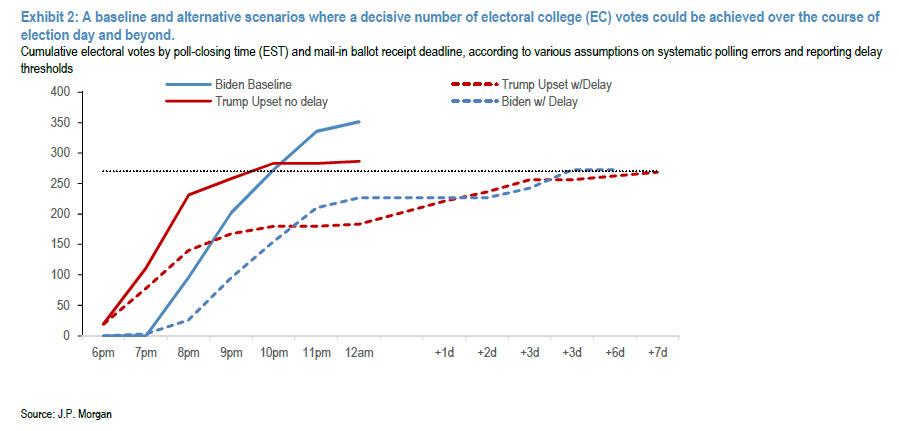

The next chart shows a baseline and alternative scenarios where a decisive number of electoral college votes could be achieved over the course of election day and beyond. This chart shows cumulative electoral college votes according to likely result release time according to various representative scenarios, to provide a template to track how the actual observed outcomes unfolding election night and beyond is tracking to either the baseline, or to alternative wildcards outcomes.

Here are some observations on the chart above from JPMorgan:

- The ‘Baseline’: Early confirmation of Biden/Blue Wave sweep (TX goes to Biden at ~9-10 pm EST). Each of TX, GA, OH, FL and IA are close contests after strong Republican outturns in 2016. Newswires called TX first in 2016, followed by OH. If the same holds true in 2020, Biden victories in TX or OH would suggest no systematic polling error in favor of Trump (and the potential for the opposite). It would set a decisive path to deliver the majority 270 EC votes by around 10-11pm (after the 9pm EST closing polls report), and towards as many as 417 Electoral College votes. Earlier in the evening (with the 7pm poll closures) a definitive Biden victory in Florida and Georgia would also go a long way to signaling a highly probable Biden victory. Importantly, if Biden wins in all the states where he has a polling margin lead (including Florida), he will be able to be confirmed without relying on states where there could be potential reporting delays because of mail-in ballot counting, with the decisive EC votes coming in after CA and WA report. Finally, Biden could win even with a polling margin error of up to ~4% in favor of Trump, but this would likely involve a delay.

- Wildcards: On the other hand, Trump has a path to win or at least contest the election process (Trump wins Florida at ~11pm EST, PA/WI/MI results are delayed). Trump realistically needs Florida to remain competitive on election night. If he wins Florida and upsets in a number of smaller states (e.g. NC, GA and AZ, implying a systematic polling error at least 2% in Trump’s favor), then this would elevate the importance of PA, WI and MI to cross the 270 electoral vote threshold. These three states have all seen massive surges in requests for mail-in ballots, and largely do not pre-process the votes; this creates risk of reporting delays. Delayed results in these states keep a contested election a possibility, and could delay the final official outcome for several days while late absentee votes are counted in PA. Importantly, a Trump upset requires a greater than 4.5% systematic polling error in his favor and will almost necessarily involve states where there would likely be delayed reporting. Without any delays, this upset win could be confirmed as soon as the 10pm closing polls report.

- Biden/gridlock likely (Republicans defend almost all Lean-R incumbent Senate seats pushing to a Jan 5 Georgia Runoff). If Biden wins, Democrats need to net +3 seats to have the bare minimum for a Blue Wave sweep that includes a win in the Senate. Per Cook, they look poised to net +2, with seven toss-up seats to be decided. A Biden victory in NC or IA could potentially carry the Senate seat as well, giving Democrats net +3 or +4. So the signal for the Senate may be clear before midnight (it was called at 1:24am EST in 2016). But if the Republicans mount a strong defensive performance, it may come down to seats in Georgia – at least one of which is likely to be decided in a run-off format on 5 Jan 2021. Thus in a tail-risk scenario, there is scope for the Senate not to be decided until January, which would pose significant discomfort for market participants given the potential legislative agenda at stake.

According to JPM, markets should focus on and potentially reprice specifically around outcomes in Texas and Florida. A Texas Biden win should trigger a fuller pricing in of the Blue Wave scenario and a closing of wildcard hedges, as it will also likely rule out a delayed or contested scenario. A Florida win by Trump should trigger a pricing of greater risk premium against the baseline low-drama Blue Wave scenario. Together with news of too-close-to-call outcomes in PA, WI, MI and NC will trigger hedging against a delayed outcome and more significant chance of a Trump upset.

The chart below presents a full listing of state-level election details, together with the risk of delays and the deadline to receive absentee ballots when it's not election day.

Risks of delays and lead changes

Concerns around delays due to greater voting by mail may be overblown in some states, and understated in others. Over 93 million Americans have already voted, including 59 million by mail and 34 million in-person. For reference just 25% of the 2016 votes were by mail, although a big reason for the mail votes is due to the covid pandemic. Most of the swing states are able to process and even count votes ahead of Election Day, which should reduce or eliminate delays. Therefore we would not expect any significant delays in Arizona, Florida, Georgia, Iowa or Ohio, thought marginal delays (hours not days) could be seen in Michigan and Wisconsin.

The biggest potential for delays come from Pennsylvania and North Carolina as under current law both states will allow ballots to arrive up to three days after Election Day so long as they are sent by November 3. These are the two most important swing states after Florida, therefore a tight race in these states could lead to delayed results through Friday, November 6. Both states could see potential cases in the Supreme Court that could alter these rules: Pennsylvania could see its deadline forced back to Election Day and North Carolina could see its deadline extended from three days to nine days. These states need not see such long delays, though, if there is a big lead by one candidate; rather this how long the delays could be under a worst-case scenario. Officials in North Carolina expect over 98% of ballots will be reported on election night which suggests we may still see early results there.

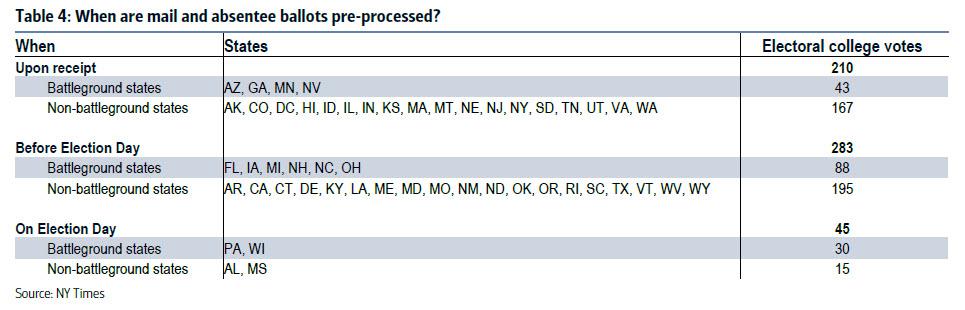

How are the mail in ballots being counted?

According to BofA, states could have a challenging time working through such a large number of mail-in ballots. The rules also vary by state in terms of when the ballot can be sent and counted. The most common state deadline is on Election Day when the polls close (see Table 3 above).

However, some states will accept a mailed ballot if it is received after Election Day as long as it is postmarked prior. The rules differ in terms of when the ballots can be counted. Some states do not allow mail-in ballots to be opened before Election Day which could mean counting delays. This includes a few of the critical swing states – such as PA and WI. Moreover, mail-in ballots may be contested for signatures that don’t match voter registration cards.

Expect to wait for Arizona

On election night in 2018, Arizona Republican Martha McSally appeared to be on the road to victory in the state’s U.S. Senate race, telling her supporters she was going “to bed with a lead of over 14,000 votes.” Six days later, McSally conceded the race to Democrat Kyrsten Sinema as election officials tallied hundreds of thousands of mail-in ballots, including many from the Democratic-leaning metropolitan areas of Phoenix and Tucson that were handed in at voting centers on Election Day.

Arizona officials said they hope it will take less time to count ballots this year as Maricopa County, which includes Phoenix, has upgraded its equipment and added an extra week to handle early mail-in ballots. But if the race is close, it could still take days to fully count the votes. That would be “an indication of things going the way they’re supposed to,” said C. Murphy Hebert, a spokeswoman for the Arizona Secretary of State. “The process is complex, and we would just invite folks to be patient.”

Lead changes throughout the night

One potential consequence of the significant early voting and different counting procedures is for lead changes throughout the evening. In states with delayed processing/counting (e.g., Michigan, Wisconsin, Pennsylvania), in-person Election Day voting could be counted and reported sooner than mail-in voting which could appear to give Trump an early lead that later diminishes. Conversely, states reporting already-counted mail-in votes early could appear to give Biden a lead initially that then reduces as in-person Election Day votes are tallied (e.g., Florida, North Carolina). This is why Twitter today said it will flag tweets from certain accounts, including those of presidential candidates, who claim a U.S. election victory before it’s called by two of seven media outlets (indicatively, Twitter cited the following news outlets as acceptable race callers: The Associated Press, ABC News, CBS News, CNN, FOX News, DecisionDeskHQ and NBC News).

Contested election risk

Close races in key states could lead to delays because it can trigger recounts, in some cases automatically, especially in Ohio, Pennsylvania and Florida if the margin is less than 0.5%. Initial machine recounts can be done in days while manual recounts if needed can take longer. Even if results are not within the margin to trigger automatic recounts, candidates are still able to petition for recounts in close elections.

Recounts - an infrequent if normal part of elections - come with added risk this year as markets have becoming increasingly concerned with the potential for a contested election. A contested election is conditional on close/unclear results. Clear, lopsided results on election night could still lead to challenges but they are unlikely to be material or alter outcomes. However, a scenario wherein: (1) the Electoral College 270 vote threshold is a function of one or two states, and (2) where initial results in those deciding states are close enough to require recounts could lead to a significantly higher probability of a contested election, as was the case in the 2000 Bush versus Gore election.

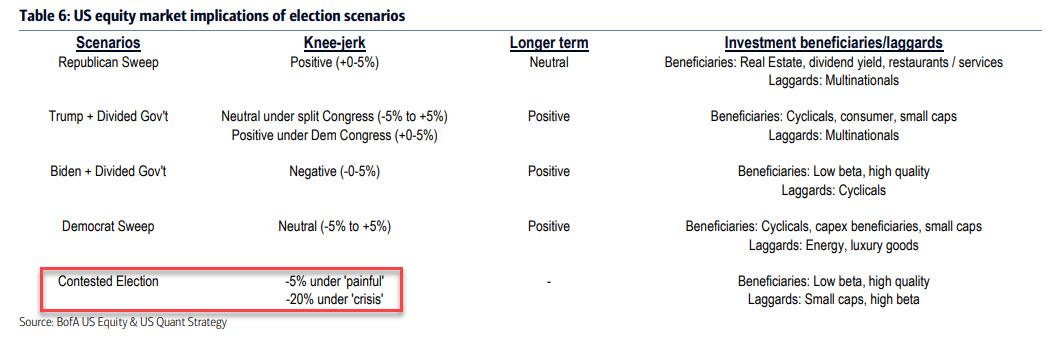

Therefore, if the overall outcome is not known by the morning following the election as we are waiting on recounts or delayed results, the markets could quickly price in a higher probability of a contested election and we could see the USD higher and equities and yields lower on risk-off sentiment until there is greater clarity.

A recent note from Bank of America attempted to quantify the impact of a contested election on markets: in it BofA's Michelle Meyer and Savita Subramanian said that stocks could slide as much as 20% if there’s a contested election. This means that as soon as Wednesday once it emerges if the election will not have a clear winner, we could see a bear market. Whether that happens or note will depend on the reason and duration of the delay. There are three scenarios:

- Benign: Results are delayed due to counting backlogs given the large number of absentee and mail-in ballots but a result is expected within days.

- Painful: If the count is close, it could result in a dispute about ballot validity and lead to a recount at the state level. C

- Crisis: Either side refuses to accept the results, leading to a legislative battle and a high degree of government dysfunction

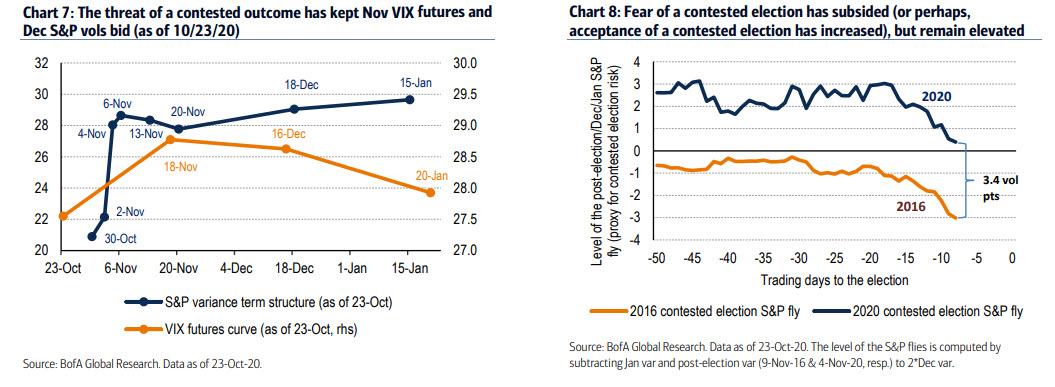

"A landslide victory for either Trump or Biden and rapid election conclusion would likely be welcomed by markets while a severely contested election could see risk-off and drive 10-year rates materially lower"...

... and even though probability of a contested election has subsided (or perhaps, acceptance of a contested election has increased) VIX futures still remain elevated, clearly discounting risks of a contested election.

The flipside, of course, is that "if markets sell off violently and the economic data deteriorate, we could see Washington facilitate the passage of stimulus even in a highly contentious environment."

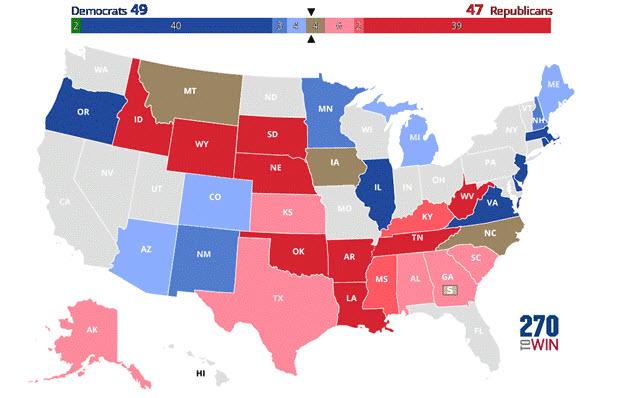

The battle for the Senate

An unspoken truth is that while the presidential race is important, it will have little to no impact on markets. It will however, matter, in conjunction with the outcome of Congressional votes. As such the outcome of the Senate race matters more markets. Currently, Republicans hold 53 of the 100 seats, with 34 seats up for re-election this year. Recall that in the event of a 50-50 split, the Vice President acts as a tiebreaking vote. Currently forecasters expect Democrats to lose a seat in Alabama and gain seats in Arizona, Colorado and Maine for a net gain of 2 seats (from 47 to 49 of 100). This leaves four toss-up Senate seats to watch: Georgia, Iowa, Montana and North Carolina. Democrats would need to win one of these four and the Presidency or two of these outright to ensure control of the Senate. The Georgia Senate seat requires 50% of votes; however, there are multiple candidates running which likely means a run-off election on January 5 will be needed to determine the winner of that seat. Though unlikely, this can create a scenario where the Senate majority is not known until then.

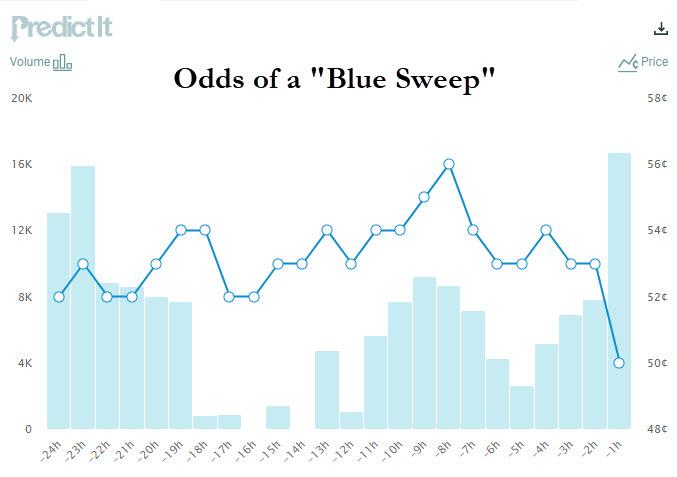

According to the Iowa Electronic Markets, the probability of the Democrats taking over the Senate and maintaining the House (Democratic Sweep) is the mostly likely outcome with a 57.5% probability, although online prediction market PredictIt begs to differ, and according to the latest data, odds of a Blue Sweep have tumbled to just 50%, the lowest in weeks and leaving open the possibility of years of Congressional gridlock.

As noted above, the Senate and Presidential election results need not be called at the same time, and historically this has been the case for many of the key states we are watching. In 2016 Senate results were typically called earlier than Presidential results, and the same political party won both elections in all swing states. In 2012, though, the Senate results were usually slightly delayed compared to the Presidential election; however, here again there was consistency across parties with three of the four swing states seeing the same political party win both contests.

The story for stimulus

The first order impact of the election will be on the trajectory for additional stimulus. Here are our expectations:

- Biden win + Democratic Congress (‘Blue wave’): $2.0 – 2.5tr in stimulus, including additional funds for the COVID health response. Passed right after inauguration.

- Biden win + divided Congress: $500bn - 1tr in stimulus. Passed after inauguration but with some delay. There is also some chance of continued gridlock in this scenario.

- Trump win + divided Congress (‘Status quo’): $1.5 – 2.0tr in stimulus. Passed in the lame duck session because neither side gains an advantage by waiting for a new government to form.

Needless to say, a clear victory could accelerate stimulus negotiations. This is particularly the case if it returns the status quo so neither side has a reason to delay. The two sides are not that far apart — both agree on additional unemployment insurance (around 100% replacement income which is about $300-400 additional/week) and aid for small businesses. They disagree over state & local aid and liability protections for businesses but these appear surmountable hurdles. It is even possible that stimulus is passed in the lame duck session with a status quo result.

The worst case scenario, and one which could lead to a 20% drop in markets according to BofA, a scenario of a Biden victory with a Republican Senate could make it harder to get any package through, creating a risk of sustained gridlock. By contrast, a “Blue Wave” would make a stimulus package very likely by February, one that is likely in excess of $2tr. Under any election result, there will be much more clarity on the path for fiscal stimulus with a fading of the uncertainty shock.

In the event of a contested election that looks like either scenario 2 or 3, the political environment creates a challenge for additional stimulus. Markets will likely become discouraged about the prospects for compromise. However, there is a threshold. If markets sell off violently and the economic data deteriorate, we could see Washington facilitate the passage of stimulus even in a highly contentious environment.

To summarize, BofA believes that an election result of status quo could lead to an earlier passage of stimulus (in lame duck), a “Blue Wave” makes a stimulus package very likely but only after inauguration and a highly contested election would likely create an impediment to stimulus but if the markets and economy deteriorate, an emergency stimulus could be triggered. A clear victory would be a net positive for the economy as it reduces some of the negative risk from higher uncertainty. A Blue Wave likely means greater stimulus which thereby provides the greatest near-term boost to the economy.

The Fed wild card

If there is not a result and financial conditions tighten due to a contested election, BofA believes the Fed’s credit facilities will once again be needed. The Fed could consider easing terms to facilitate the flow of credit. The Fed could also ramp up the QE program, buying Treasuries and MBS at a faster rate, as well as corporate credit as needed, particularly if it sees concerns over market liquidity. Ultimately the focus could be on credit (MBS and corporate credit) versus USTs in a risk-off scenario. Or as BofA recaps, "the Fed has tools and will use them."

https://ift.tt/323BjcH

from ZeroHedge News https://ift.tt/323BjcH

via IFTTT

0 comments

Post a Comment