One Bank Throws Up All Over The Surge In COVID Optimism

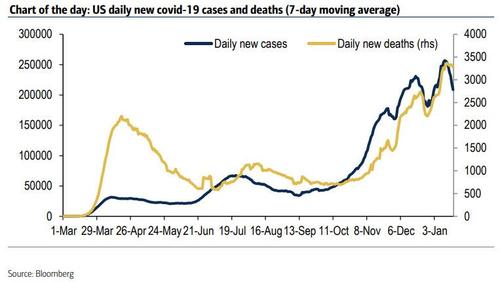

With every passing day since the Biden inauguration, which also coincides with the day new covid cases in the US peaked...

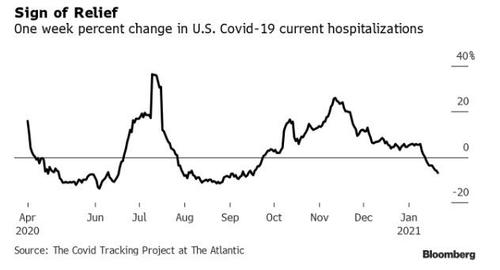

... and hospitalizations plunged by a record amount...

... the covid-related news gets better and better as blue-city after blue-city rushes to reopen after scrambling to enforce full lockdowns into the presidential election.

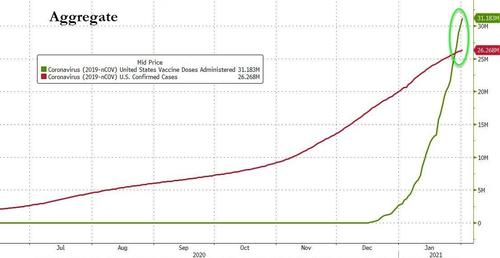

Furthermore, in the best covid-linked news yet, just a few hours earlier, we learned that covid vaccinations in the US topped the number of cases for the first time...

... and with 1.3 million vaccines now being given out daily, one can argue that it's only a matter of months before herd immunity is reached.

To summarize where we stand, the covid newsflow before and after the Biden inauguration is night and day, with cases and hosptializations tumbling while the daily pace of vaccination has risen from around 200k at end of last year to more than 1 million today. Meanwhile, after a widely-anticipated post-holiday surge, cases have dropped 41% from their peak. Are we out of the woods?

One bank disagrees with this cheerful assessment, and in a note from BofA economist Aditya Bhave, he warns that the worst may be yet to come as he remains "concerned about the new, more contagious virus strains out of the UK, South Africa and Brazil."

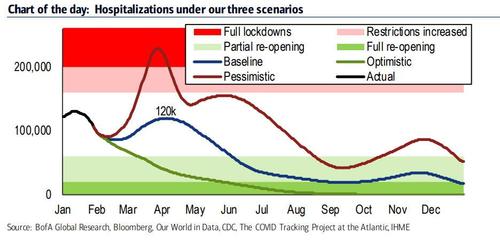

Why? Because according to BofA simulations, even a very optimistic pace of vaccination cannot fully offset their impact the mutations they become dominant. Therefore the bank's base case is that cases and hospitalizations will actually return to their post-holiday peaks in the early spring (as shown in the chart below).

It could get even worse: in BofA's pessimistic case, the new strains cause a larger increase in underlying transmission, pushing cases and hospitalizations to unprecedented levels and potentially forcing lockdowns in March-April.

Only BofA's optimistic case sees no "spring wave" , yet ominously Bhave then says that he views this scenario "as the least likely."

However, after the spring doldrums, it then starts getting better again and "by the summer, enough people would have been vaccinated to slow even the more contagious virus strains." This should allow for significant economic reopening.

After the summer, BofA expects another wave in the fall due to colder weather pushing activities indoors and holiday super-spreader events. The size of this wave will be a function of the speed of vaccination. And, as the bank finally concedes, "vaccination slows in our baseline scenario because of hesitancy among the younger population. But if a sufficiently rapid rate of inoculation can be maintained through year-end, we might be able to avoid a fall surge and sustain full economic re-opening."

Which will be a problem for one simple reason: as we noted earlier, a majority or 51% of Americans, are unlikely to want to get vaccinated, which means that while the rate of vaccinations is currently surging, once the early candidates get vaccinated, the daily pace will fall off a cliff as half the nations refuses the vaccine. What impact that will have on BofA's pessimistic scenario remains to be seen.

https://ift.tt/3am0pXW

from ZeroHedge News https://ift.tt/3am0pXW

via IFTTT

0 comments

Post a Comment