Reddit Trader DeepFuckingValue Loses $19 Million In Two Days As He Holds On To Gamestop Stock

Earlier this week, one of the most notorious and popular WallStreetBets traders, best known by his alias DeepFuckingValue, by his YouTube username Roaring Kitty, and perhaps best known as the mastermind behind the Gamestop short squeeze, revealed himself to the world in concurrent articles from both Reuters and the WSJ (where he was also interviewed). His real name: Keith Patrick Gill, CFA, a title which the 34-year-old used while working in marketing for Mass Mutual, which he joined in 2019. The title then became worthless to Gill after he recently quit the life insurer to focus on just one thing: trading and spreading the gospel about Gamestop stock out of a basement of the home he rents in Wilmington, Mass... and boy was he successful.

Regular readers know the story: through frequent posts on Reddit’s WallStreetBets thread, Gill became the Pied Piper of GameStop, sharing screenshots of his portfolio which inspired thousands of amateur retail investors to follow him into the ailing retailer too, while orchestrating the biggest short squeeze ever.

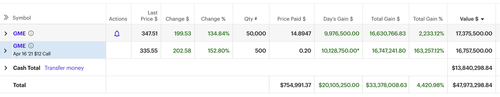

Gill began sharing his bets with the group in September 2019, posting a portfolio screenshot indicating he had invested $53,000 in the company and had already netted a $46,000 profit. By last Wednesday, Gill was up over 4000% on stock and options investments in the company, with his GME position plus cash worth nearly $48 million (the value of his GME investments was $34 million), according to his Reddit posts.

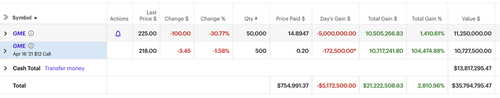

Sadly for Gill, after his account peaked in the middle of last week, it's all been downhill, and the money that took Gill over a year to accumulate he lost more than half in just two days: on Feb 1, DFV was down $5.2 million to $35.8 million including the cash, or $22 million in GME securities...

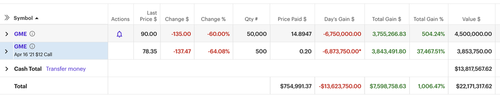

... followed by a record drawdown earlier today, when he lost a record $13.6 million bringing the value of his GME securities to just $8.4 million.

While for a hedge fund this sum is pocket change, for a trader who started off with $50,000 and worked diligently for nearly two years to build up a loyal following, the amount means months of hard work flushed down the drain. For most Americans, it's an amount they can only dream of.

And just like that, easy come, easy go: in the span of a few days, the value of Gill's GME stock and call has plunged by 75%.

Of course, with $22 million still in the account (thanks to $14 million in cash), Gill remains a winner although should GME stock continue to drop - and it most likely will not that the short interest has collapsed - his victory will get smaller... but at least he'll hold.

“Your steady hand convinced many of us to not only buy, but hold. Your example has literally changed the lives of thousands of ordinary normal people. Seriously thank you. You deserve every penny,” one Reddit user, reality_czech, responded to one of DFV's famous P&L screengrabs.

We are confident that Gill will have lots of pennies left over long after the GME short squeeze is forgotten, but to all those who followed in his footsteps and bought the stock on the furious momentum scramble higher over the past two weeks - all of whom are now underwater if they too held without selling since Jan 26 - and who plan on holding until the bitter end, they may not be so lucky.

https://ift.tt/2O2nJCv

from ZeroHedge News https://ift.tt/2O2nJCv

via IFTTT

0 comments

Post a Comment