US Mint Warns It Can't Meet "Surging Demand" For Silver & Gold

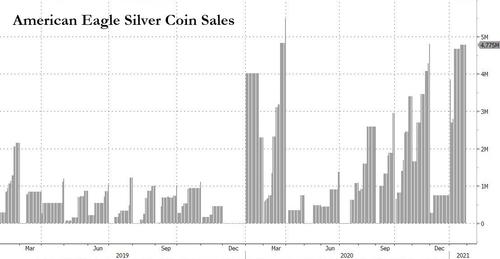

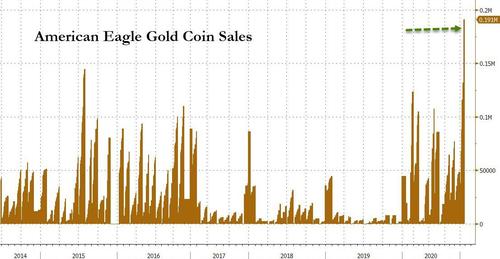

With The Fed printing money 'out the wazoo', monetizing COVID relief package debt as fast as Congress can pass the bills, demand for bullion was already surging. However, the last week or so, on the heels of the Reddit-Raiders taking aim at Silver, demand for silver (and gold coins) has exploded...

Sales of U.S. gold bullion coins rose 258% in 2020 while silver coin demand was up 28%, the U.S. Mint said Tuesday.

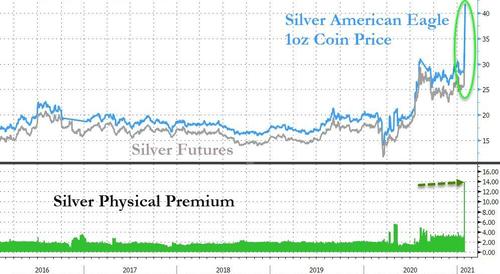

Which has led to bullion dealers running dry of stock and physical premium to paper silver prices soaring to record highs.

“There are massive shortages. We’ll be completely out of stock if it carries on like this - the first time since our company opened in Singapore seven years ago,” said David Mitchell, managing director at Indigo Precious Metals.

“In the short term, stocks may run out since it takes a long time for sea shipping, but overall supply is ample,” said Peter Fung, head of dealing at Hong Kong-based Wing Fung Precious Metals.

And now, courtesy of Reuters, we have an answer to the shortage.

The US Mint is limiting distribution of its gold, silver and platinum coins to specific dealers because of heavy demand, and a limited number of suppliers of metals, it said in a statement.

The United States Mint said on Tuesday it was unable to meet surging demand for its gold and silver bullion coins in 2020 and through January, due partly to pandemic-driven demand and plant capacity issues... Heavy buying has continued in 2021, it said, squeezing supplies, which had already been tight as the coronavirus affected production.

The last time the US Mint 'admitted' its inability to meet demand was in June 2010.

And the reaction in precious metals was...

Trade accordingly.

https://ift.tt/3rhZWwI

from ZeroHedge News https://ift.tt/3rhZWwI

via IFTTT

0 comments

Post a Comment