Vol Traders Positioned For Continued Rate Selloff Up To 100bps

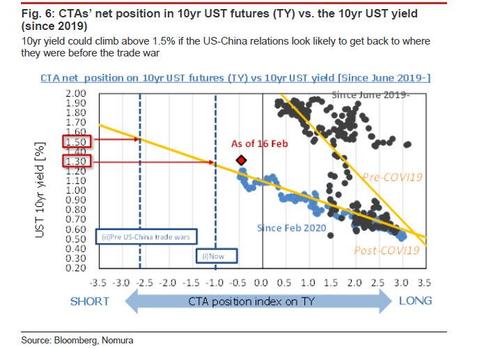

With the 10Y yield rising as high as 1.39%, and just shy of the critical 1.50% level which, according to Nomura, could set off a liquidation cascade for risk assets once breached...

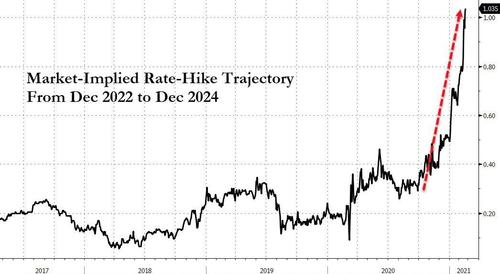

... many traders believe that we have now hit seller exhaustion levels - at least for the time being - especially since market implied rate hike odds have exploded in the past three weeks, with traders now pricing in approximately 4 rate hikes between 2022 and 2024, a key catalyst behind the furious liquidation in duration.

On the other hand, perhaps the selling is just getting started.

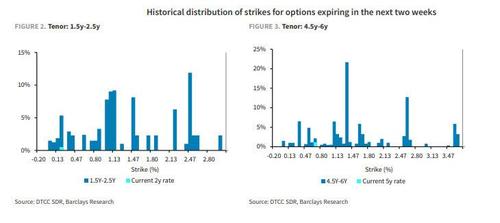

According to Barclays rates trader Amrut Nashikkar, swaption data from the Swap Data Repository (SDR) reveal that vol traders continue to anticipated a steep US rates selloff and have established multiple limited loss strategies to position for a move higher in rates.

Some of the more popular swaptions positions reveal selloff expectations anywhere between 30bps and 100bps; to wit, Nashikkar observes that in the most popular Theme, investors have put on multiple limited-loss structures including 3m*10y payer fly targeting a 30bp selloff and 2y5y payer spreads targeting a 100bp selloff.

A second theme finds that the inverted vol surface is spurring forward vol trades, with many calendar spreads on 10y and 30y tenors anticipating a deeply inverted vol slope in long end (here trades have included 3m*30y vs 1y30y payers and 2.5y10y vs 7y10y straddles, etc.)

A final theme reveals that conditional curve trades involving belly and the long end are popular, and the relative vol pricing suggests that they are bear flatteners or some combination with bull steepeners, including 3m10s30s through slightly OTM payers and 2y5s30s through straddles.

In short: while some (mostly equity tourists) are hoping for the best, and that the rate selloff is finally over, rate pros are hedging for the worst including a potential spike in yields of as much as 1%.

https://ift.tt/3uqDSCa

from ZeroHedge News https://ift.tt/3uqDSCa

via IFTTT

0 comments

Post a Comment