WeWork's Neumann Nears Deal To Settle With Softbank For $500MM, Retain 'Major' Ownership Stake

The former CEO and co-founder of WeWork, the tech/real-estate private company which saw its IPO implode back in 2019 (before talk of a possible second bite at the apple resurfaced in recent weeks) is reportedly nearing a settlement with Softbank in a closely-followed case.

Per WSJ, Neumann could be nearing a settlement with Softbank, the Japanese telecom giant/VC behemoth, which takes out long-term leases and then divvies it up on shorter terms after completing hip renovations, cut thousands of jobs and withdrew from dozens of buildings around the world. The settlement would allow SoftBank to avoid paying some of the money it agreed to pay to Neumann back in the fall of 2019, while still allowing Neumann to walk away with $500MM, and retain his status as a major shareholder in WeWork.

For those who haven't been closely following this legal saga, Softbank rescued WeWork when it came to the company's rescue after WeWork's IPO fell apartment in 2019. But one of the strategies it used to recapitalize the company involved buying back, or rather, promising to buy back, shares owned by insiders, including Neumann, which left the firm with a majority stake, and the freedom to make sweeping management changes.

Originally, the deal struck between Softbank and WeWork back in late 2019 involved a commitment to spend $3B to buy shares from Neumann and other WeWork insiders.

But, according to terms being discussed currently, Softbank would spend roughly $1.5B to buy the shares of early WeWork investors and employees, including nearly $500MM to purchase shares from Neumann. Neumann - who was widely panned for the $185MM golden parachute consulting agreement he pocketed during the chaos of 2019 - would only walk away with half of what Softbank initially promised him, meaning his hopes for regaining billionaire status have potentially been snuffed out - at least, unless the WeWork SPAC becomes a reality and a success.

That's right: Instead of $1B, Neumann would only walk away with $500MM, according to WSJ's sources. Bloomberg points out that the price of the shares that Neumann has agreed to sell hasn't changed since 2019. However, SoftBank will only walk away with half the original number.

Under the terms of the potential settlement, SoftBank would purchase half of the WeWork shares it originally agreed to buy in 2019, said one the people, who asked not to be identified because the talks are still private. That means Neumann would be able to sell close to $500 million in stock, and that SoftBank would pay about $1.5 billion overall. The shares are being sold at the same price agreed upon in 2019, the person said.

The deal would mean Neumann sells about a quarter of his position in WeWork and remains a major shareholder in the company, the person said, while noting the agreement isn’t finalized and could still change. The agreement could also pave the way for a second attempt at a WeWork public listing, the person added. A spokesman for Neumann and a spokeswoman for SoftBank declined to comment. The Wall Street Journal reported on the talks earlier.

Despite the comity once shared between Softbank and WeWork, negotiations have reportedly been tense, and the relationship between Neumann and his former patron, billionaire Softbank Chairman Masayoshi Son, has reportedly soured.

As the SPAC boom rolls on, WeWork has been in talks with a SPAC called BowX Acquisition and the two sides could reach a deal in the coming weeks, the people said.

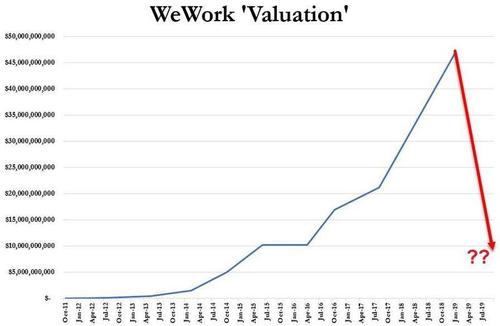

WeWork is infamous for seeing its private-market valuation implode over the span of a few weeks during the summer of 2019 as WSJ, Bloomberg, Reuters and others reported on a stream of leaks purportedly emanating from the investment bankers working on the deal and their clients, who were seriously dissatisfied with the price that the bankers were purportedly demanding for the shares.

There is no guarantee WeWork will reach a deal with BowX, and other financing and SPAC options are still on the table, the people cautioned. But with the SPAC boom rolling on seemingly with no end in sight, few would be surprised, at this point, if WeWork does eventually trade in the public markets.

https://ift.tt/3aLYZaC

from ZeroHedge News https://ift.tt/3aLYZaC

via IFTTT

0 comments

Post a Comment