"This Is The Best Inflation Hedge": Goldman Doubles Down On Commodity Supercycle

Less than three weeks after JPM declared that a new commodity supercycle has begun, it is Goldman's turn to remind clients that it was the first to predict a secular rise in commodities, only instead of using the "supercycle" cliche, Goldman calls it a "new structural bull market in commodities."

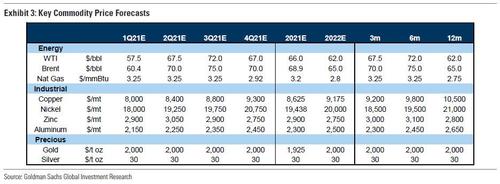

Commenting on the dramatic outperformance of commodities in 2021, Goldman chief commodity strategist Jeffrey Currie writes that "not only have oil, metal and agriculture prices rallied ytd, but structural impediments on supply have created sustainable deficits, in our view, giving commodities broad-based positive carry. Accordingly, we recently raised our oil, metal and grain forecasts and lowered our gold forecasts, which in aggregate suggests a 12m commodity index return of 15.5%. Further, commodity diversification is back as returns have decoupled from other asset classes."

The kicker: "As we have argued since October last year, we believe this is the beginning of a new structural bull market in commodities, and with every market but cocoa and zinc in a deficit we maintain our conviction in this view."

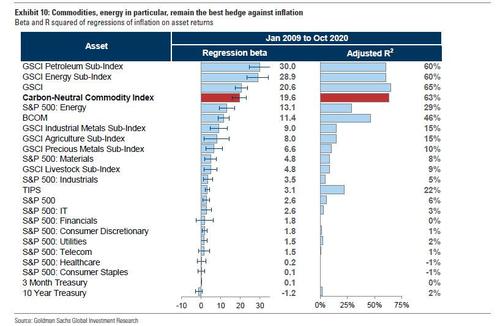

In light of this it's hardly surprising that Goldman still believes that "commodities remain the best inflation hedge" but there is a twist: amid widespread concerns that the coming inflationary spike is cost-push driven and will therefore fizzle shortly amid lack of widespread demand to keep prices sustainably higher, Currie argues that "despite commodities leading the reflation trade, we believe it is not about cost-push inflation but rather demand-pull inflation." Elaborating on the difference, the commodity strategist notes that "cost-push inflation episodes, which are very rare, are supply-side events that are both very transient in nature and self-defeating by creating a recession and/or supply response such as the oil shocks of the 1970s" not to mention the $140 price in oil hit just months before Lehman collapsed in 2008. Instead, Goldman sees "supply across all of these markets chasing demand higher but not catching up, leading to demand pull inflationary pressures, even in oil."

And the punchline: "commodities are the crucial link between growing demand, a weaker dollar and inflation, which is why they have been statistically the best hedge against inflation."

And while contrary to JPM, which believes that oil will be the biggest beneficiary from the current supercycle, Goldman sees muted gains in Brent and WTI which it expects to peak in Q3 at $75 and $72 respectively, the bank is positively euphoria on industrial metals such as copper, nickel, zinc and aluminum, expecting all to keep rising for the foreseeable future.

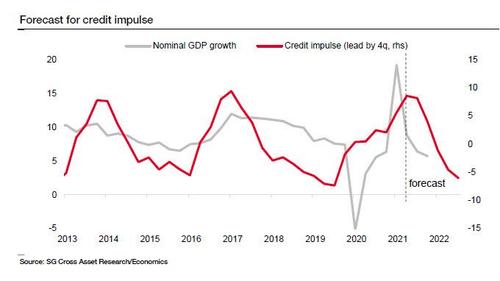

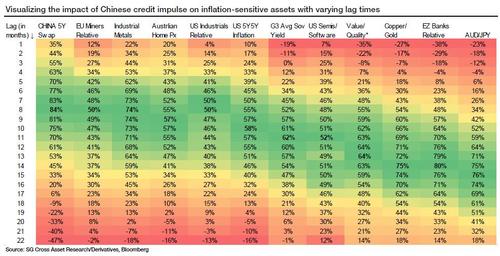

As usual, we would beg to differ with Goldman and while we too anticipated strong commodity gains for the next 6-9 months, the longer-term is far more cloud if for no other reason than China's all important reflationary credit impulse has now peaked...

... and will have adverse consequences on all inflation-linked assets over the medium-term.

Just yesterday we saw the adverse impact of this critical impulse as China's latest mfg PMIs dropped to a nine month low.

Alas, Goldman glosses over the impact China plays on commodity prices and instead in addressing his latest price forecasts, Currie writes that "strong fundamentals, not money flows, drive prices."

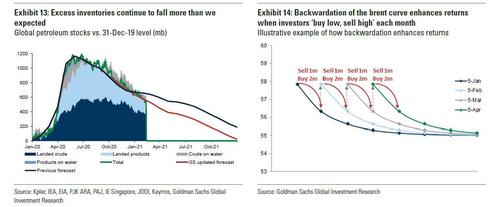

Our recent upgrades of 6m oil to $75/bbl from $65/bbl, 12m copper to $10,500/t from $10,000/t and downgrade of our gold price target to $2000/toz from $2300/toz were fundamentally driven. Lockdowns have driven a wedge between the consumption of services and goods, generating additional demand from both households and governments looking to stimulate activity while minimizing the virus spread. Backwardation supports our view that this was fundamental and not money flows, reinforced by the fact oil length is near normal and commodities exposure relative to total AUM remains under-invested, even relative to 2008.

Goldman then goes back to its most controversial assumption, namely that rising prices are the result of demand-pull not cost-push trends, which explains the key role commodities play by being at the forefront of the macro reflation trade - and are also critical in restarting the reserve recycling flow (better known as petrodollar in the case of oil) - and are therefore the best hedge to inflation:

In recent weeks reflation has become top of mind as inflation expectations have recovered from the recent pandemic lows and are now close to the Fed’s implicit AIT target of 2.25%. Commodities have sat at the heart of this reflation story and we believe the key here is that this reflation push is demand driven, not cost push inflation, despite being centered on rising commodity prices. Cost-push inflation episodes, which are very rare, are supply-side events that are both very transient in nature and self-defeating by creating a recession and/or supply response such as the oil shocks of the 1970s. Instead, we see supply across all of these markets chasing demand higher but not catching up, leading to demand pull inflationary pressures, even in oil. Further, commodities remain the best hedge against inflation (Exhibit 10), in our view, as they remain key inputs into households consumption bundles, and therefore the components of the CPI. Indeed, commodities are the crucial link between growing demand, a weaker dollar and inflation. Commodities are mostly produced in emerging markets, leading rising prices to enhance their current account surpluses. These surpluses end up as additional dollar reserves at EM central banks, which are then required to diversify these holdings into other DM currencies, selling their excess dollars and driving down the dollar, a process known as reserve recycling. In addition, excess reserves raise the availability of credit in these regions, further spurring demand growth, commodity prices, and dollar depreciation, all of which act as a tailwind for prices.

Having recently extolled the virtues of copper which it views as the most attractive commodity (not least because it anticipates a historic supply shortage in coming years), Goldman then spends some time to justify its oil bullishness which prompted it to hike its Q2 and Q3 oil price projections by $10, referring to the to backwardation in the strip as the primary drive for crude outperformance:

As a result of a faster-than-expected rebalancing, we now forecast Brent prices will reach $70/bbl in 2Q21 and $75/bbl in 3Q ($10 above our prior forecasts). We expect this rally to be driven by both rising long-dated prices as well as a sustained steep level of backwardation driven by tightening that will likely unwind the entire OECD surplus by summer. As the market reflects the expected level of inventories two to three months ahead, we see this additional level of backwardation being brought forward from 3Q to 2Q. Meanwhile, the non-OPEC supply response has been neutralized by a collapse in energy capex globally as well as a paradigm shift in the shale industry towards FCF generative business models that should generate shareholder returns as US shale producers are sharply disciplined if they raise capex plans. Though JPOCA-related risks to Iranian production remain, we continue to believe it will not derail the tight oil market as there remains work to be done before a renewed agreement can be reached, while OPEC+ – Russia in particular – is likely to help accommodate a ramp up in Iranian production.

But what about the coming OPEC+ meeting where member states, and certainly Saudi Arabia, are widely expected to boost oil output? In response, Goldman writes that it expects that even a 4.4mb/d rise in OPEC production would leave a 1.35mb/d deficit in the summer, leaving headroom for faster-than-expected production ramp ups before the oil rebalancing is derailed.

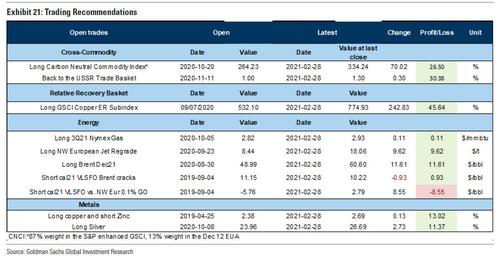

Finally, here is a snapshot of Goldman's current commodity trade recommendations:

https://ift.tt/3caJxV1

from ZeroHedge News https://ift.tt/3caJxV1

via IFTTT

0 comments

Post a Comment