'Unwelcoming' Food Inflation Outpaces Incomes With Destabilization Risks For Emerging Markets

Food prices are undeniably soaring faster than inflation and incomes around the world. As everyone's favorite permabear, SocGen's Albert Edwards, who, unlike Goldman, has already sounded the alarm on rising food inflation.

As a reminder, the Food and Agriculture Organization's Food Price Index surged to a seventh consecutive month in December.

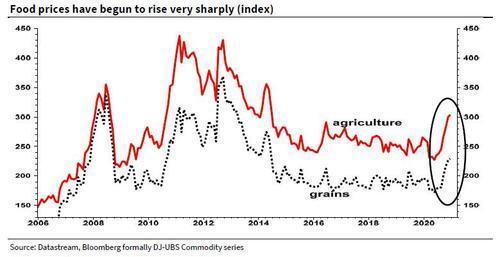

With the FAO food index rapidly rising, Edwards noted that "annual inflation in cereals reached 20%, the highest annual rise since mid-2011 when the Arab Spring was in full flow!."

With this in mind, tofu prices in Indonesia are 30% higher than it was in December. Brazilian prices of turtle beans are up 54% over the last year. Russians are paying 61% more for sugar than one year ago, according to Bloomberg.

Emerging markets are far less insulated from soaring raw commodity prices than developed economies. An unprecedented amount of fiscal and monetary policy by governments and respective central banks has flooded the world with liquidity. Edwards makes the point that expansive monetary policies by central banks, more importantly, the Federal Reserve, was to blame for the global tidal wave in food inflation back in 2011: "Despite Ben Bernanke's denials that the Fed's QE policies caused rampant food price inflation in 2011 (link), many economists such as myself believe that was absolutely the case."

Consumers in developed countries such as U.S., Canada, and Europe aren't immune to rising food prices from pandemic-related disruptions (but increases aren't as bad as EM countries at the moment). Kraft Heinz Co and Conagra Brand recently warned customers that surging prices of wheat, sugar, and other commodities would be passed onto customers.

Kraft Heinz CEO Miguel Patricio said inflation is everywhere in the agri complex.

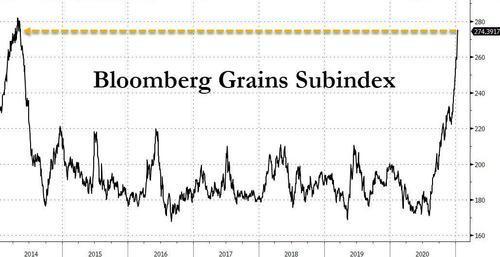

Patricio said inflation in "everything related to grains" is being observed, and it may result in price increases of some categories, including mac and cheese and mayonnaise, later this year.

"People will have to get used to paying more for food," said Sylvain Charlebois, director of the Agri-Food Analytics Lab at Dalhousie University in Canada. "It's only going to get worse."

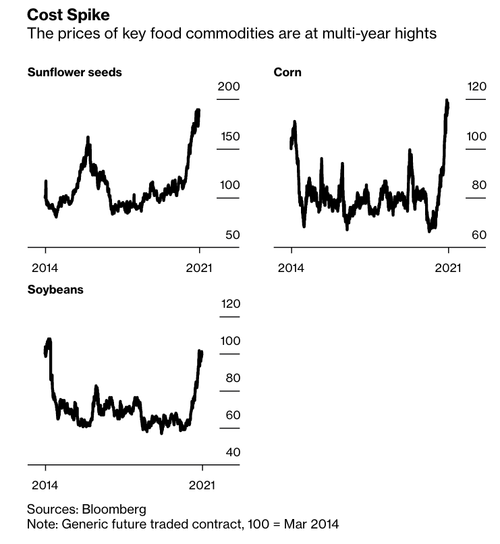

Food inflation is never welcomed in economies because it can generate socio-instabilities. Prices of staples like grains, sunflower seeds, soybeans, and sugar show no signs of letting up. With global supply chain disruptions, volatile weather, and China increasing demand, food prices will likely remain elevated through 2021.

Food insecurity has become a significant issue for the US. The latest figures from Feeding America show 13.2 million Americans face missing meals due to mass layoffs and depleted savings as they struggle to survive.

Food Prices Are Soaring Faster Than Inflation and Incomes: BBG

— zerohedge (@zerohedge) March 1, 2021

According to the Fed, this is only a problem for the 340 million people without access to the Fed charge card right @neelkashkari

But more importantly, food price increases should be closely watched in emerging markets.

"I got a smaller piece of tempeh and tofu now, with the same price as last week," said Rahayu, who goes by one name as many in Indonesia do, a 64-year-old grandmother in West Java province, noting that in recent weeks, the price of chili had more than doubled to 70,000 rupiah ($4.97) per kilogram. "I'm going to need to use less."

Countries like Russia and Argentina have put price curbs on certain staples and slapped tariffs on exports in their attempt to battle domestic food inflation.

For more color on what could be around the corner if food prices continue to rise - here's what we said in early 2011, just as Arab Spring was unfolding...

The last time food prices hit ridiculous levels, the immediate outcome was global food riots in places such as Haiti and Bangladesh. Which is why distributors of riot equipment in the world's poorest countries may be in for a bumper crop as the Food and Agriculture Organization has just announced that world food prices have just surpassed the previous record last seen in 2007-2008. But it's ok: according to the centrally planning Chairman it's all good, and the inflation is really just in our heads. After all, courtesy of the recent spike in mortgage rates, home prices now have about 10% to drop, meaning even less equity will be extracted from already substantially depressed food prices.

This leads to the conclusion that rising food inflation could be enough to trigger social-instabilities in some emerging market economies - though which ones have yet to be determined.

Another lesson to be learned is that rising food inflation in modern markets and economies could be one of the best predictors of bond yields.

https://ift.tt/2MB8908

from ZeroHedge News https://ift.tt/2MB8908

via IFTTT

0 comments

Post a Comment