Chinese Cryptoexchange Huobi Suspends Some Services, Stops Miner Hosting Services

Last week, when cryptos again plunged on the well-timed recurring "news" report that China was again banning crypto - something China has been doing with zero success since 2014 but has taken on new urgency now that its Digital Yuan has emerged as a total flop - this time in the format of cracking down in Proof-of-Work (such as Bitcoin and Ethereum 1.0) crypto miners, we said that this could be the best thing to happen for crypto: after all, the China was and is the bitcoin bears biggest friend: as long as bitcoin is mostly mined in China, where coal power plants account for most of electrical generation, bitcoin will remain "dirty" and give the ESG fanatics ammo to criticize bitcoin.

China is the bitcoin bears biggest friend: as long as bitcoin can be mined in China it is "dirty"

— zerohedge (@zerohedge) May 21, 2021

Once China bans bitcoin mining there, the anti-ESG case collapse

In other words, if China does carry through on its threats and does ban bitcoin mining there, the anti-ESG case collapse (as for miners, they will easily find other places to mine PoS tokens, and while their cost basis may be higher, the source of electricity will be far clearner). Microstrategy's Michael Saylor, who has bet the future of his firm on bitcoin, agreed with this take:

A crackdown on miners in China would radically reduce the carbon footprint of Bitcoin mining, increase the profitability of all the remaining #Bitcoin miners, reduce nagging China FUD, support progress toward our ESG goals, & drive up the value of $BTC. We should be so lucky... https://t.co/78ELDF9sku

— Michael Saylor (@michael_saylor) May 21, 2021

Then, a report from Goldman published overnight reinforced just why a crackdown on Chinese mining is a good thing: as the bank's head of commodities, Jeff Currie wrotes, "while PoS protocols raise security concerns due to the need for trusted supervisors in the verification process, Bitcoin is also not 100% secure. Four large Chinese mining pools control almost 60% of bitcoin supply and could in theory collude to verify a fake transaction."

Dear China: please ban bitcoin mining.

— zerohedge (@zerohedge) May 22, 2021

Four large Chinese mining pools control almost 60% of bitcoin supply and could in theory collude to verify a fake transaction: Goldman

Dan Guido, Co-Founder and CEO of Trail of Bits, a software security research and development firm specializing in blockchain software and cryptography, provided some further color on why bitcoin mining concentrated in China is a liability not an asset:

Goldman: What form would such an attack take, and how difficult would it be for a bad actor to execute one?

Dan Guido: An oft-discussed threat is the so-called 51% attack in which a single entity gains control over 51% or more of the mining power in the world, allowing it to invalidate the immutability properties of the blockchain to rewrite history or cause what’s called a double-spend: Suppose Alice tries to give Bob and Eve one bitcoin each, but Alice has only one bitcoin. If those two transactions are submitted to the blockchain at the same time, it’s almost arbitrary which one will be executed first, but the one executed second will fail. Someone with 51% control of the network can make them both succeed. It’s almost impossible to know for certain where miners are located geographically, but there’s evidence that a significant portion of them are concentrated in China, likely due to energy resource availability; several weeks ago, a gas explosion and flood in a coal mine in the Xinjiang region led the Chinese government to shut down all the neighboring cryptocurrency mining farms to conduct fire safety inspections. That was the morning of April 16, and by the end of the day, Bitcoin’s global hash rate had dropped by 50%.

The drop in the hash rate can be seen in the chart below; a similar plunge has taken place in recent days as well amid concerns China is set to crackdown (again) on its local miners (spoiler alert: it won't as it needs someone to pay for all that electricity its coal plans generate, but the "narrative" needs a few months to figure this out):

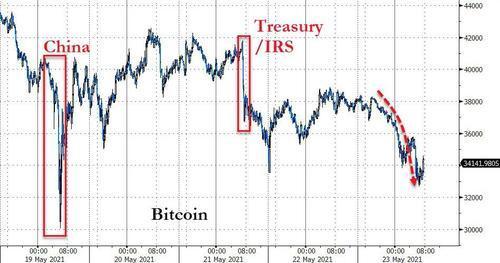

In any case, on Sunday morning the market refuses to see that China purging its bitcoin miners would be in the best long-term interest of bitcoin in particular, and cryptos in general, and as a result bitcoin's losses have accelerated, pushing the token below $33,000...

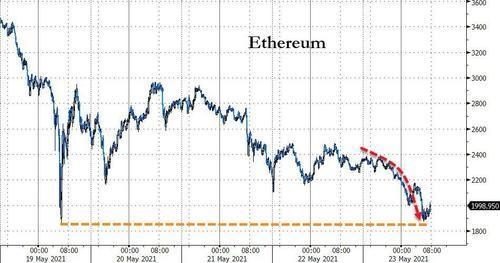

... while Ethereum has plunged even more, dropping below $1,800 and some 60% from its all time highs a little over a week ago...

... even as Bloomberg writes this morning that Ethereum is is on the verge of "cutting its energy use over 99%" as it shifts from PoW to PoS for Ethereum 2.0, while Goldman wrote over the weekend that Ethereum is set to overtake bitcoin.

Ether beats bitcoin as a store of value

Given the importance of real uses in determining store of value, ether has high chance of overtaking bitcoin as the dominant digital store of value. The Ethereum ecosystem supports smart contracts and provides developers a way to create new applications on its platform. Most decentralized finance (DeFi) applications are being built on the Ethereum network, and most non-fungible tokens (NFTs) issued today are purchased using ether. The greater number of transactions in ether versus bitcoin reflects this dominance. As cryptocurrency use in DeFi and NFTs becomes more widespread, ether will build its own first-mover advantage in applied crypto technology.

So what is behind this morning's wipe out? As usual, the source of the crash is China (as a reminder, Beijing is desperate to force broader acceptance of its catastrophic digital Yuan and will do anything to cripple non-state cryptos in the process), where as Coindesk reports, cryptocurrency exchange Huobi said it’s scaled back or suspended some of its services and products in certain countries and has stopped its miner hosting services in mainland China in response to the recent crackdown on crypto in that country..

The expression of the Chinese government is to crack down on Bitcoin mining, but it seems absurd to understand it purely from the literal meaning. In fact, there are more MLM involved in such as Fil and Chia.

— Wu Blockchain (@WuBlockchain) May 23, 2021

“Due to recent dynamic changes in the market, in order to protect the interests of investors, a portion of services such as futures contracts, ETP, or other leveraged investment products are temporarily not available to new users from a few specified countries and regions,” according to Huobi’s statement shared with CoinDesk.

“Huobi always strives to abide by the evolving policies and regulations of each jurisdiction to adhere to risk and preserve the well-being of our users and their assets,” the statement added.

News of the exchange’s pullback, which includes suspending some of its futures contract trading services, leveraged investment products, exchange-traded products (ETP) as well as miner hosting services in China, appears to be one of the reasons for the latest drop in the crypto market. The price of bitcoin fell to as low as $32,300while ether is down to $1,842.44, down 24% in the last 24 hours after having been above $4,300 a few weeks ago. Most other major cryptos are down anywhere from 15% to 30% and more.

The exchange did not disclose the specific countries and regions where it will stop the trading services and investment products.

Separately, according to ChainNews, Huobi's "Machine Mall" was suspending the sale of crypto mining machines and mining hosting services in mainland China, adding that it will soon give its existing clients more details in regard with what to do with their mining machines.

To be clear, however, CoinDesk notes that Huobi did not stop the operation of its own mining pools but the co-location hosting services the exchange provides to anyone who wants to invest in crypto mining. The hosting sites operate their clients’ mining machines with maintenance services in their mining.

Huobi is a major crypto trading services provider for the Chinese crypto investors, it has the eighth largest mining pool in the world with 4% hashrate of the entire bitcoin network, according to data from BTC.com. As such, its disappearance would be painful in the short-term but beneficial in the long-run as China's influence on bitcoin mining fades away.

The latest Chinese developments take place after the Financial Stability Development Committee of the State Council called - at 11pm on Friday local time - for a crackdown on crypto mining and trading while earlier in the week three financial industry associations sent a more targeted message to the Chinese banks and platform companies that have been friendly with crypto firms. The National Internet Finance Association of China, the China Banking Association and the Payment and Clearing Association of China, which specifically oversee major financial institutions, issued a crackdown notice that asks their member banks and payment companies not to offer services related to crypto such as over-the-counter (OTC) trading.

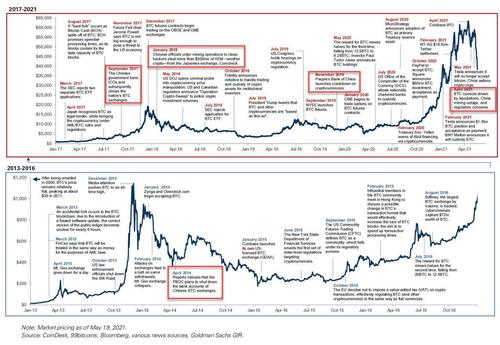

Of course, none of this is new at all: Beijing has been sending out the exact same warning against crypto in previous years, most recently in 2017, although now that the Digital Yuan has been launched to dismal public reception, Beijing has sharpened the focus on the Chinese banking industry that has been providing services to crypto firms that run crypto trading platforms such as OTC desks.

Incidentally, as the following Wired article from 2019 reveals.

... and the chart below shows, China has been "trying" to "ban" crypto ever since 2014.

Confirming that today's Bitcoin puke is mostly the result of panicked Chinese sellers, tether on the Chinese fiat currency renminbi has been in sharp decline since Saturday morning after the State Council’s notice, indicating there is more demand to trade the stablecoin for renminbi.

“Chinese investors are exiting the market, selling tether into RMB to avoid collateral damages (ie if further action against peer to peer OTC and banking),” Dovey Wan, founder of crypto investment firm Primitive Capital, said on Twitter.

Apart from more restrictions on trading activities, the latest crackdown advocated by the State Council, has also affected the mining industry in China as they may be cashing out as the crackdown notice came out on Friday night. China is arguably the largest bitcoin mining hub in the world. As CoinDesk notes, the Inner Mongolian branch of the National Development and Reform Commission (NDRC) said recently it will encourage people to report on any crypto mining operations in the region, signally a tougher stance on the industry since the local government decided to eliminate all mining businesses due to environmental concerns.

And while China purging all of its miners will be a good thing for crypto in the long run, not to mention the flood of cheap mining machines that will hit the market in the coming days, it will take the "cubic zirconium hands" holders a few days to figure this out.

https://ift.tt/3wq5pnG

from ZeroHedge News https://ift.tt/3wq5pnG

via IFTTT

0 comments

Post a Comment