"Descending Into A Farce": Chaos Erupts After Stiffed UniCredit Bondholders Get Fat-Fingered Payment

Step aside Citigroup, and your erroneous $500MM transfer to Revlon bondholders: there is an even dumber "fat finger" in town.

Late last week the financial world was shocked when Andrea Orcel, the new CEO of Italy's second largest bank UniCredi, decided not to make a €30MM debt coupon payment on the grounds that the bank made a loss last year, even though investors had been assured of the cash. Then, on Tuesday, the financial world was even more shocked when the news broke that despite the bank's decision, some bondholders said they had received notice of payment after all. And while UniCredit insists it didn’t pay it, raising Citigroup-esque dejavi questions about how the payment was made, Orcel's calculated show of strength has "rapidly descended into a farce", according to Bloomberg.

What happened?

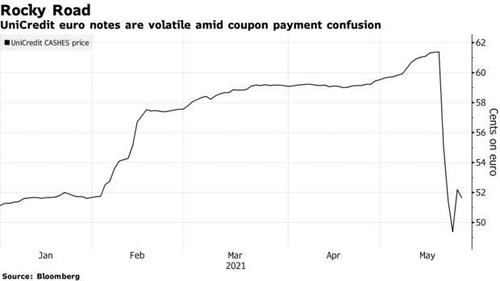

It all started last Friday when UniCredit made the shocking decision to skip the payment of coupons on some financial instruments, in a U-turn that sent he bond in question into a tailspin and hurt some other debt sold by Italy’s No. 2 bank. Just back in February, when presenting full-year results, Finance Chief Stefano Porro had told analysts the bank expected to pay a coupon on the legacy bond it issued over a decade ago, as well as on Additional Tier 1 bonds. But a spokesman on Friday said UniCredit would not do so after posting a 2.79 billion euro ($3.4 billion) loss last year.

As Reuters noted, UniCredit has withheld coupon payments on the CASHES notes in the past after ending the year in the red, but the latest decision, taken by new Chief Executive Andrea Orcel barely a month after his arrival, took bond investors by surprise.

However, some bond investors were even more surprised when they woke up on Tuesday to find that their bank accounts had been properly debited with the required coupon payment from the UniCredit bonds.

Initially there was much confusion who was responsible for the payment or where it came from, even if the confusion was understandable: the 2.98 billion euro bond’s complicated structure meany that there are several players involved, and the error could have come from any one of them. The CASHES, short for Convertible and Subordinated Hybrid Equity-Linked Securities, have different banks serving as depository and fiduciary for the instruments.

The confusion went away this morning when we learned that Euroclear - Europe's largest bond custodian and settlement agent of securities transactions - said it had mistakenly credited client accounts with funds for a coupon payment on UniCredit bonds that the bank had decided not to honor. The flub by Euroclear added a fresh - and confusing - twist to the surprise decision by new UniCredit Chief Executive Officer Andrea Orcel not to pay the debt coupon of about 30 million euros.

In response, the bonds fell 0.5 cents on the euro to about 51.2 on Wednesday, while UniCredit shares fell 0.6% to 10.29 euros as of 10:38 a.m. in Milan. The bank’s Additional Tier 1 bonds, a newer-style capital security, were little changed. The CASHES are quoted almost 10 cents on the euro lower than prior to the news of the coupon skip last week.

“It’s embarrassing for them of course, even if it isn’t their fault,” said Jerome Legras, a managing partner and head of research at Axiom Alternative Investments. “But the truth is this happened because they took everyone by surprise.”

For Orcel, the fat finger debacle is denting what would have been another signal of a high-energy start to his tenure. In just over a month in charge the Italian has already slimmed down the management ranks and cut down on co-head structures to simplify decision making - all while embroiled in a high profile court case in Spain over millions of dollars in lost pay.

In any case, now that the source of the mistake has been isolated, the question is what happens next: does UniCredit pull a Citigroup and try to recover the funds (it didn't work too well for Citi), or does it slink away with its tail folded between its legs.

it would raise questions over whether investors will need to return the funds -- and who will be on the hook for the payment if not.

“Even if it isn’t their fault, but of the depositary or fiduciary bank, the timing is very unfortunate,” said Paola Biraschi, an analyst at CreditSights. “They already incurred some reputational damage given the inconsistent market communication around the intention to pay the coupon. Investors will now want to understand the reasons behind the alleged payment of the coupon. And if any money was transferred, I imagine they will attempt to claw it back from bond holders.”

Since a clawback appears unlikely especially in the aftermath of the Citi cash study, an angry UniCredit may just take out its anger and frustration on more bondholders and refuse to pay future coupons. According to Bloomberg, given the notes’ terms the bank could also skip the next three coupons, even though UniCredit took steps last year to update terms of the CASHES allowing it to pay the coupons after reporting a loss or without distributing a dividend.

The notes are a legacy of the financial crisis, highly complex securities issued more than a decade ago. Investors in this type of legacy bond contend not only with unpredictable decisions by lenders, but also labyrinthine regulations and often-tortuous terms that can be interpreted in different ways. As Bloomberf notes, They’ve already been the subject of controversy after a London hedge fund accused the bank of boosting its capital strength by misclassifying them. The issue fizzled after the European Banking Authority sided with the bank, saying it found “no clear evidence” to support the hedge fund’s claim.

https://ift.tt/3unz2Vm

from ZeroHedge News https://ift.tt/3unz2Vm

via IFTTT

0 comments

Post a Comment