Despite Trimming Her Largest Stakes, Cathie Wood's ARK Hasn't Run Aground Just Yet

We have been harping on Cathie Wood's apparent "strategy" of selling liquid tech names in order to rotate into smaller, more "speculative" names, in her ARK ETFs for the better part of 2021.

While she has been able to ride out the "volatility" in the NASDAQ (read: the NASDAQ is literally only about 5% off highs) using this strategy so far, people in the mainstream media are starting to notice her allocation decisions and are keeping a close eye ARK's trades.

Wood's strategy has held up so far. Despite selling some of her largest holdings, ARK "no longer holds a stake bigger than 20% in any stock," Bloomberg reported this week. The firm's largest holding, formerly 21.3% in Compugen, is now down to 17.2%.

Nikko Asset Management has a minority stake in ARK and the number of stocks where the two asset managers own more than 20% has fallen to 8 names, from 10.

Tom Essaye, a former Merrill Lynch trader, told Bloomberg: “This is an evolution a bit -- Ark accepting it’s a large fund-family now. It makes sense that especially in some of the smaller cap names they are reducing that concentration. How much money you put to work in the smaller names can alter the risk-reward calculation.”

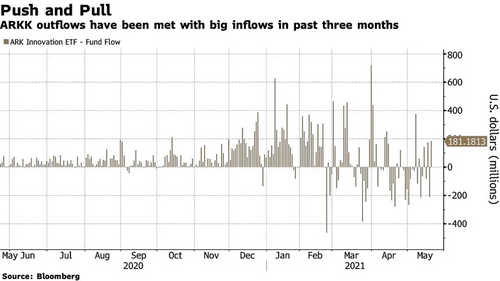

ARK's flagship "Innovation" fund is down more than 32% from its peak on February 12, but outflows haven't yet been rushed. This has allowed Wood the time for "an orderly adjustment of positions".

Todd Rosenbluth, head of ETF & mutual fund research at CFRA Research, commented: “My fear was that investors that were relatively new to the strategy would see weak performance and then pull out just as management had increasingly favored some of these smaller companies. But because investors have stayed relatively loyal, they have not had to make changes to the portfolio to meet client redemptions.”

“Investors may not want to make that rash a decision, but if the fund doesn’t bounce back -- and we don’t think it will so quickly -- then we could see some of those newer investors take their money back,” Rosenbluth commented.

The firm's total assets sits at $41 billion, down from $60 billion at its highs. The firm's six actively managed funds have still taken in a net $15.1 billion to date.

Nate Geraci, president of the ETF Store, an advisory firm, concluded: “That speaks to the conviction of Ark investors. Investors aren’t running for the hills, they appear to be in it for the long haul.”

https://ift.tt/3fdiQkV

from ZeroHedge News https://ift.tt/3fdiQkV

via IFTTT

0 comments

Post a Comment