Futures Jump As Inflation Fears Fade On China's Commodity Crackdown

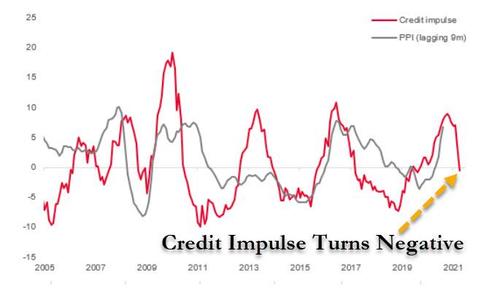

Now that the inflation narrative has been crippled with Bloomberg picking up on what we said last week about China's tumbling credit impulse...

... and the deflationary consequences thereof, while an acceleration of China’s crackdown on commodities speculation weighed on raw-material prices with steel dropping more than 5% and iron ore tumbling by close to the daily limit, stocks are again free to roam about the stratosphere as the risk of runaway prices is fading and S&P futures rose to 2-week highs on Monday as higher oil prices lifted energy stocks ahead of key inflation readings later this week when the personal consumption data is released on Thursday, the Fed’s preferred inflation measure. At 7:30 a.m. ET, Dow e-minis were up 118 points, or 0.%, S&P 500 e-minis were up 21 points, or 0.51%, and Nasdaq 100 e-minis were up 87.5 points, or 0.65%.

After falling as much as 4.3% from its May 7 record high, the S&P 500 is now only 2% off that level as investors picked up technology stocks that were beaten down the most. Risk sentiment also improved as cryptocurrencies rebounded from a weekend rout fueled by further signs of a gathering Chinese crackdown on the emerging sector. The dollar and Treasuries were steady. Implied volatility for major global indexes remains subdued, suggesting investors aren’t pricing in a surprise from the Fed in the next six months.

Some notable pre-market movers:

- Bitcoin advanced above $37,000 following another weekend of big swings, with shares including Ebang International Holdings and Bit Digital falling in premarket.

- Coinbase initiated with a buy rating at Goldman Sachs, with price target on the cryptocurrency exchange set at $306, the second-lowest among analysts tracked by Bloomberg. Shares gain 2.5% to $227 in U.S. premarket trading.

- Chevron, Occidental Petroleum and Schlumberger rose between 1% and 2% in premarket trading as oil prices firmed more than $1 a barrel.

- Jiuzi rises ~10% in U.S. premarket trading, set for a second day of gains after a 13% rally on Friday; the shares were volatile as they started trading last week.

- Virgin Galactic soars as much as 36% in premarket trading after the company founded by British billionaire Richard Branson conducted a test flight to space for the first time in more than two years.

- Cryptocurrency-exposed stocks including Riot Blockchain, Ebang and Bit Digital slipped after Bitcoin’s volatile moves over the weekend.

- Beyond Meat adds 3.8% after the plant-based meat producer is upgraded to outperform at Bernstein.

- Martin Marietta Materials said it would buy HeidelbergCement AG’s assets in California and Arizona for $2.3 billion.

“It’s going to be a very mixed market over the next several months until we get more information on what’s really going to happen with inflation and how the stimulus in the U.S. affects spending there, but also how the coronavirus really progresses,” JoAnne Feeney, a partner at Advisors Capital Management LLC, said in a Bloomberg TV interview.

In Europe, the Stoxx Europe 600 fell 0.1%, after rising as much as 0.2% amid low volumes, with travel and leisure shares leading gains among sectors while utilities fell the most. The FTSE 100 outperformed, rising 0.2%. German, Danish, Norwegian and Swiss stock markets are closed for holidays. In France, Solutions 30 SE shares plunged after a two-week halt as its troubles escalated amid a row with its auditor over the 2020 accounts. Here are some of the biggest European movers today:

- Juventus shares rose as much as 6.1%, the steepest intraday advance since April 19, after the Italian soccer club qualified for the Champions League.

- Cineworld gained as much as 4.5% after the company reported a strong opening weekend in the U.K., with the performance beating its own expectations.

- Alpha Bank shares rose as much as 13%, the most intraday since December, as the lender gives details for its share capital increase plan to support growth projects.

- Premier Foods shares climbed as much as 4.7% after analysts at Peel Hunt and Jefferies increased their price targets following the company’s FY results and bond refinancing.

- Solutions 30 plunged as much as 77% as the stock resumed trading following a two-week halt. The technology- services firm said its auditor wasn’t in a position to express an opinion on its 2020 financial statement, and subsequently published its unaudited report on Sunday.

- Indra Sistemas dropped as much as 5.2%, extending Friday’s losses after Spain, the company’s main shareholder, said it intended to name a new chairman.

- Ted Baker rose as much as 3.7% after the company confirmed FY results will be in line with consensus expectations and reiterated its FY23 financial targets.

Earlier in the session, Asian stocks were little changed as weakness in technology shares offset gains in cyclical sectors such as banks and automakers. Taiwan Semiconductor Manufacturing and Japan’s SoftBank Group were among the biggest drags on the MSCI Asia Pacific Index, while Mitsubishi UFJ Financial Group and Toyota Motor climbed. The moves mirrored U.S. market performance on Friday, when the tech-heavy Nasdaq fell while the Dow Jones Industrial Average advanced. Sentiment in the Asia Pacific remained fragile as investors continued to assess risks, among them the resurgence of Covid-19 cases and the potential rolling back of stimulus by the region’s policy makers as inflation rises. Central bank decisions from South Korea, Indonesia and New Zealand due out this week will be closely monitored by investors. “Lingering inflationary pressure and viral concerns may continue to dampen sentiment in risk assets across the Asia-Pacific region,” said Margaret Yang, an strategist at DailyFX. Japan’s Mothers gauge of small cap and tech-heavy stocks and South Korea’s equivalent, the Kosdaq, each fell 1.8%. Meanwhile, Japan’s Topix benchmark advanced alongside benchmarks in Vietnam and China

Chinese stocks fluctuated in a narrow range, with further declines in health-care-related stocks offsetting gains for financial shares. The CSI 300 Index rose 0.4% at close after falling as much as 0.8%. The Shanghai Composite Index added 0.3%, while the small-cap ChiNext Index gained 0.9%. A gauge of health-care stocks fell 0.5%, dropping for the fifth consecutive day. Financial-related shares gained, led by brokerage stocks. Hong Kong’s Hang Seng Index slipped 0.2% on its first trading session after the gauge’s compiled announced the addition of three new members and lowered the weighting of the biggest stocks, including Tencent, which fell 5%. Xiaomi dropped 2.9% in Hong Kong amid concern over a global chip shortage after Taiwan’s Covid situation worsened. Xinyi Solar, BYD Added to Hong Kong Stock Gauge in Overhaul Chinese education stocks fell after President Xi Jinping urged regulation of the after-school education sector. China Education Group lost 2.1%, while Minsheng Education Group slipped 2.2%. Gainers

In rates, bunds and gilts drift off best levels (bund futures volumes are ~50% of recent averages), while Treasuries were steady in narrow ranges. A subdued Asia session has been followed by slow European morning action, with holidays in France and Germany, among others. U.S. auction cycle totaling $183b starts Tuesday. IG supply expected to be busy and front-loaded this week ahead of next week’s Memorial Day holiday. Treasury 10-year yields around 1.615%, slightly richer vs Friday close with gilts slightly outperforming and bunds marginally underperforming; curve spreads also little changed.

In FX, the Bloomberg Dollar Spot Index fluctuated in a narrow range, staging a modest rally to fade Asia’s losses. The dollar was mixed versus its Group-of-10 peers in muted trading, with the exception of one sudden move higher in the greenback in European morning hours. Norway’s krone led gains in G-10 after nearing a one-month low against the greenback on Friday amid higher oil prices, while the Australian dollar was the worst performer, tracking heavy losses in iron ore futures after China stepped up its campaign to cool a raw-materials boom. The pound inched lower, yet held onto most of its recent gains, with the U.K.’s economic reopening set to remain on track as data shows Covid vaccines are effective against a worrying variant, Cable’s retreat from last week’s high to $1.4172 in the spot market was met by strong demand for front-end calls that briefly traded above parity for the first time this year

In commodities, Crude futures grind higher: WTI rises 1.8% near $64.75, Brent extends above $67. Spot gold is ~$3 in the red, trading just off session lows near $1,878/oz. Most base metals are in negative territory with LME zinc underperforming; copper and nickel hold small gains. China’s crackdown on commodities speculation weighed on raw-material prices, with steel dropping more than 5% and iron ore tumbling by close to the daily limit. Bloomberg’s industrial metals subindex declined for a fourth day to a one-month low.

Looking at today's calendar, we get the April Chicago Fed National activity index followed by a bunch of Fed speakers, including Brainard, Mester, Bostic and George, while in Europe, the European Council meeting begins.

Market Snapshot

- S&P 500 futures up 0.4% to 4,169.00

- STOXX Europe 600 fell 0.05% to 444.23

- MXAP little changed at 204.30

- MXAPJ down 0.1% to 682.63

- Nikkei up 0.2% to 28,364.61

- Topix up 0.4% to 1,913.04

- Hang Seng Index down 0.2% to 28,412.26

- Shanghai Composite up 0.3% to 3,497.28

- Sensex up 0.2% to 50,653.99

- Australia S&P/ASX 200 up 0.2% to 7,045.93

- Kospi down 0.4% to 3,144.30

- Brent Futures up 1.8% to $67.64/bbl

- Gold spot down 0.0% to $1,881.10

- U.S. Dollar Index down 0.11% to 89.92

- German 10Y yield rose 0.4 bps to -0.126%

- Euro up 0.1% to $1.2200

Top Overnight News from Bloomberg

- The next French presidential election is 11 months away but markets are already starting to get worked up. French bonds have been underperforming their German counterparts in recent weeks with the spread between their 10-year yields widening to the most since June. Part of the reason may be expectations for a slowdown in European Central Bank debt purchases, but strategists say the move is also being driven by fears of a potential election cliffhanger

- Weeks after President Joe Biden pitched the first major set of tax increases since 1993, signs are mounting that anxiety among congressional Democrats will significantly temper any increases that manage to pass Congress

- Bitcoin’s extreme volatility carried into the weekend as the world’s largest cryptocurrency continued to whipsaw investors with double-digit percentage moves

- Flights are being re-directed to avoid Belarusian airspace after the government in Minsk forced a Ryanair Holdings Plc plane to land and arrested a journalist on board. The EU will consider further sanctions against President Alexander Lukashenko’s administration when its leaders meet for dinner in Brussels on Monday night for the start of a two-day summit

- As the hunt for investments that can withstand rising interest rates gathers pace, frontier assets are gaining popularity over their larger emerging-market peers. The bonds of the world’s least-developed economies have returned 2.6% this year, keeping pace with their 2020 performance, while higher-ranked emerging-market debt has lost almost 2%, reversing some of last year’s 5.3% advance, according to JPMorgan Chase & Co. indexes

A quick look at global markets courtesy of Newsquawk

Asia-Pac equity markets began the week choppy following on from last Friday’s mixed performance on Wall Street, light weekend newsflow and heading into month-end. ASX 200 (+0.2%) swung between gains and losses with the index underpinned by strength in healthcare, tech and gold miners although gains in the broader market were briefly reversed alongside pressure in other commodity-related sectors after China’s NDRC vowed a zero-tolerance approach on commodities futures violations and with property names initially constrained after the recent increases in home loan rates among the big 4 banks. Nikkei 225 (+0.2%) shrugged off opening losses although was contained by the indecisive mood in the local currency and with Japan planning an extension to the virus state of emergency beyond May 31st. Hang Seng (-0.2%) and Shanghai Comp. (+0.3%) were mixed with risk appetite sapped by crackdown concerns after China’s State Council said it will prevent financial risks and crackdown on Bitcoin mining, while the NDRC also pledged zero tolerance on commodities futures violations and warned to severely punish commodity monopolies and price violations. Furthermore, it was also reported that the CSRC approved 6 companies for an IPO on the ChiNext board and that the Hang Seng Index compiler added 3 companies to the Hong Kong benchmark in its quarterly review to take the total constituents to 58 effective June 7th, which is part of the overhaul announced in March that would raise the total number of components to 80 by mid-next year and therefore, dilutes the individual stock weightings. Finally, 10yr JGBs were relatively flat with marginal gains due to the cautious mood in stocks and with the BoJ also present in the market for JPY 925bln in 1yr-5yr JGBs, while the Aussie 10yr yield was down about 1.5bps amid the RBA’s regular QE purchases.

Top Asian News

- Thailand Says Its Tourism Industry May Not Recover Until 2026

- JD Logistics Prices Low in Sign of IPO Market Cooling: ECM Watch

- Xinyi Solar, BYD Added to Hong Kong Stock Gauge in Overhaul

- China Auto Makers Fall as Huawei Says It Won’t Invest in Sector

Europe sees a raft of cash closures in observance of Whit Monday, with Germany and Switzerland among those away. The rest of the bourses trade relatively flat (FTSE 100 (+0.4%), CAC 40 (+0.2%), AEX (+0.1%), IBEX (+0.1%)) whilst the FTSE MIB (-0.4%) narrowly lags its peers. US equity futures also see broad-based gains to the tune of around 0.5% at the time of writing with Fed speak the main State-side highlight today. JPM highlights some factors that could lead to US inflation getting hotter before normalising is due - 1) global logistics and supply chain disruptions (cited by recent PMIs), 2) transitory factors like restrained labour supply, 3) oil price recovery, 4) release of pent-up consumer demand, 5) base effects of weak 2020 price prints. Meanwhile, Morgan Stanley suggests that correlations are breaking down amid the economic shift from early to mid-cycle, and this "should translate to a) dampened volatility for many investor portfolios (which can justify continued high leverage) and b) more dispersion driven by single-names instead of factors and themes (i.e. a good environment for stock picking)." Back to Europe, sectors are mixed with no clear overarching theme and with the breadth of the action shallow, although miners reside towards the bottom of the pile amid hefty losses in the Chinese base metals complex overnight - with Fresnillo (-3%) and Antofagasta (-1.2%) among the laggards in the UK. In terms of individual movers, Cineworld (+3.6%) is firmer after announcing a strong opening weekend in the UK, whilst anticipating most of its cinemas will be open by month-end. Co. has also received the full USD 203mln in tax refunds under the US CARES Act. Finally, given last week's focus on cryptos' ripple effect across other markets, it's worth noting that the crypto market saw another notable selloff over the weekend after China reiterated its stance whilst crypto exchange Huobi suspended some services and stopped miners from hosting services.

Top European News

- How Belarus Snatched a Dissident Off a Ryanair Plane From Greece

- Poland to Propose Sanctions on Belarus at EU Meeting: Minister

- Solutions 30 Plunges as Auditor Fails to Sign Off Accounts

- Johnson’s Plan to Open U.K. Economy Gets Boost From Vaccine Data

- Nord Stream 2 Gas Pipelaying Vessels Move Into German Waters

In FX, the charts will record that the Dollar index managed to ‘close’ above the psychological, if not key technical 90.000 mark last Friday having pared some losses and successfully defending multiple waves of downside pressure, but the last traded price was still below the prior week’s final level to keep the Buck in a clear bear trend awaiting today’s lean data agenda that puts the focus firmly on another raft of Fed speakers including Brainard, Mester, Bostic and George. Back to the DXY, rather aimless trade either side of the round number within a tight 90.108-89.861 band in the absence of many European participants out of action due to Whit Monday and the start of Pentecost.

- NZD/AUD - A much more robust recovery in NZ retail sales than most were anticipating in the run up to trade data and this week’s RBNZ policy meeting, is keeping the Kiwi underpinned between 0.7187-58 parameters vs its US counterpart alongside the NZIER shadow board noting that tightening is more appropriate likely over the year ahead than previously envisaged. Meanwhile, the Aud/Nzd cross has backed off from the high 1.0700 area as the Aussie feels the heat coming off Chinese commodity prices again, such as iron ore that plunged 5% overnight. Hence, Aud/Usd is languishing below 0.7750 and nearer 0.7700 amidst another ‘outbreak’ of COVID-19 in Melbourne, Victoria, albeit confined to just 2 cases at this stage.

- EUR - The Euro has peered above 1.2200 against the Greenback, but not been able to extend much beyond and perhaps heavy option expiry interest at the strike (1.3 bn) is keeping a lid on the headline pair on top of offers with a more psychological leaning. However, by the same token Eur/Usd could remain supported around 1.2150 given expiries spanning the half round number between 1.2145-60 (1 bn), and as Eurozone yields rebound from earlier lows to marginally narrow spreads vs USTs.

- GBP/JPY/CHF/CAD - All softer vs their US rival, with Sterling losing further momentum and sight of 1.4150 as Eur/Gbp tests 0.8650, while the Yen is slipping back to retest support circa 109.00 and the Franc is trying to stay afloat of 0.9000 in wake of some verbal intervention from SNB chair Jordan. Note, Switzerland is also observing Whit Monday so weekly sight deposit balances will be posted tomorrow, while Canada is celebrating Victoria Day, but the Loonie is deriving impetus to a degree from a rebound in crude prices to keep its head above 1.2100.

In commodities, WTI and Brent front-month futures continue the grind upwards adopted at the European entrance, with WTI now eyeing USD 65/bbl (vs low 63.63/bbl) and Brent inching towards USD 68/bbl (vs low 66.46/bbl). The focus for the energy complex this week remains on Iran, with a one-month technical agreement between Iran and the IAEA announced as expected - this is separate from the broader JCPOA deal. Meanwhile, assuming gaps are narrowed, participants expect an official nuclear deal to be announced later this week. "If and when the US re-joins the Iranian nuclear deal, this will likely hit sentiment in the oil market, however, we are still of the view that the market will be able to absorb this additional supply, so would expect price weakness to be short-lived.", ING says. Meanwhile, Citi continues to expect an early agreement on some aspects of the nuclear agenda between Iran and the US, though this would only be a partial return of Iranian supply to the market. The bank expects strong summer demand, with markets tight enough for mid-USD 70/bbl. Elsewhere, spot gold and silver move in tandem to the Buck and yields in the absence of any fresh catalysts, with the former back to levels around USD 1,875/oz and the latter meandering USD 27.50/oz. Finally, base metals overnight were back under pressure after China's NDRC reiterated zero tolerance on price manipulation, with Dalian iron ore ending daytime trading with losses of 5%, whilst the Singapore contract fell as much as 7.5%. LME copper fell in tandem but has since recouped most of its earlier losses as it sets its sights on USD 10,000/t to the upside once again.

US Event Calendar

- 8:30am: April Chicago Fed Nat Activity Index, est. 1.10, prior 1.71

- 9am: Fed’s Brainard Speaks at Crypto Currency Conference

- 11am: Mester Speaks on Diversity and Central Bank Communication

- 12pm: Fed’s Bostic Discusses Policy Response to Covid-19

- 5:30pm: Fed’s George Speaks at Agricultural Symposium

DB's Jim Reid concludes the overnight wrap

I have a spring in my step this morning as there is now a golf major winner who is 4 years older than me and Liverpool qualified for the Champions League after a strong end to a dreadful season! This offset the outrage of the U.K. gaining “nul points” and finishing rock bottom at the Eurovision Song Contest on Saturday. I suspect given Brexit, even if “Hey Jude”, “Imagine”, “Stairway to Heaven”, or “Billy Jean” had been our original song we still would have come last. Just for the record our song wasn’t quite in this league!

From one poll to another now and we will publish our latest monthly survey results in the next hour. Many thanks to those who filled it in. We have some interesting results on inflation with fears rising over the past month according to respondents. It’s the first time this year where the majority expect a taper tantrum at some point in 2021. This is reflected in the least bullish 3-month views on equities since last July. The net bullish 3m view on the S&P 500 is down to +6% from +65% in February. Lots more stuff in the note.

On paper this doesn’t look like the most exciting week ahead but don’t panic as it’s only 11 days until the next payrolls report which will be a blockbuster a week on Friday. Oh and only 17 days until the next US CPI report which will possibly be one of the most-watched economic releases in history. Maybe that’s a slight bit of hyperbole but the inflation debate is probably the most important macro story in a generation.

Having said that it will be quiet, we do have a couple of important inflation markers on Friday with the April core PCE deflator and the final reading on the University of Michigan May consumer sentiment survey. On the former DB expect +0.77% MoM vs. +0.36% previously and +1.8% YoY to +3.1%. All eyes on any clues as to any non-transitory elements.

For the University of Michigan's consumer sentiment index (83.0 final vs. 82.8 preliminary), it will be the revisions to the median 5 - 10 year inflation expectations series that will be key. In the preliminary release this surged 40bps to 3.1% – the highest since August 2008. Was the first print an aberration or will expectations have increased still further? As a reminder DB’s 10yr UST view (2.25% by YE) is based on such expectations moving back into the higher 1998-2014 regime. The preliminary reading firmly knocked us back in this range after 7 years away.

Before we look at the other key highlights this week we’ll first look at the Asian session where it’s been a mixed start to the week. Both the Nikkei (+0.21%) and the Shanghai Comp (+0.16%) have advanced this morning, whereas the Hang Seng (-0.34%) and the KOSPI (-0.10% have both moved lower. Meanwhile in the US, S&P 500 futures are up +0.31% to point towards a positive open later on.

The more eventful moves have been in crypto-assets however, with Bitcoin continuing to be volatile after experiencing some sizeable swings last week. After being back above $40,000 on Friday we traded as low as $31,133 yesterday afternoon and are now at $35,336 this morning. Other cryptocurrencies including Ethereum, Litecoin and XRP have all seen similar moves over the weekend. Our monthly performance review isn’t out until next week, but as it stands Bitcoin is on track for its worst monthly performance in almost a decade, having lost over -37% since its closing level in April.

As for the rest of this week, we have a gathering of EU leaders meeting in Brussels today and tomorrow for a special European Council meeting. The items on the agenda include the Covid-19 response, climate change, a strategic debate on Russia, and discussions on the EU’s relations with the UK. They’re also expected to discuss the weekend news that Belarus ordered a Ryanair flight moving through its airspace to land before arresting a journalist on board.

Otherwise, data releases this week include the German Ifo tomorrow and final Q1 GDP alongside the US Conference Board’s consumer confidence. The other main releases are noted at the end in our day by day guide.

On the central bank side, the 2 decisions from G20 central banks next week are from Bank Indonesia tomorrow and the Bank of Korea on Thursday. In terms of what to expect, our economists think that Bank Indonesia will keep its policy rate steady at 3.5%, as it continues to prioritise the rupiah’s stability. Meanwhile the Bank of Korea is also likely to keep its policy rate steady at 0.5%, and the market will be closely watching for forecasts revisions for clues to its policy bias. Otherwise there are only a few speakers from the Fed and the ECB, including Fed Vice Chair Quarles who’ll be making multiple appearances, including a speech on the Economic Outlook.

For earnings, the season is really winding down to the end now, with just 15 companies each from the S&P 500 and the STOXX 600 reporting. Among the highlights are Intuit tomorrow, Nvidia on Wednesday, before Thursday sees reports from Salesforce, Medtronic, Costco, HP, Royal Bank of Canada and Dell Technologies.

Back to last week now and inflation worries eased slightly which allowed technology stocks to climb higher even as broader risk markets pulled back a touch. The S&P 500 fell -0.43% (-0.08% Friday) for a second straight weekly loss – the first consecutive losing weeks since the end of February. As mentioned the easing of inflation worries propped up technology shares in particular as the NASDAQ gained +0.31% (-0.48% Friday) while the FANG+ index was up a greater +1.03%. The weekly gains for the two tech indices were the first in five weeks, while cyclicals sectors underperformed their growth counterparts as banks (-0.91%) fell back as yields slid slightly. European stocks rose to within 0.25% of their all-time highs with the STOXX 600 climbing +0.43% over the week, with southern European bourses such as the FTSE MIB (+0.84%) and IBEX (+0.64%) outperforming.

Inflation expectations fell back markedly this week even as US 10yr yields finished the week just -0.7bps lower (-0.3bps Friday) at 1.622% - the fifth drop in the last seven weeks. Inflation expectations as measured by 10yr breakevens (-9.1bps) fell by the most since mid-April 2020, but remain up +4.1bps on the month and closed at an 8 year high last Monday. European rates fell back slightly as well with 10yr bund yields mostly unchanged (-0.1bps) last week but with UK gilt yields falling -2.7bps and OATs dipping -1.9bps. Commodities fell for a second straight week, with the Bloomberg commodity spot index losing -1.18%. Oil prices in particular fell back this week with WTI (-3.3%) and Brent crude (-2.7%) retreating partly on news that Iranian President Rouhani said that a broad outline had been reached to end oil sanctions.

In terms of economic data from Friday, the global flash PMIs were the main story with prints in both the US and Europe beating expectations. In the Euro Area, the headline PMI rose to a 3-year high of 56.9 in May, up from 53.8 in April and beating expectations of 55.1. The gains were mostly driven by the services PMI reaching a 35 month high of 62.8 as reopenings drove much of the improvement. In the US, the composite PMI rose to 68.1, the highest reading since 2009, on the back of a record services PMI at 70.1. Among the few misses was the lower-than-expected UK services data which was still a robust 61.8 (62.2 expected) and German manufacturing which was also at a robust 64.0 (65.9 expected).

https://ift.tt/3hLUBfp

from ZeroHedge News https://ift.tt/3hLUBfp

via IFTTT

0 comments

Post a Comment