Futures, Tech Stocks Jump After Fed Officials Talk Down Inflation Risks

US equity futures and tech stocks gained for a second day, rising alongside European and Asian stocks after Fed officials on Monday played down the risk of "non-transitory" inflation easing bond yields for the fourth straight day, as investors waited for consumer-confidence data. At 7:00 a.m. ET, Dow e-minis were up 75 points, or 0.2%, S&P 500 e-minis were up 11 points, or 0.26%, and Nasdaq 100 e-minis were up 63.75 points, or 0.47%.

“Monday’s lethargy seems to have been shaken off after a chorus of Fed voices delivered dovish statements, downplaying arguments for early tightening,” said Nema Ramkhelawan-Bhana, an analyst at Rand Merchant Bank in Johannesburg, “Let’s not forget that it only takes one inflation print to unsettle investors or a strong economic figure to guide nominal yields higher. And so the lesson is to make hay while the sun shines.”

The S&P 500 and the Nasdaq ended about 1% higher on Monday after Federal Reserve officials maintained that the U.S. central bank’s ultra-easy monetary policy will remain in place, pushing the longer-dated U.S. Treasury yields lower. Lael Brainard, Raphael Bostic and James Bullard said they wouldn’t be surprised to see bottlenecks and supply shortages push prices up in coming months as the pandemic recedes, but that much of those gains should be temporary. While market-based measures of inflation expectations have dipped, investors remain cautious about the risk of a pullback in stimulus. They are also monitoring Covid-19 spikes in regions such as Asia.

The Fed comments aided sentiment, as officials reiterated they expect transitory rather than lasting price pressures from the U.S. economic rebound. Treasury yields ticked lower. Emerging-market stocks climbed as China’s CSI 300 gauge surged more than 3% following Beijing’s efforts to talk down raw material costs.

Some notable premarket movers include:

- Adamis Pharmaceuticals slumps 17% in premarket after saying in a filing that the company and its subsidiary, US Compounding Inc., received a subpoena issued in connection with a criminal investigation.

- Ault Global Holdings climbs 19% after posting a 1Q profit from a loss last year.

- Cryptocurrency-exposed stocks including Marathon Digital and Riot Blockchain ease with Bitcoin slightly lower after Monday’s rally, triggered by Elon Musk’s tweet indicating effort to bolster the token’s green credentials.

- Lordstown falls 16% following the electric carmaker’s quarterly results, which Morgan Stanley (underweight) says featured a larger-than-expected loss, higher cash consumption, a reduced forecast and a need for outside capital.

- Virgin Galactic Holdings shares fall 4%, trimming Monday’s rally and indicating the end of a seven-day winning streak. Morgan Stanley lowered its price target for the stock while keeping an equal-weight rating.

- Apple, Amazon, Microsoft and Alphabet added between 0.4% and 1% in premarket trading as the yield on 10-year bond slipped to a fresh two-week low on Tuesday.

Amazon is poised to announce an acquisition of the Metro-Goldwyn-Mayer movie studio as soon as Tuesday and is in talks to pay almost $9 billion for the business, according to a person familiar with the matter.

In Europe, the Stoxx Europe 600 Index rose 0.4% to a record. Vonovia SE fell as much as 6.8% after it agreed to buy rival Deutsche Wohnen SE for about 19 billion euros ($23 billion) in the biggest-ever takeover in European real estate. Deutsche Wohnen jumped 15% and buoyed the sector as a whole. Here are other big European movers today:

- Royal Mail shares jumped by as much as 7.7% to a three year high, with the company set for a return to the FTSE 100 Index.

- Abivax shares gained as much as 49% to the highest since early March following positive medical trial results. Bryan Garnier raised its target price by 22% following the data.

- Amigo Holdings shares plunged as much as 61% in London after saying its redress plan failed to secure court approval. Company had said in March that failure of the scheme could result in the insolvency of the company.

- Greencore Group Plc shares dropped as much as 15%, the most since May 2020. “Challenging” 1H results showed revenues are rebuilding, though a profit recovery “will take time,” according to Goodbody.

- Trainline shares fell as much as 7.4% to the lowest since Nov. 4 after Stifel downgrades to hold and cuts its price target to a Street low, saying it can “no longer maintain a buy with any conviction.”

- Nel ASA shares dropped by as much as 8.2% following Iberdrola’s announcement of a hydrogen alliance with Cummins.

Earlier in the session, Asian stocks also rose, heading for a fourth day of gains, led by technology shares. Communication services, which include China’s Tencent and Japan’s Nintendo, was the best-performing sector in Asia on Tuesday, followed by information technology. Asia’s gain, the longest rally in five weeks, mirrored Wall Street’s performance on Monday, when comments by Fed officials aided sentiment for growth stocks. The Fed’s Lael Brainard, Raphael Bostic and James Bullard said price gains resulted from bottlenecks and supply shortages should prove temporary. “Central banks in the region -- like their peers in the developed markets -- are likely to look beyond the spike in inflation and stay accommodative this year,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a note. The market’s rally on Tuesday was broad-based with all sectors in the MSCI Asia Pacific gauge trading in the green. China led gains, while New Zealand and Malaysia shares declined.

In rates, the Treasury 10-year yields fell one basis point to a 2-week low of 1.59% keeping pace with bunds and gilts, and holding curve-flattening gains despite weekly highs for S&P 500, paced during European morning by bunds; The Asia session was muted with low volumes and futures activity dominated by calendar rolls. U.S. three-auction cycle begins with $60b 2-year note sale at 1pm ET. WI 2- year yield around 0.157% is 1.8bp richer than April’s. which tailed by 0.4bp. Cycle includes $61b 5-year sale Wednesday, $62b 7-year Thursday. In Europe, Italian bonds outperform, leading peripheral debt after the BTP 10-year yield fell back below 1%.

In FX, the dollar again fell against most of its Group-of-10 peers, while the euro came off a more than four-month-high of $1.2262, even as the German Ifo institute’s gauge of business expectations for the next six months rose to 102.9, exceeding all but one estimate in a Bloomberg survey. The risk-sensitive Swedish krona led G-10 gains and rose to a three-month high against the greenback. Australia’s dollar climbed, following gains in local stocks and iron ore, and after a rally in China’s yuan; the New Zealand dollar climbed as much as 0.4% ahead of the RBNZ Monetary Policy Statement tomorrow.

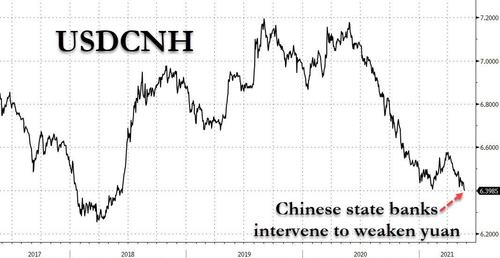

The Chinese offshore yuan climbed to its highest level in three years amid risk-on sentiment that lifted most emerging Asian currencies higher, and which was met by dollar buying from Chinese state-owned banks, according to traders. Investors’ short-term USD/CNH option bias turned bearish for the first time since 2019. The USD/CNY fell as much as 0.3% to 6.4016, the weakest since June 2018, while the offshore yuan breached the key 6.4 per dollar level: the USD/CNH declined as much as 0.3% to 6.3922, also the lowest since June 2018.

In commodities, oil prices slipped on Tuesday, but were near one-week highs after jumping more than 3% the previous session as investors tempered expectations of an early return of oil exporter Iran to international crude markets. Brent crude futures were down 30 cents, or 0.4%, at $68.16 a barrel by 1004 GMT, having jumped 3% on Monday. U.S. West Texas Intermediate futures were off 42 cents, or 0.6%, at $65.63 a barrel, after gaining 3.9% the previous session.

Elsewhere, Bitcoin pared a rally sparked by Elon Musk’s effort to bolster the token’s green credentials, extending a bout of marked volatility in the wake of last week’s crypto rout. The largest cryptocurrency remains about $25,000 off its mid-April record.

ooking at the day ahead now, we have April’s new home sales, the Conference Board’s May consumer confidence reading which likely slipped in May from a 14-month high hit in the prior month, and the Richmond Fed manufacturing index for May. Separately, central bank speakers include the Fed’s Evans, Barkin and Quarles, the ECB’s Lane and Villeroy, and the BoE’s Tenreyro. With the S&P 500 back to just within 1% of its May 7 all-time, all eyes will be on the U.S. personal consumption report on Thursday, the Fed’s favorite inflation gauge following a bout of market volatility recently triggered by fears of a longer period of higher prices.

Market Snapshot

- S&P 500 futures up 0.3% to 4,206.50

- STOXX Europe 600 up 0.4% to 446.78

- MXAP up 1.1% to 206.49

- MXAPJ up 1.4% to 691.86

- Nikkei up 0.7% to 28,553.98

- Topix up 0.3% to 1,919.52

- Hang Seng Index up 1.8% to 28,910.86

- Shanghai Composite up 2.4% to 3,581.34

- Sensex down 0.1% to 50,579.61

- Australia S&P/ASX 200 up 1.0% to 7,115.19

- Kospi up 0.9% to 3,171.32

- Brent Futures down 0.6% to $68.08/bbl

- Gold spot down 0.0% to $1,880.74

- U.S. Dollar Index down 0.23% to 89.64

- German 10Y yield fell -1.3 bps to -0.153%

- Euro up 0.3% to $1.2251

Top Overnight News from Bloomberg

- Be it down to a series of speeches awaited from policy makers, upcoming inflation data out of the U.S. or expected month-end flows, euro options suggest some traders are preparing for large price swings over the next week

- “I don’t see any reason to make any change (to the pace of PEPP) at the moment,” ECB Governing Council member Yannis Stournaras tells Reuters

- Turkey’s President Recep Tayyip Erdogan appointed a new deputy governor at the country’s central bank, tapping an economist and long-serving member of the institution in his latest leadership rejig

- For the first time in years, the global supply of debt with a negative yield is in meaningful decline. The trend is strongest in Europe, where subzero bonds have been an everyday reality for investors

Quick look at global markets courtesy of newsquawk

Asia-Pac stocks traded higher after taking the impetus from the encouraging performance in the US where all major indices gained, led by outperformance in tech amid a decline in yields and rebound in crypto. ASX 200 (+0.9%) benefitted from the constructive mood with tech, real estate and miners spearheading the advances for the benchmark which briefly reclaimed the 7,100 level, although the index has since met resistance with gains also capped by mixed data releases. Nikkei 225 (+0.7%) was positive amid reports the Japan's government plans to maintain support measures for firms impacted by the pandemic with 0% interest loans extended to the year-end and although the US announced a ‘do not travel’ advisory against Japan, officials suggested this is unlikely to have implications on the Olympics, while the KOSPI (+0.9%) was lifted after recent data showed South Korean Consumer Sentiment at its highest in almost 3 years. Hang Seng (+1.8%) and Shanghai Comp. (+2.4%) conformed to the upbeat mood across the region amid strength in tech and biopharmaceuticals, as well as a recovery in mainland commodity prices from the recent China crackdown-induced selling, with Xiaomi among the biggest gainers in Hong Kong after FTSE Russell announced it will reinstate Xiaomi and Luokong Technology to its global indices. Finally, 10yr JGBs were rangebound with upside capped by the gains across regional stock markets and mixed results in the enhanced liquidity auction for longer-dated bonds, while the Aussie 10yr yield was slightly softer in the aftermath of Australia’s 2040 treasury indexed bond offering.

Top Asian News

- Ant Shelves Sales of Debt Backed by Online Loans After Crackdown

- Indonesia Holds Rates, Focuses on Liquidity Amid Recovery Signs

- China Begins Antitrust Probe Into KE Holdings, Reuters Says

- Malaysia Covid Spike May Spark ‘Vertical Surge,’ Health DG Says

Major bourses across Europe see somewhat of a divergence as Germany and Switzerland play catchup after yesterday’s Whit Monday holidays, but broadly speaking the region ekes mild gains. Cash markets aside, European equity futures have been waning from best levels before finding a floor in what coincided with the release of an upbeat German Ifo survey - which noted that the upswing is picking up pace but warned that the rising costs for raw materials are increasingly becoming a problem, whilst more companies say they have price hikes on the table. US equity futures meanwhile hold onto modest gains following yesterday’s bull run, with the NQ narrowly outperforming peers as yields remain suppressed. Back to cash, the DAX (+0.8%) and SMI (+0.7%) outpace regional peers after the long weekend, with the former also seeing tailwinds from Deutsche Wohnen (+15%) after the Co. confirmed Vonovia’s (-4%) EUR 18bln takeover offer at around an 18% premium to Friday’s closing price. Thus, the Real Estate sector outperforms, closely followed by Tech which sees a continuation of the sectorial performance seen on Wall Street and in APAC. The other end of the spectrum sees Basic Resources as a laggard as base metal prices bear the brunt of further jawboning by China. In terms of some individual movers, BHP (-0.1%) gave up earlier gains despite resolving a union issue at its small Cerro Colorado copper mine, as the recent losses in the red metal fed through to the miner, and with eyes also on union developments BHP’s larger Escondida mine. Positive broker moves see L’Oreal (+0.2%) and Royal Mail (+7%) on firmer footings. Finally, FTSE-listed Aveva (+4.4%) gains on the back of strong earnings.

Top European News

In FX, it’s looking increasingly ominous for the Dollar and index, as recoveries become fewer and farther between as well as less pronounced. Indeed, the DXY has descended into yet another lower range after only managing a tame or lame rebound to 89.867 and is desperately trying to stay above 89.500 amidst almost all round Greenback weakness against G10 contemporaries and EM currencies, like the Yuan that has extended gains through 6.4000 irrespective of reports suggesting that the PBoC was defending that line overnight having set a 6.4283 midpoint fix for the Cny. The index has been down to 89.533 and the half round number is now the only real or tangible prop left before the y-t-d trough appears on the radar, at 89.206 from January 6.

- EUR/CHF/GBP - All reaping the rewards of their rivalry with the Buck, but the Euro not actually getting much in the way of an additional boost from IFO’s latest survey that beat consensus on all counts having breached barriers at 1.2250 before the release and then losing some momentum. Meanwhile, the Franc scaled 0.8950 ahead of delayed weekly Swiss sight deposit balance updates that revealed a Chf 4+ bn rise at domestic banks and Sterling briefly popped over 1.4200, though remained under pressure vs the Euro around 0.8640 in advance of a speech from BoE’s after seeing no reaction to sub-par CBI distributive trades .

- AUD/NZD/JPY/CAD - The Aussie and Kiwi are maintaining 0.7750+ and 0.7200+ status against their US peer respectively, albeit off best levels in wake of somewhat mixed data for the former via preliminary trade, weekly payrolls and wages, while the latter awaits NZ trade before attention switches to the RBNZ on Wednesday with option pricing implying a 45 pip break-even for the policy meeting event. Conversely, the Yen has stalled just above 108.60 again and the Loonie remains hesitant on approaches towards 1.2000 following retracement from circa 1.2013 last week.

- SCANDI/EM - A bit more respite for the Nok as it consolidates off worst levels against the Eur and back over 10.2000, but further underperformance/divergence beneath parity vs the Sek that might be taking note of stronger Swedish PPI prints in context of follow-through to headline inflation. Elsewhere, the Try might be on the back foot due to a decline in Turkish manufacturing sentiment and/or latest changes at the CBRT after the replacement of a Deputy Governor.

In commodities, WTI and Brent front month futures are softer on the day as the complex gives up some of yesterday’s gains amid the tentative trade and as JCPOA negotiations continue (at 15:00BST), whilst some downbeat sentiment may also be seeing in via China’s concerns regarding soaring commodity prices feeding into inflation. WTI resides around USD 65.50/bbl (vs high USD 66.34/bbl) whilst its Brent counterpart trades on either side of USD 68/bbl (vs high USD 68.90/bbl) with the US and Iran both noting that gaps remain in nuclear deal negotiations, but Iran has been cautiously optimistic in what is hoped to be the final round of talks. Elsewhere, precious metals have been moving in tandem with yields and the Dollar with spot gold within reaching distance of USD 1,900/oz (USD 1,872-87 range) and spot silver extending gains above USD 27.50/oz (USD 27.47-80 range). One narrative to keep in mind - some participants have also cited the detreating sentiment surrounding bitcoin as a possible bullish factor for spot gold as investors turn to a physical (and less volatile) “store of value”. Meanwhile, attention has once again been on base metals with LME copper losing the USD 10,000/t handle amid reports that China's Premier Li has discussed solutions to tackle the commodity price surge and reiterated that China is to stabilise commodity prices and fight against commodity hoarding. Copper also eyes developments regarding Chilean mine workers – BHP managed to strike a deal at its Cerro Colorado mine, although attention remains on union developments at its Escondida mine which has the world’s largest copper deposits. Dalian iron ore futures were subdued overnight following four straight sessions of losses after China intervened in the bull-run last week with commodity follow-through to inflation cited as a concern.

US Event Calendar

- 8am: Fed’s Barkin Discusses the Economic Outlook

- 9am: March S&P CS Composite-20 YoY, est. 12.50%, prior 11.94%; 20 City MoM SA, est. 1.30%, prior 1.17%

- 9am: March FHFA House Price Index MoM, est. 1.2%, prior 0.9%

- 9:40am: Fed’s Evans Discusses Economic Outlook at BoJ Event

- 10am: May Conf. Board Consumer Confidenc, est. 119.0, prior 121.7; Expectations, prior 109.8; Present Situation, prior 139.6

- 10am: April New Home Sales MoM, est. -7.0%, prior 20.7%; New Home Sales, est. 950,000, prior 1.02m

- 10am: May Richmond Fed Index, est. 19, prior 17

DB's Jim Reid concludes the overnight wrap

The last time I talked about the weather it was about 6 weeks ago when it hadn’t rained since we scattered a big patch of new grass seed a month before. We were getting very worried it had all died. We needn’t have been too concerned though as 6 weeks later and it hasn’t stopped raining since. The silver lining is that the grass seed has turned into a mini-jungle. Nevertheless, remind me never to do a rain dance again. The good news is that the weather is about to change with hints of summer about to arrive. Hoorah!

There weren’t many rain clouds hovering over markets yesterday as global equities got the week off to a strong start, with the S&P 500 (+0.99%) rebounding following two consecutive weekly declines. The moves come as inflation jitters have continued to subside among investors for now, with expectations of future Fed hikes over 2021 and 2022 moving back slightly once again yesterday following their increase after the US CPI reading for April. Indeed, as it currently stands the S&P is less than 1% shy of its all-time closing high seen earlier in the month, and up by +3.30% since its recent low on May 12 on the day that the CPI report was released.

In terms of the specific moves yesterday, the advance was a pretty broad-based one as 21 of 24 sectors in the index moved higher on the day, though rate-sensitive tech stocks led the outperformance, with the NASDAQ (+1.41%) and the FANG+ (+2.26%) both seeing strong gains. The only industries that fell back yesterday were Utilities (-0.20%), Biotech (-0.19%) and Telecoms (-0.10%). European equities earlier saw a slightly more subdued advance than the US, with the FTSE 100 (+0.48%) and the CAC 40 (+0.35%) seeing modest gains, while the STOXX 600 (+0.14%) was relatively weaker thanks to the German and Swiss markets being closed for a holiday.

Overnight one of the main news stories has continued to be the fact that Belarus forced a flight to land in its airspace before arresting a journalist on the plane. This has led to swift condemnation from the EU, and European Commission President von der Leyen called the events, “an attack on democracy, this is an attack on freedom of expression and this is an attack on European sovereignty.” European leaders have proposed some Belarusian officials be added to an existing blacklist and are looking at broader measures to target businesses and entire sectors of the country’s economy. President von der Leyen also announced sanctions not just “on individuals that are involved in the hijacking but … also on businesses and entities that are financing this regime.” The White House called the forced landing and jailing of a journalist “a brazen affront to international peace and security by the regime”, with Press Secretary Psaki saying the Biden Administration demands, “an immediate international transparent and credible investigation of this incident.” President Biden agreed with the EU decision and said that he has asked advisers “to develop appropriate options to hold accountable those responsible, in close coordination with the European Union, other allies and partners, and international organizations.”

Meanwhile in Asia overnight, equity markets have followed the US lead higher, with the Nikkei (+0.65%), the Hang Seng (+1.26%), the Shanghai Comp (+1.60%) and the Kospi (+0.77%) all having advancing. Furthermore, S&P 500 futures (+0.22%) are pointing to another day of gains. As with the US, Asian equities appear to be supported by helpful comments from Fed officials, who continued to adopt a relaxed tone on inflation. Fed Governor Brainard said that longer-term inflation expectations “have been extremely well anchored, implying that if we saw some development pushing inflation up I wouldn’t expect that to get embedded in the ongoing inflation rate”. Meanwhile, Atlanta Fed President Bostic said “I am not seeing that it is going to be enduring”, so sticking to the view that transitory factors like base effects and bottlenecks associated with the reopening are driving the faster rise in prices, rather than anything more permanent.

The comments from Fed officials supported sovereign bonds, which rallied alongside equities yesterday. By the close, yields on 10yr US Treasuries were down -2.0bps to 1.601%, though 10yr inflation breakevens actually rose +1.3bps, even as US inflation fears have dulled in recent days, and remain -10.5bps away from their 8-year closing high only a week ago. Over in Europe there was a similar move lower for yields, with those on 10yr bunds (-1.0bps), OATs (-1.1bps) and gilts (-1.9bps) all declining. As an aside, yesterday also saw the spread of 10yr Greek debt over bunds fall to its lowest level in over a decade, at just 1.09%.

Another rebounding asset yesterday were cryptocurrencies after a very bad couple of weeks, with Bitcoin up +15.8% in its best daily performance since February 8, and its second-best performance over the last 12 months, putting it back at $39,024 at the end of the US day, though this morning it’s down to $38,413 again. Comments from Bridgewater’s Dalio that he would rather own Bitcoin than a bond seemed to help provide fresh momentum, while there was a further advance late in the session after Elon Musk tweeted that he’d spoken with North American Bitcoin minters, saying that they had “committed to publish current & planned renewable usage & to ask miners WW to do so. Potentially promising.” Elsewhere in the asset class, Ethereum (+26.7%), XRP (+26.5%) and Litecoin (+28.9%) all saw even larger rebounds yesterday, though we should keep this rebound in perspective as Bitcoin’s price remains well beneath its intraday peak of $64,870 back in mid-April. Commodities broadly had a decent performance after a couple of weeks of declines, with Brent crude (+3.04%) and WTI (+3.88%) oil prices seeing rebounds, along with the key industrial bellwether of copper (+1.01%). All of the positive commodity moves came against a falling USD (-0.19%), which was the currency’s 5th decline in its last 7 sessions and leaves it just under 0.5% away from its 3-year lows.

In terms of the latest on the pandemic, the situation continues to improve for now at the global level, with the rate of increase in new cases having come down by more than a quarter since its peak in late-April. The US announced its slowest weekly rise in new Covid-19 cases (0.5%) yesterday since the pandemic began, as the country has now administered at least one shot to 61% of the adult population. In terms of the return to normal, New York City Mayor de Blasio said that a remote learning option wouldn’t be available for public-school students when they return in September. However, there have been some restrictions reinstated as the US government issued a ‘do-not-travel’ advisory on Japan ahead of the Summer Olympics. The advisory comes as Japan remains under a state of emergency with just under two months until the Olympics are supposed to begin.

There was barely any data to speak of yesterday, though the Chicago Fed’s national activity index fell to 0.24 in April (vs. 1.20 expected), suggesting that economic growth moderated in April. And returning to the virus, the UK’s ONS estimated that the number of trips made by UK residents abroad in 2020 was down -74% compared to 2019.

To the day ahead now, and data releases include the German Ifo Institute’s business climate indicator for May, the UK’s public sector net borrowing for April, and from the US we have April’s new home sales, the Conference Board’s May consumer confidence reading, and the Richmond Fed manufacturing index for May. Separately, central bank speakers include the Fed’s Evans, Barkin and Quarles, the ECB’s Lane and Villeroy, and the BoE’s Tenreyro.

https://ift.tt/34c6Ud8

from ZeroHedge News https://ift.tt/34c6Ud8

via IFTTT

0 comments

Post a Comment