How A $1 Billion Cryptocurrency Fund Is Trading The Crash

Back in December, vol-specialist hedge fund One River Asset Management surprised its peers when long before Elon Musk arrived on the scene, it became one of the first major asset managers to disclose it had purchased $600 million in bitcoin and ethereum and said it would own more than $1 billion in cryptos in early 2021. It wasn't along in this pioneering effort: Brevan Howard Asset Management co-founder Alan Howard had taken an ownership stake in One River Digital and was helping provide the company with backend trading services. Another prominent backer was British hedge fund Ruffer, which last December also revealed that 2.5% of its total AUM were in bitcoin.

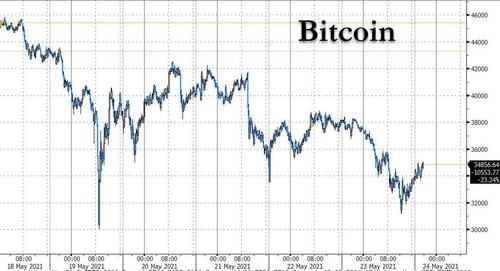

And since the last big bitcoin plunge took place last March, that makes the current crypto crash the first major stress-test for One River, not to mention a majority of the 14% of Americans who owned crypto at the end of 2020.

So how is the hedge fund trading the current crash? Below, are some digital market comments from Marcel Kasumovich, the fund's head of research, as of May 19, so much of the selling indicated here has taken place in the 72 hours subsequent to this note:

This is a broader crypto trading washout. It is worth benchmarking the Bitcoin downturn to previous ones. We are approaching the percentage drawdown of the Feb-Mar 2020 period. A price decline to $23,700 or so would replicate the initial 2017-2018 downturn. The patterns thereafter of those two downturns were vastly different obviously. After the initial bottom in 2018, Bitcoin fell another 55% and it took nearly four years to recover the 2017 high-water. It took only months to recover the 2020 downturn.

The role of Grayscale lockups remains poorly understood. This was arbitrage demand for Bitcoin that now needs to be absorbed. In the next ten days, 33mm shares become unlocked and will need to be sold as the unwind of the original trade. Through the end of August, 151mm shares will be unlocked (22% of total supply). At a Bitcoin price of $33k, that is $3.2bln of supply to be absorbed. There can be high profile stresses in the ecosystem of players engaged in this trade. The Grayscale discount is fairly stable around 20% discount through the latest downturn, suggesting some institutional demand willing to absorb supply at prevailing prices.

We learn a lot from the ecosystem data. Take stablecoin prices. USD.T and USD.C are incredibly steady through this downturn. Dai shows a bit more volatility, trading to as low as 0.995 (to put into real world numbers, on $1mn of collateral we’re talking about a $5k haircut from Dai at the low in prices, which was quite brief). It is not nothing, particularly in violent markets. But overall, this element of the ecosystem is performing very well. Trading volumes in USD.T are running $64bln in the past 24 hours, roughly 3-times the start of the year.

The liquidity shock in leveraged trading markets is easily evident. Deribit is a good example. The bid-offer pricing on $10mn Bitcoin in the perpetual swap market (leveraged forwards) was wider than 30% earlier today and is currently around 10%. Other exchanges were trading at a fraction of this price tiering. You see the same in implied yields across exchanges. The 1-month annualized yield on the Deribit exchange plunged to -75% annualized at its worst point today. Ether is similar, though not as extreme as Bitcoin relative to last March.

There has been a rapid inflow of Bitcoin back to exchanges. This is an indicator of holders preparing to sell. In turn, cash holdings through markets like USD.T also show a rise. Large wallets or “whales” are not responsible for flows in the past month. Flipside Crypto does a terrific job of documenting these flows day by day. Smaller wallets and exchanges overwhelm the flow, accounting for 550k of Bitcoin token flows compared to 17k for whales. Ether flows are an entirely different architecture, even though the outcomes are correlated. The moves are between decentralized exchanges and smart contracts, such as ETH embedded in Dai.

Where do we go from here? The speed of moves and ecosystem make it clear this is a speculative risk move, with a liquidity component. Is the macro backdrop intact? Yes. Are there near-term challenges to overcome? Absolutely. Grayscale locks and FATF (Financial Action Task Force) guidance on decentralized finance are big ones. Not a crypto winter, more of a cold front from Washington. A recovery slower than March 2020, but much faster than 2018 would be my benchmark.

https://ift.tt/3vhv9SS

from ZeroHedge News https://ift.tt/3vhv9SS

via IFTTT

0 comments

Post a Comment