Oil Rebounds As Iran Nuclear Deal Talks Hit A Snag

Oil prices rebounded from last week's Iran deal optimism-inspired rout, as a new potential "snag" emerged in reviving the 2015 Iran nuclear deal that could add more oil supply, even as Goldman Sachs said last night that the case for higher prices remains intact even with increased Iran exports.

Brent crude oil futures for July rose $1.06, or 1.8%, to $67.50 a barrel West Texas Intermediate for July was at $64.73 a barrel, up $1.15, or 1.8%.

Oil prices fell almost 3% last week after Iran's president, Hassan Rouhani, said the United States was ready to lift sanctions on his country's oil, banking and shipping sectors. However, as we reported over the weekend, the speaker of Iran's parliament said on Sunday a three-month monitoring deal between Iran and the U.N. nuclear watchdog had expired and that the country would block inspectors from accessing nuclear site images.

However, offsetting some of the tension, on Monday morning - and as expected - a one-month extension to the monitoring agreement has been announced.

And yet, the mood soured further after Secretary of State Blinken said that there was no sign yet that Iran is willing to comply with nuclear commitments needed to lift sanctions, when asked if a decision was made to lift sanctions on Iran.

European diplomats said last week that failure to agree an extension of the monitoring deal would plunge wider, indirect talks between Washington and Tehran on reviving the 2015 Iran nuclear deal into crisis. Those talks are due to resume in Vienna this week.

"All in all, it seems to be only a matter of time before the sides involved put pen to paper on a new nuclear accord," said Stephen Brennock of oil broker PVM. "Investors are bracing for a fresh wave of what will surely be heavily discounted Iranian crude ... yet for all this alarmism, an aggressive ramp up in Iranian production and exports is unlikely to stall the drawdown in global oil stocks".

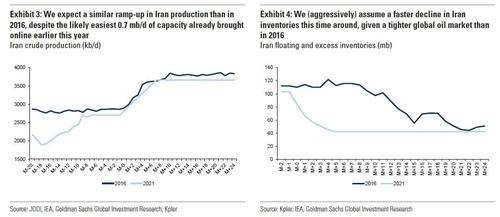

Meanwhile, even with a potential restart of Iran exports, the case for higher oil prices remains intact due to a vaccine-driven increase in global demand, Goldman Sachs commodity analyst Damien Couravlin said in a note published on Sunday (and discussed here).

"Even aggressively assuming a restart in July, we estimate that Brent prices would still reach $80 per barrel in fourth quarter, 2021, with our new base case for an October restart still supporting our $80 per barrel forecast for this summer," Goldman said.

https://ift.tt/3umnFgs

from ZeroHedge News https://ift.tt/3umnFgs

via IFTTT

0 comments

Post a Comment