On Friday A PBOC Official Called For A Stronger Yuan; One Day Later His Article Was Deleted

By Sofia Horta e Costa, Bloomberg reporter and commentator

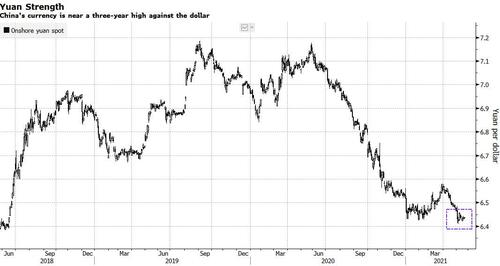

China’s rising inflation is putting focus on the role of the yuan, which is trading near a three-year high.

On Friday, a central bank official in the Shanghai branch said China should allow the yuan to appreciate to offset the impact of rising import prices.

“As an important consumer of commodities globally, China is inevitably impacted by international market prices through imports,” Lyu Jinzhong, director of the research and statistics department at the central bank’s Shanghai branch, wrote in an article published Friday by China Finance, a magazine run by the PBOC.

The comments were unusually blunt, and the article has since been deleted.

On Sunday, People’s Bank of China Vice Governor Liu Guoqiang appeared to counter that view, saying the exchange rate will be kept at “basically stable” levels. Local media also chimed in with a front-page commentary, saying the exchange-rate mechanism is expected to stay stable for some time.

A stronger yuan would cut the cost of imports, such as commodities, which have been a major component of increasing prices. But the strength of the yuan means additional gains may fuel speculation that authorities are letting go of the currency -- thereby spurring traders to bet on further appreciation. Such one-way bets have long been resisted by the PBOC, while a too-strong yuan would also hurt the nation’s global competitiveness by making exports more expensive.

If Beijing was serious about letting go of the yuan or making it more international, more effort would need to be made to take down capital controls. So far, there’s little sign of that. A botched mid-2015 move to let the market have a greater role in setting the yuan spooked global investors, eventually pushing Beijing to adopt its current framework: welcoming inflows of overseas capital while limiting the outflow of domestic money.

https://ift.tt/3hPzlFI

from ZeroHedge News https://ift.tt/3hPzlFI

via IFTTT

0 comments

Post a Comment