Zoltan's Latest Shocker: The Taper Will Be Bullish If...

Ask around on Wall Street (or any street) what the biggest bogeyman to capital markets is and 11 times out of 10 the answer will be "the taper", even though the fact that everyone is fully aware of the risks from the Fed's looming announcement, also means that it is more than fully priced in.

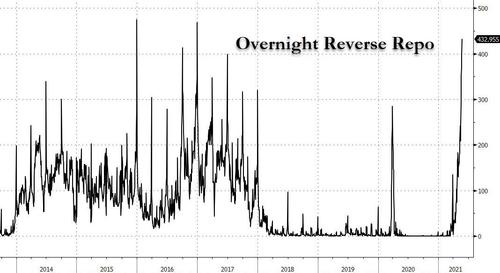

Which is why, in light of the fact that the market's true biggest risk is runaway, out-of-control, inflation, we previously suggested that far from being a crash catalyst, the taper may well end up being a trigger for further market gains especially since it would mean that the unprecedented flood of liquidity in the market which has sent the Fed's reverse repo facility to near record levels...

... as banks simply no longer have a place where to store all the Fed's reserves, will finally ease.

Translation: there is so much excess liquidity in the system, banks don't have a place to store it and are BEGGING the Fed to taper.

— zerohedge (@zerohedge) May 21, 2021

Yes, taper will be bullish https://t.co/nFrmsr2ooK

taper will be bullish https://t.co/5gh2f2VxkF

— zerohedge (@zerohedge) May 11, 2021

Incidentally, we are not the first ones to make that argument: back in 2013, just around the time Ben Bernanke spooked the market with the first "Taper Tantrum", none other than hedge fund titan David Tepper made the same argument: "If the Fed doesn't taper back, we're going to get into this hyper-drive market," he explained. "It's a backwards argument. To keep the markets going up at a steady pace the Fed has to taper back."

Fast forward to today when the same logic applies: the longer the Fed does nothing, the more likely it is to lose control of inflation altogether (not to mention flooding the repo system with liquidity beyond repair) and so we expect that within the next few weeks ahead of the Fed's September "Taper bomb", the narrative will change accordingly.

Which brings us to the first indication thereof: in his latest Global Money Dispatch note, repo guru Zoltan Pozsar (formerly the NY Fed's market plumbing wunderkind and currently at Credit Suisse), the Hungarian provides a rather technical and more nuanced, if altogether similar argument: the taper could well lead to lower rates (i.e., no bond market tantrum when then jumps to stocks) provided that at the same time, the Fed announced the end of Wells Fargo's asset growth ban, activating some $500 billion in unused balance sheet capacity, or more than enough to offset many months of declining Fed purchases courtesy of a brand new private sector entity.

For those curious how the groundwork is being set to paint the taper in a positive light, here is the full Pozsar note:

There is the QE problem, the Wells Fargo problem, and the taper problem…

The QE problem has to do with the Fed buying way too many mortgages, richening MBS relative to Treasuries. The Fed is buying $40 billion of MBS a month, and Bank of America is providing a tailwind by buying as many MBS as the Fed.

What will fix this issue is either the Fed buying less MBS and more Treasuries, or Bank of America doing the same – the Fed for “market functioning” reasons and Bank of America for relative value reasons. Either way, fixing the QE problem will require one of these banks to buy more Treasuries before taper commences.

If you are concerned about the MBS float, the last thing you need is the Fed suddenly lifting Wells Fargo’s asset growth ban. Well Fargo has an unused balance sheet capacity of more than $500 billion, and after years of no growth and a shrinking loan book, it would be stepping into duration markets with force.

If the QE problem is bad enough for MBS and leads to a bid for Treasuries, the QE problem plus freeing Wells Fargo now would mean MBS trading even richer and, by extension, an even stronger bid for Treasuries. Timing is everything…

…and getting it right can turn a problem into an opportunity.

While lifting Wells Fargo’s asset growth ban now would do more harm than good, it could come in handy when the Fed commences taper later this year or next. The market assumes that taper will lead to a sell-off in rates, like in the past – but that need not be the case. The Fed could announce its plans to taper, while at the same time announcing the end of Wells Fargo’s asset growth ban, so that fewer purchases by the Fed would be offset by more purchases by Wells.

Less buying by the Fed and more buying by Wells Fargo…

…and rates don’t have to sell off, provided there is coordination at the Fed. The monetary and regulatory arms of the Fed typically do not coordinate, but never say never. Using the Wells Fargo “option” could help the Fed make taper a smoother affair than the 2013 experience, which wasn’t smooth to begin with. It’s one thing to taper against a boring fiscal backdrop like during 2013, and another to taper against a backdrop painted with cumulonimbi of fiscal issuance – given the fiscal outlook, the Fed should be creative with the Wells Fargo option.

Then there is the consensus problem, which is that everyone expects rates to go up from here, and “if everyone is thinking alike, then somebody isn’t thinking”: the macro reasons for higher rates make sense, but the potential for more Treasury purchases either by the Fed or banks before taper commences, and Wells Fargo deploying $500 billion of balance sheet after taper commences, could set off a rates rally from here. Consider these problems at least as risks...

https://ift.tt/3unLvbk

from ZeroHedge News https://ift.tt/3unLvbk

via IFTTT

0 comments

Post a Comment