TINA, BOGO & FOMO's Engines Are Stuttering

Authored by Peter Tchir via Academy Securities,

The Last Thing I Wanted to Write about is Omicron

I really didn’t want to have to start another weekend T-Report thinking about COVID. I would much rather have pointed you towards the excellent Around the World – Geopolitical Surprises, published Friday. I’d much prefer to jump into today’s themes, but it is difficult to talk about markets, the economy, or inflation without at least attempting to address what is going on with COVID.

What we “seem” to know so far:

Omicron is highly transmissible. The spread seems rapid and it seems to be able to infect people who have been vaccinated, who have had boosters, or who have had other variants.

-

The symptoms seem relatively mild. That seems to be the case for those who have been vaccinated and those who have not been vaccinated. From what I can tell it is more severe for the unvaccinated, but even then, nowhere close to what we were seeing when COVID initially burst onto the scene.

-

We have likely gotten far better at dealing with COVID. Knowing those most at risk presumably helps them be more cautious when necessary. Treatment options now exist unlike back in early 2020. We should be able to manage this much better.

-

Have the politician’s gotten better at dealing with COVID? While I believe that the population at large actually has a decent understanding of the risks and is taking precautions as they see fit, the wildcard is what governments do with the latest variant. We are seeing countries in Europe revert to lockdowns. China, if it maintains its zero-tolerance policy, will see lockdowns as well. On Tuesday, President Biden is set to give a speech detailing our plans. As far as I can tell, lockdowns have become politically dangerous here. There seems to be (at least from everything I can tell) a large portion of the population that has done all the vaccinations and followed all the rules and doesn’t seem to believe that a lockdown is necessary given what we know about this variant.

-

What politicians do may be more dangerous than the Omicron variant for markets and the economy. Several people that I find to be very good have expressed this view, and I agree with it.

I think on Tuesday, President Biden will be cautious but avoid anything too disruptive.

COVID Modelling

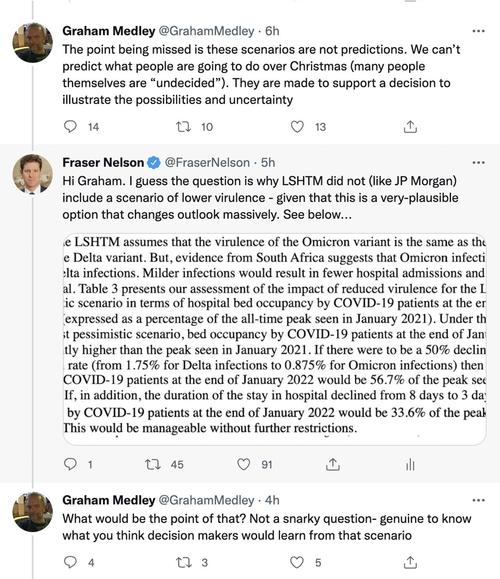

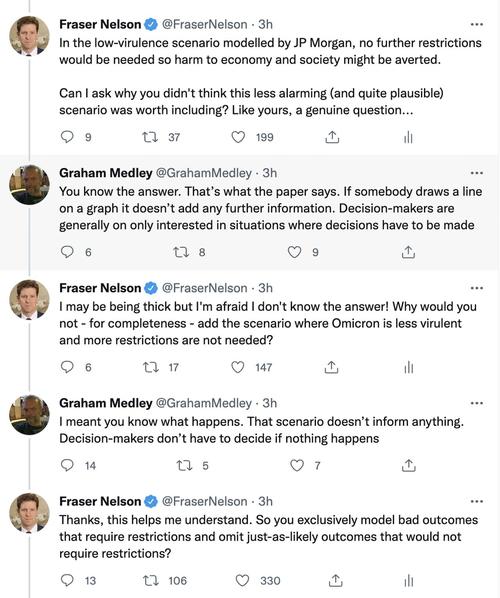

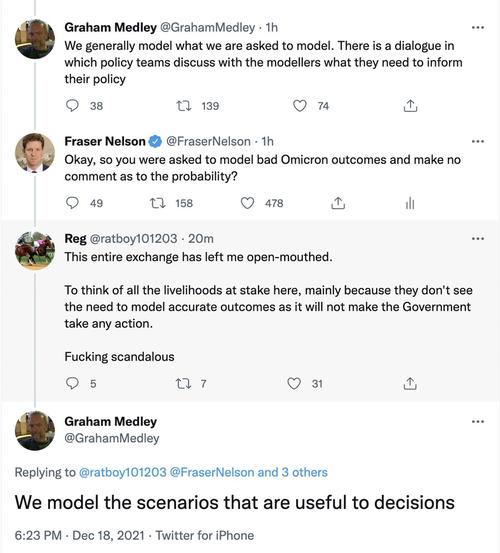

On Twitter, there is an interesting thread about COVID modelling that is worth reading. @NateSilver538 weighed in on the discussion, which is what caught my eye, as he is an expert at modelling. The original thread started with @FraserNelson (Editor of the Spectator, which I don’t know much about, and would have ignored, if not for Nate weighing in). The other participant is @GrahamMedley, professor of infectious disease modelling and chair of the SPI-M, a sub-group of SAGE, which seems to be responsible for the modelling that the U.K. government relies on.

What is interesting is that the modelling focuses on what could be considered “worst-case” scenarios, certainly those where the population does little to curtail the spread.

I am not sure what side of the argument I come out on (my bias is certainly towards probability weighted scenario analysis), but I’m not sure what the right approach is on this topic. Having said that, I found this thread fascinating and intend to dig deeper as it gives a little insight into the “science” and how politicians use (or even drive) the “science.”

I am not sure what to make of this subject, and maybe it is nothing, but it caught my eye enough that I figured that I’d point it out to you as I suspect it will be a topic that gets addressed going forward giving us more insight into models and policy response.

TINA, BOGO & FOMO’s Engines Are Stuttering

Now we can focus on a few things that will be in play in the coming weeks.

Year-end is always a difficult time to think about market direction as people are out of the office, liquidity is thin, people have positions to defend or push in an environment that makes it easier to push. And, this year, we have the impact of Omicron, and how politicians choose to respond to that.

This week’s piece follows up on a few recent pieces:

-

To a lesser extent, Inflation, Like Greed, Is Good, which got a boost this past week with the Senate cracking down on slave labor in the Xinjiang Province of China. We are at the early stages of supply chain scrutiny, driven by ESG, and that will reshape the global economy.

BOGO vs Quality

Buy One, Get One free, or BOGO seems to be running rampant right now.

If I check my emails, I think there are sales that started as Black Friday sales (on the Monday before Thanksgiving) that turned into Cyber Monday sales and are somehow “still” available today. It reminds me of the “going out of business” sales which would hit late night TV, where the seller seemed to be going out of business for years, despite creating an urgency on Saturday nights at 1 am.

I think that there are a few important things to take away from this:

-

There was a time, not that long ago, that if you slapped a big enough sale price on something, people would buy it. Now, and this is more anecdotal, but no one wants to buy things in “that color” or with those design “features” at a discount if no one wanted to buy them at regular price. Whether there is less care about owning the label rather than something that looked good, I am seeing/hearing about the trend towards quality. That extends, to some degree, not just to the product but to the procurement of that product.

-

I believe that we will continue to see this trend towards “quality”, where people will pay more for the product they want, which will include factors such as country of origin, sustainability, and other potentially “intangible” factors that affect the perceived quality of a good or service. Capturing this shift will allow companies to drive sales and earnings.

-

This phenomenon also seems to be hitting the stock market. Even as the S&P 500 and Nasdaq hover near all-time highs, there are a large number of stocks that are 50% below their peaks. Everywhere I turn, I see articles about the lack of breadth. How unusual it is for indices to be up 23% (S&P 500) year to date, with so many laggards. I highlight this, because as a contrarian, I naturally gravitate to these types of stocks. These, in theory, are stocks that could be ripe for huge bounces, possibly even short squeezes, and I’m finally inclined to get on that bandwagon. But (and this remains a big but) quality matters and half off sales now don’t attract buyers in stocks or goods. Maybe it is too early for some of these, despite the discounts?

Fundamentals vs Technicals

This little rant follows directly from the BOGO comments.

The number of interviews I’ve watched or listened to recently where the pundit or stockpicker mentions that the recent 10%, or 25%, or even 50% pullback had nothing to do with fundamentals and has everything to do with technicals has reached a peak. It is driving me nuts! (I am sure that some of my comments on media drive people nuts as well, but that is a topic for another day).

I am completely willing to accept that the drops are not associated with fundamentals per se. I am biased, so I do think broad shifts in the economy impact future fundamentals, but my main issue is that no one seems to believe that any of the 50% rises, or doublings, or even triplings, had anything to do with technicals and things out of their control.

I can completely agree that a stock dropping 50% in a couple of months had more to do with positioning and other factors (which is why I love exploring those other factors). But I also believe that stocks that doubled or even quadrupled in a quarter or two likely weren’t being completely driven by fundamentals and other factors (like performance chasing, thin floats, etc.) impacted the upside.

Not sure why this one bothers me so much, but I suspect that until there is more acceptance that these factors work both ways, there will be people holding positions that could be in for more downside.

TINA vs There Is An Alternative

Not sure what a good antonym for TINA would be and TIAA is already taken, but maybe someone will come up with a good one (or send me a good antonym if it already exists).

While the Fed hasn’t hiked and interest rates across the globe remain low, Central Banks are gradually pumping less money into the economy. The “threat of hikes” is real.

While today, I can’t say that there is an alternative, we are headed down a path to where there will be alternatives which should offer opportunities and add to some existing risks.

FOMO’s Engines are Stuttering

While FOMO’s engines may not stall, that is increasingly a big risk.

I’ve had a lot of interesting discussions about FOMO in the past week or two.

There is the obvious driver of FOMO, which is higher prices. Higher prices create the atmosphere where the fear of missing out becomes prevalent. But let’s spend less time on that obvious one and spend a bit of time on things that aren’t discussed quite as much and could be the death knell for some of the biggest FOMO trades (with a focus on crypto).

-

For many assets the “average” investor is already likely to be under water on their investments.

-

Early buyers are still way up because they bought cheap. Investors who came late to the party have born the brunt of the pullback. For many assets, the in-flows accelerate as prices rise, so that when they fall, the “average” investor is now staring at losses.

-

-

There is a correlation between “weak” hands and losses.

-

Almost by definition, FOMO means that an investor eventually succumbs to their fear of missing out and buys the asset. So, when we get the pullbacks, the people with losses are the ones who were least interested in being involved in the first place. The early adopters told the story, the 2nd wave believed it, and spread it to the 3rd wave, etc. The latest wave of buyers is far less likely to be successful in generating a next wave (what forces someone in once the music may have stopped).

-

-

Complexity aids FOMO, but also encourages doubt.

-

The more complex something is, the easier it is to overcome fear, because maybe people do know a lot more than you. After all, Bitcoin is always pictured as a cute gold coin, so it must be a coin or currency of some sort? Sorry, for being a bit too sarcastic with that one, but I did start 2021 bullish crypto. It is very difficult to convince someone to buy a generic $1 bill for $5. It is much easier to find a buyer for something that is truly difficult to comprehend. As that doubt sets in, and starts infiltrating the conversations, you have a real risk of “rolling” back the waves. Each successive wave was more reluctant than the prior wave and their performance has been disappointing.

-

The sheer number of coins, NFTs, tokens, etc. were always a bit of a head scratcher when things were going up, but raises some concerns as things are going down. I’ve read some great papers about coins that will do well in the metaverse for example, but during FOMO, this competition added to the opportunity set and now it may make many wonder why there are so many and if they are all useful.

-

El Salvador, Bitcoin Bonds, and Bitcoin City. This may work in the end, but if I was good at GIFS, I’d have a good “how it started” and “how it is going” GIF. This could have been inspirational (and it may yet be), but it may also further detract from the “use” case, which is the way I’m leaning at the moment.

-

-

Volatility is a requirement of FOMO.

-

This may sound a bit weird, but volatility is required to create FOMO. If something can jump 10% in a day, then you better buy it today because it might be too expensive tomorrow. In a world where I’ve seen the term “non-permanent losses” used to describe what pullbacks do to your holdings, you need that hope of a huge swing. In stocks, TQQQ, a triple leveraged Nasdaq 100 play, is all the rage, and in London, a 5x version was launched (along with 3x versions of various ARK funds).

-

If prices merely stabilize, FOMO will decrease. Gambling is the most fun when you get instant gratification. Heck, maybe even instant results, as gamblers keep coming back. If the market is heavily skewed by “gamblers”, let’s call them people who are heavily leveraged, enjoy the weekly option trading game, etc., then a decrease in volatility (especially for the weekly options players) immediately impacts their participation.

-

While a bit of a non-sequitur, I have been thinking a lot about David Tepper’s interview on CNBC from September 2010. It is quite famous as he used a colloquialism to describe his positioning which turned out to be spot on. What most people forget, is at the end of that interview, he is asked by Kernen if he has any questions. While it seems to have been edited out of the clips I can find, I will do my best to paraphrase what happened next. Tepper asked Kernen about what drives their business (the business of financial media). Kernen swept his arm, broadly indicating the set and said that even with the fancy new studio and all the new graphics, whether markets went up or whether they went down, none of it mattered, because what mattered was volatility. Why do people tune in en masse? Because there is volatility and I think that fits the narrative that FOMO and volatility go hand in hand.

-

Do Diamond Hand, HODLers Ever Run Out of Money?

Buy the dip.

Buy the dip.

How much money do people have if they never sell? The diamond hands/HODLer seems to apply more to crypto than to stocks, though I think you could easily argue that it has filtered into the meme stocks and maybe some specific areas (think back to BOGO).

There have been record inflows into stocks this year. How much more money is available? How much leverage is being employed? That really scares me as leverage is the biggest step towards forced selling.

Bottom Line

On the equity side of things, I’m leaning heavily towards:

-

Companies and cash flows that are relatively easy to understand

-

Valuations that are compelling on “traditional” metrics (probably a convoluted way of saying value).

-

Dividend payers

-

The plumbing. Anything that makes the economy work. Logistics. Companies that benefit from building factories and infrastructure domestically. Real estate probably falls into this category.

-

Mexico, then Latin America, and Canada. As supply chains shift, the “repatriation” will be to those that we are closer to, both in terms of proximity and in terms of political ideology.

-

Cyclicals.

On the fixed income side of things:

-

I’d like to bet on slightly higher long-end yields and steeper curves, but the Fed seems to be intent on saying things that the market is interpreting as policy mistakes.

-

Credit is fine. When you look at what I like in equities, that encompasses the vast majority of the credit market, especially high yield, from a sector standpoint. Own credit, including high yield and leveraged loans.

-

Delve into structured products. While TINA might be fading in equities, I think it will still exist in credit and will be where to pick up incremental yield and is worth the risk. Digging into structured products will be key.

While reaction to Omicron will drive the direction at the start of the week, I think quality will overwhelm FOMO in the coming weeks.

https://ift.tt/3paatvs

from ZeroHedge News https://ift.tt/3paatvs

via IFTTT

0 comments

Post a Comment