Here Are The Two Things That Will Crush The Fed's Hiking Plans

During Powell confirmation hearing today, the Fed chair said something notable which explains the Fed's aggressive tightening posture: "the economy no longer needs highly accommodative policies" adding that "it is really time for us to move away from those emergency pandemic settings to a more normal level."

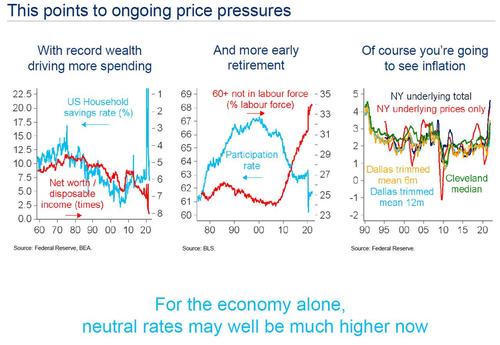

To be sure, this observation may actually be correct, and indeed in his latest presentation Citi's Matt King agreed, noting that "for the economy alone neutral rates may well be much higher now."

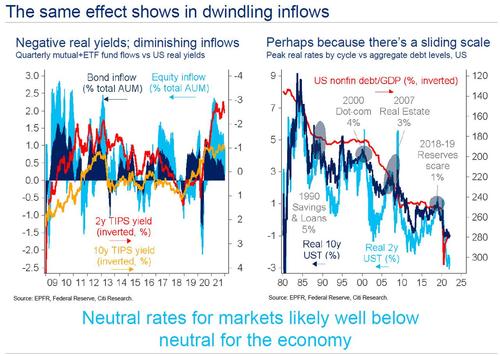

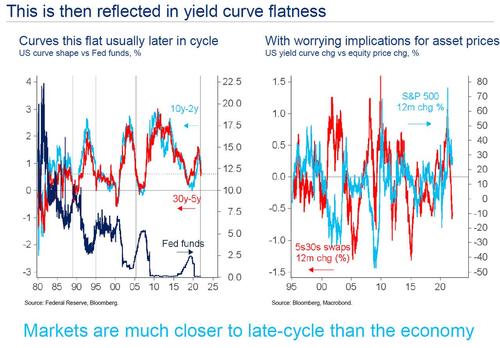

However, while the economy - with its rip-roaring inflation and ultra-tight labor market may indeed be able to absorb several rate hikes and even a material trim in the size of the Fed's balance sheet, the same can not be said about the market. Here we once again go to the latest Matt King slideshow, in which he warned that "neutral rates for markets likely well below neutral for the economy"...

... as "markets are much closer to late-cycle than the economy".

In other words, the Fed's tightening - whether in the form of rate hikes or balance sheet runoffs - while long overdue for the broader economy, will have dire effects on a market which is now used to the Fed's billions in monthly monetary injections; anything less, and certainly a drain of liquidity, and markets will unleash a major tantrum.

But while stocks may have no choice but to find what the strike price on the Fed's put is, which as Morgan Stanley's Michael Wilson recently said is about 20% below all time highs, some market elements are already signaling that not even the economy will be able to sustain just a handful of rate hikes.

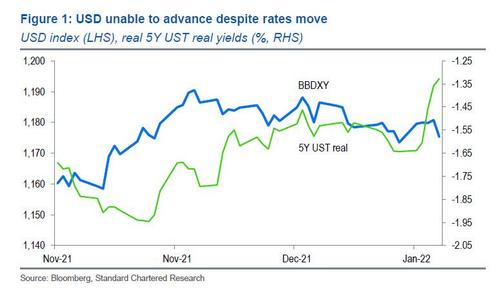

Take the dollar: as we noted earlier, a new conundrum has emerged in recent months, with the dollar now sliding despite "good" economic news such as rising real yields and falling equities.

And while we analyzed a recent note from Standard Chartered FX strategist Steven Englander looking at what may be causing this paradoxical USD response to an increasingly more hawkish Fed, the answer may be far simpler: FX traders are now pricing in the coming economic slowdown that will take place in the coming quarters as the Fed tightening further slows the stagflating economy, which if not contained in time, would lead to recession.

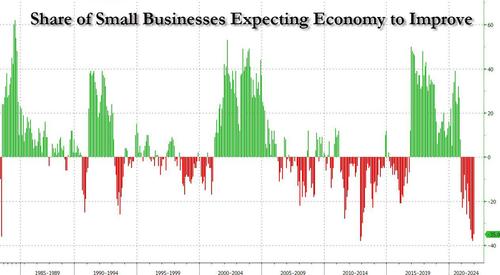

Or, even simpler, look at the December NFIB Small Business Optimism report which printed this morning, and which found that the share of small business expecting the economy to improve in the near future remains stuck at all time lows!

And when it comes to future of the economy, we will take the assessment of small businesses - those who actually transact every single day inside the US economy - over that of the Fed, which is a bunch of ideologically-driven economists who never exist their Marriner Eccles ivory tower, every day.

Which brings us to the gist of this article: what are the two things that will determine not only the end of the current market correction, but when the Fed will capitulate on its aggressive hawkish rhetoric, as it is forced to realize the US economy is slowing at an ever faster rate.In short, what are the two key things to watch to determine if economic growth is once again slowing.

For the answer we go to the latest Weekly Warm Up note from Morgan Stanley's Michael Wilson, whose persistent bearish bias appears to finally have been validated in recent days, and who writes that "with rates having adjusted, our focus now turns to growth".

As Wilson explains, "the Fire part of our narrative is in full gear with both nominal and real rates moving sharply higher so far this year. This is having a disproportionate impact on expensive growth stocks, as it should," but as the Morgan Stanley bear correctly stipulates, the real determinant of how long and deep this correction lasts will be growth.

And to assess where the US economy is in the all important business cycle, the Morgan Stanley chief strategist is laser focused on just two things: i) PMIs and ii) earnings revisions, both of which are heading lower in Wilson's view (who sees software as s a good case study and possible leading indicator in this regard for the broader market).

But let's step back for a second before we get to the meat of the argument, and instead let's take a look at some of the recent market context where, as noted above, just the threats of the Fed's liftoff and/or runoff have already wreaked havoc.

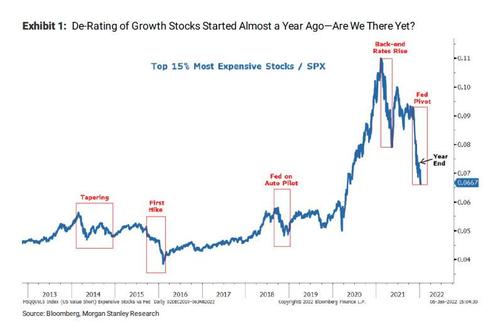

Summarizing the recent market situation, Wilson writes that 2022 is "off to a blazing start" with some of the biggest rotations ever witnessed at the beginning of the year, although in reality "much of this rotation in the equity markets began back in November with the Fed's more aggressive pivot on tapering and rate hikes. More specifically, and as shown below, the most expensive stocks were down almost 30 percent in the last 2 months of 2021. Year to date, this cohort is down another 10%, prompting the number one question Morgan Stanley's clients ask "is it over yet?"

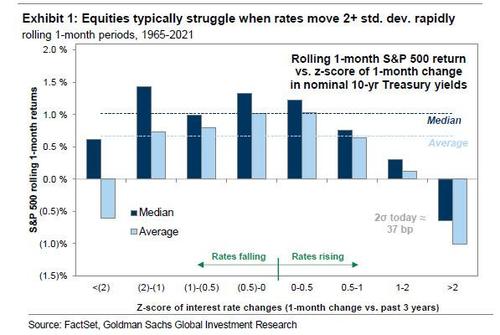

In response to this question, the equity strategist writes that what's changed since the turning of the calendar year "is the move in back end rates— both nominal and real. In fact, the move in 10-year real rates is one of the sharpest on record and harkens back to the original taper tantrum in 2013." Indeed, even Goldman over the weekend pointed out that while the absolute move in yields is hardly jarring, the speed with which yields have spiked is the kind of two-sigma event that sends stock lower in the ensuing weeks.

Wilson then notes that there is little doubt that such a move is garnering the attention of investors even though it's something equity markets have been thinking about for months. Indeed, if one looks again at the de-rating chart above, it's easy to see that the equity market has been discounting this inevitable rise in real rates for months. This fits Wilson's infamous "Fire" narrative, as well as his view that "the equity market is smart enough to know that the rates market has been influenced by QE, and therefore using the stated rate structure for one's discount rate would be a mistake for any longer term valuation assessment."

The obvious question to ask then is why is the rates market suddenly waking up to the reality of inflation and the Fed's response to it. After all, this has been telegraphed for months. Morgan Stanley thinks this has to do with several technical support mechanisms that are now being lifted:

- First, the Fed itself likely increased its liquidity provisions at year end to deal with the typical constraints in the banking system at this time of the year.

- Second, many macro speculators and trading desks likely shut down their books in December despite most views that long duration rates should be higher.

This combination has now reversed and ignited what seems like an inevitable move that many risky assets have been discounting ahead of time. So based on the move in 2013, Wilson predicts that "real rates still have further to run, potentially much further". Referencing Morgan Stanley's rates strategists, he believes that real rates are headed back toward 50bps which is another 25bps higher (Goldman's own forecast is for -0.70% real yields so a bit lower). Wilson notes that "real rates are unreasonably negative given very strong real GDP growth. Therefore, the Fed is absolutely correct to be trying to get them higher. It's also why tapering may not be tightening for the economy even though it is the epitome of tightening financial conditions for markets. Of course, the speed of this move is likely as important as the magnitude."

But while the market "Fire" is already raging, the good news (for the bulls) is that "winter is coming", or in other words the economic slowdown that inevitably accompanies all rate hikes by the Fed and which allows the Fed to resume its generous liquidity which in turn sends all risk assets soaring again.

This is the part which you should focus on even if you skip everything else in this post.

As Wilson explains, with the first part of his Fire and Ice narrative in full gear, it is time to turn our attention to the Ice. As already noted, growth is slowing and while most appreciate this dynamic, there is a lot of debate as to how much it will slow and whether it will matter for stocks. To be sure, growth is likely to remain positive (absent major shocks) but for some companies that remains to be seen given how difficult the comparisons are vs. last year especially in 1H 2022.

Here, as the title suggests, Morgan Stanley is focused on two metrics in particular as key drivers of stocks—PMIs and earnings revisions.

1. PMI

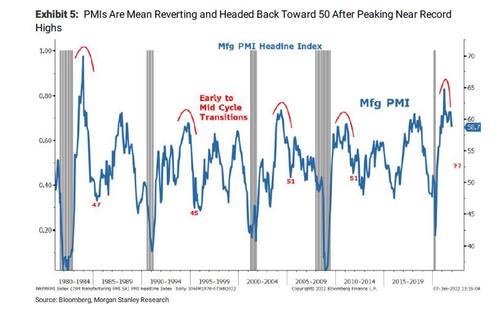

First on PMIs, both the manufacturing and services headline indices reached cycle highs and topped in 2021. Manufacturing PMIs peaked in the spring, while Services has more recently from an all time record high of 70. Given this survey is an oscillating/diffusion index, it typically returns toward 50 after the initial surge following a recession. This time will be no different, and it looks like we are headed there now. Wilson's guess is that by the spring of this year, we will see a Mfg PMI in the low 50s, if not slightly worse given how high it got this time—every action entails a comparable reaction.

In addition to the normal mean reversion we typically get in PMIs at this stage of the recovery, Wilson is also looking at other indicators that suggest "this reversion is imminent and could be sharper than normal."

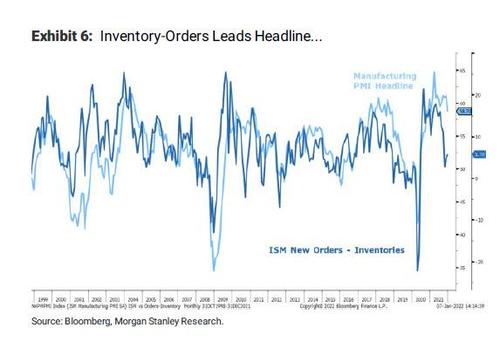

- First, limited supply has been one of the major constraints to growth for the past 6 months. Some of this is due to real supply chain issues and shortages but most of it is due to the excessive level of demand that was created by the extraordinary fiscal stimulus. As noted over the past few months, there have been more anecdotes about improving supply (although little actual results as even Powell noted during his testimony today). While this will help companies meet some of the extraordinary demand they haven't been able to fulfill, it may also lead to less tightness and therefore worse pricing and even cancellation of some of the double orders that make up a good part of the demand companies are seeing. On this score, the inventory and orders sub components suggest this is exactly the risk for the headline index. As inventories catch up to orders, the overall strength of the orders will likely fade.

- Second, the internal weakness in the market has been extraordinary. From weak breadth to extreme leadership in quality stocks, a deteriorating economic and earnings situation that is likely worse than most investors expect is being depicted within market internals—i.e., PMIs, economic and earnings growth will decelerate further than investors expect during the first half of 2022...the Ice part of Wilson's narrative. In fact, according to the MS strategist, some of the extraordinary price damage we are seeing beneath the surface of the index is foreshadowing this likely disappointment

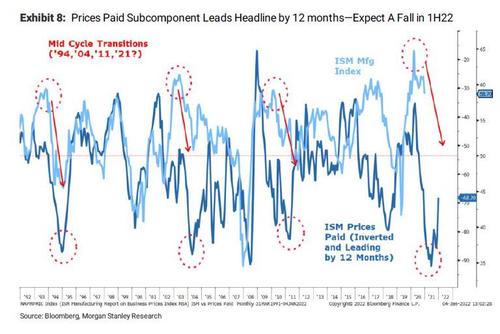

Another subcomponent of the PMI surveys that has significant signaling power is prices paid which tends to lead the headline index by approximately 12 months. It also fits Morgan Stanley's mid-cycle transition narrative nicely but has yet to fully play out. Similar to the charts above, the record increase in prices paid suggests the reversion to the mean for the headline PMI index should be imminent and sharper than normal.

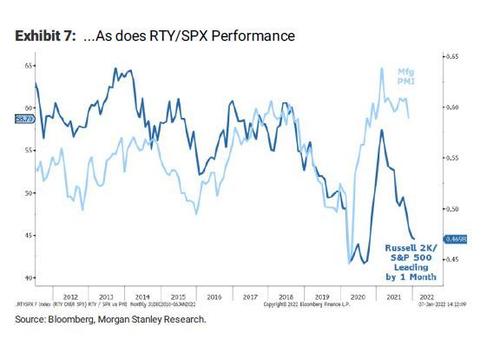

From a market standpoint, this is important because as Wilson notes, manufacturing PMIs tend to predict equity risk premiums (higher PMIs = lower ERPs), and is one of the reasons why the y/y change in PMIs lines up so well with the y/y change in the S&P 500

However - for now - the S&P 500 is still diverging from the deceleration we have already seen in the Mfg PMI to date. So if Wilson is right about PMIs falling further over the next few months, stocks still have material downside before this correction is over. This is very much in line with his outlook that tightening financial conditions with decelerating growth leads to falling valuations, particularly when the starting point is so high. Of course, it also leads to Fed panic and an even more aggressive stimulus down the line.

The good news, according to Michael Wilson, is that a good chunk of the de-rating has already happened at the individual stock level, even if the de-rating hasn't yet begun for the broader index. And while the equity strategist admits that he has been wrong (for now) at how well the index has held up in the face of so much damage to other asset prices and other mounting evidence (largely the results of an extremely narrow market leadership group in the face of the FAAMGs), this relationship with the PMI appears to be a smoking gun if it starts to fall more meaningfully.

2. Earnings Revisions Breadth.

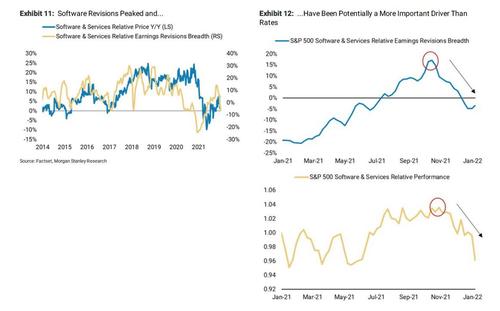

In addition to PMIs, the 2nd key signal Wilson also tracks is earnings revision breadth closely as a gauge of growth acceleration/ deceleration. It also has a high positive correlation vs. stock prices. In this case, the S&P 500 is trading in line with the current earnings revision breadth. While Morgan Stanley's work suggests the risk is to the downside for earnings revision breadth, it bears close watching as a possible offset to falling PMIs. In this regard, earnings revisions and PMIs will be more important than the direction of interest rates from here.

As an aside, Wilson brings readers' attention to what's been going on with Software and Services earnings revisions recently. Relative earnings revisions for the sector peaked in late October and have fallen decisively ever since. This coincided with the relative underperformance of the sector and may explain its underperformance even more so than the recent rise in rates. In other words, "Software stocks are simply reacting to what are deteriorating earnings revisions, at least relative to the S&P 500" and until this reverses, software as an overall cohort should continue to underperform, particularly if rates are still headed higher. Conversely, it does look like relative revisions are trying to bottom so if this can fully reverse during 4Q earnings season, so should the stocks, at least on a relative basis assuming rates stabilize, too. At this stage, Wilson says he would not recommend investors try to be too early here given how extreme valuations and positioning remain for the sector.

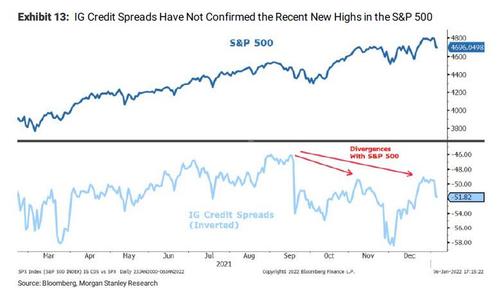

One final, and ominous, observation from Wilson which suggests the S&P 500 may finally be ready to catch up to the weak breadth under the surface is the recent divergence with IG credit spreads. For most of 2020-21, credit led the rally in stocks, as it typically does coming out of a recession. However, as shown below, "on the last two highs made by the S&P 500 in November and then December, IG credit spreads did not confirm them with new tights." Given the importance of credit spreads to equity valuations via the risk premium channel, Morgan Stanley's chief equity strategist would simply chalk this up as yet another thing to watch for the all clear sign that this correction is over, or that it is about to get much worse... and culminate with another Fed panic.

https://ift.tt/3Gj8ETh

from ZeroHedge News https://ift.tt/3Gj8ETh

via IFTTT

0 comments

Post a Comment