Calm Before The Storm? Transpacific Sea-Freight Rates Fall Amid China COVID Lockdowns

Top Chinese manufacturers have shuttered operations as expanding COVID-19 lockdowns choke off logistical networks from factories to ports and simultaneously alleviate congested transpacific shipping lanes. Though, once factories in China reopen, another wave of supply chain chaos will slam US West Coast ports.

Stringent government measures to mitigate the spread of COVID have resulted in widespread lockdowns in Shanghai. Tens of millions of people are locked down in the industrial metro area. Factories, such as Tesla's and component makers for Apple, have restricted output or closed altogether.

Disruptions to factories, trucking, warehouses, and port operations in Shanghai have depressed shipping rates because the flow of goods to the US has come to a crawl.

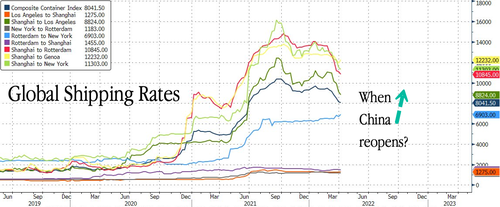

A 40-foot container from Shanghai to Los Angeles slumped 3.2%, from $9,112 a week ago to $8,824 this week. The benchmark transpacific route is down more than 30% from the September peak of $12,424 but still five times higher than in April 2019.

The market for ocean freight is cooling because of the disruptions in China. Ahead of the lockdowns, we described demand would sink for container ships. We outlined once factories reopened, another shipping crisis would materialize:

This may lead to depressed shipping rates on an intermediate basis because of the lack of demand. However, long term, shipping rates should rebound due to a backlog of products that would need to be shipped once factories reopen.

Michael Every of Rabobank agrees with our view that China's Zero COVID policies to stop the spread will ease US port backlogs. He said, "it also means far fewer people will be getting their orders from China at all," adding that "this disruption might be structural if it is going to be China's policy response to a virus."

What comes next is a giant backlog of Chinese products that will need to be shipped to the US. Once China reopens, US importers will be racing to secure containers, which will drive shipping rates higher. That should result in a tsunami of freight that will clog up US West Coast ports and may induce even more supply chain-related inflation.

https://ift.tt/R1gFUlf

from ZeroHedge News https://ift.tt/R1gFUlf

via IFTTT

0 comments

Post a Comment