Goldman Warns Of Higher Oil Prices & Volatility Due To "Self-Sustaining" Physical & Financial Deficit Doom-Loop

On the same day as oil prices slip to their lowest since Putin's invasion of Ukraine - and reports of Russia selling oil to China for Yuan - Goldman Sachs doubled-down on their Poszar-esque commodity-currency-linked warnings about the regime-change under way in the energy complex.

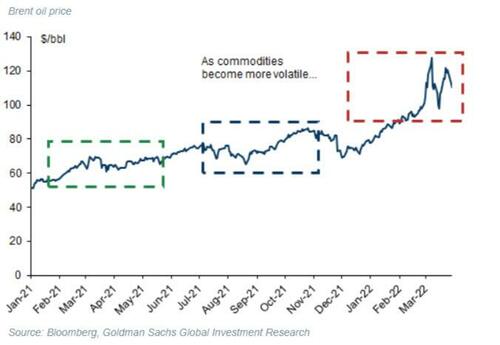

As Goldman's Jeff Currie recently warned, commodities are entering a volatility trap.

Crucially, as we detail below, this self-sustaining regime-shift driven by both physical and financial factors, is likely to last years rather than weeks.

'Physically'

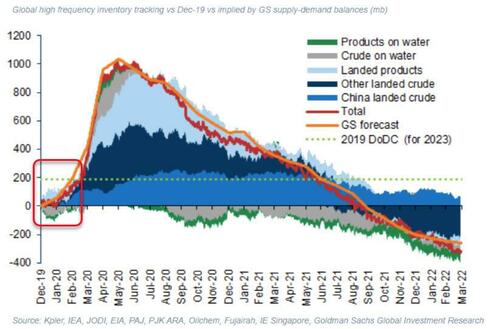

Inventories are already at historical lows in terms of 'days of demand' following 20 consecutive months of deficit...

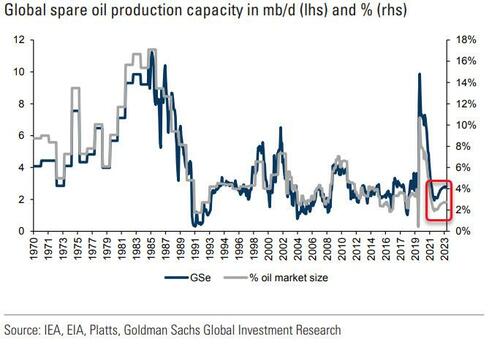

...and Goldman notes that the unavailability of the usual system buffers of inventory and spare capacity...

...has required an evolution in the pricing regime towards the more abrupt mechanism of demand destruction, amplifying the price and volatility impact of the continued pandemic shocks and, currently, the Russia-Ukraine war.

Remember, the 'physical' markets have suddenly become significantly more complicated (and delivery anything but guaranteed) as we recently noted 'oil is no longer fungible' to some extent, for some buyers... "Russian oil bidless, non-Russian oil offerless"...

'Financially'

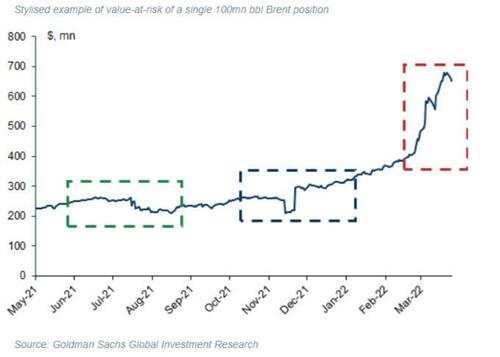

Volatility is both curbing liquidity and restricting access to the very credit required to maintain orderly financial and physical trading of commodities.

In addition, it is also exacerbating the medium- to long-term capital shortages that have built up after an era of low returns and ample supply, reinforced by political and investor ESG concerns.

This can be visualized in the following vicious doom-loop of volatility creating more illiquidity and lowering capital, leading to more volatility and so on...

As oil becomes more volatile...

...the range of possible outcomes becomes wider, with a greater potential for loss...

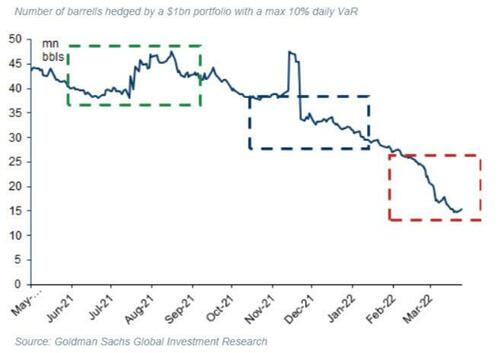

...that shifting distribution drives up the Vale-at-Risk (VaR)...

...which drives down the hedgeable amount of commodities, for any given amount of risk capital...

And a lack of risk capital lowers market participation, driving down liquidity and exacerbating volatility, and further discouraging potential lenders and investors, reinforcing lower participation and higher volatility.

This volatility trap is a direct consequence of the "Revenge of the Old Economy".

As commodity producers under-invest in new supply, commodity inventories deplete, raising volatility as the market loses its balancing buffer between small supply and demand shocks. This volatility in turn keeps commodity producer assets unattractive - it raises the uncertainty surrounding the investment's true value, lowering its appeal to investors. Capital continues to stay away from the sector, keeping new supply capacity - and hence inventories - low.

And as we saw in the 1970s, such a volatility trap can create persistently higher commodity inflation and a supply constrained market.

-

In the 1970s, the markets turned to long-term fixed price contracts and built large conglomerates to deepen the balance sheets required to deal with these funding stresses.

-

In the 2000s (pre GFC) they used financial markets, and a higher degree of bank leverage, to share the risks. Neither avenue is fully available in today’s regulatory environment.

But, it's different this time.

Given there is unlikely to be a widespread lift of sanctions on Russia, regardless of the outcome of the war, as has historically been the case with such regulatory impositions, Goldman expects this new, more volatile pricing regime to persist for the foreseeable future.

All of which reinforces Goldman's forecast for $125/bbl Brent crude in 2H22 and reinforces Poszar's warnings that you can print money but not print oil, iron, or wheat, or VLCCs or other ships to guarantee delivery of the critical commodities. Thus, as Poszar concludes rather ominously, commodity reserves will be an essential part of Bretton Woods III, and historically wars are won by those who have more food and energy supplies. And as Goldman's price forecast suggests, the current 'lull' in the stagflationary storm (as oil prices slide to post-invasion lows) is perhaps just the eye of a very much larger and longer storm.

However, while many have been predicting the birth of a new monetary system in the past decade, it is the nuances of Zoltan's vision of the monetary future that is especially troubling: as he puts it "we are witnessing the birth of Bretton Woods III - a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West."

https://ift.tt/GRx8k2c

from ZeroHedge News https://ift.tt/GRx8k2c

via IFTTT

0 comments

Post a Comment