Morgan Stanley: This Yield Curve Inversion Is Different

By Guneet Dhingra, strategist at Morgan Stanley

"The only thing we have to fear...is fear itself" – Franklin D Roosevelt (March 4, 1933)

An economic recession in the US is on the minds of all investors today – in no small part due to the inversion of the 2s10s Treasury curve. Observations over the last 70 years suggest that almost every time the 2s10s yield curve has inverted,a recession has followed close behind (it’s correlation, not causality though). We think that this time is different.We think that an inverted yield curve is here to stay, without necessarily being a signal fora recession ahead. To borrow FDR's famous words, the only thing investors have to fear about an inverted yield curve today...is fear itself.

Believers in the predictive power of the yield curve posit that inverted curves reflect rate cuts in the future, which in turn must be a sign of a growth slowdown ahead,and ultimately a recession. Unless one believes that the curve inversion in 2019 predicted the 2020 Covid recession, it is likely that the predictive power of the yield curve inversion would have been debunked in 2020 itself

The signal from the yield curve inversion worked better a couple of decades ago, when yield levels were closely tied to inflation, GDP and, ultimately, Fed policy. However, the yield curve today is uniquely affected by two factors which limit the macro signal in the curve.

First, a number of technical distortions mean that the yield curve is artificially flatter than comparable points in the past. A combination of:

- a significant amount of Fed QE,

- significant demand from defined benefit US pension funds, and

- sporadic flight-to-quality demand for Treasuries

... has depressed 10-year and 30-year yields well below the levels consistent with inflation and growth. We estimate that these distortions have kept the curve up to 50-100bp flatter than its true level. Arguably, a 2s10s curve below -75bp should be the new recession signal, instead of 2s10s below 0bp.

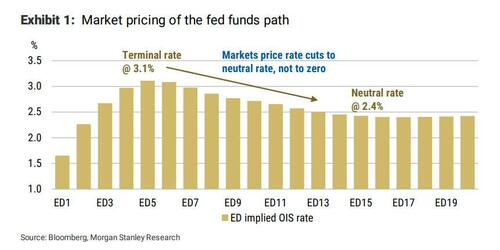

Second, the Fed's intention to deliver restrictive policy fits with inverted curves. The March FOMC dot plot shows that the Fed expects to see a terminal fed funds rate close to 3% in 2023, about 50bp higher than the Fed's perception of the neutral rate at around 2.5%. In essence, the Fed is telegraphing an inverted curve, and the rates market is reflecting the Fed's policy path. Importantly, the inversion priced into markets doesn't reflect rate cuts back to zero in 2024, but rate cuts back to a neutral rate of 2.5% (Exhibit 1) – hardly a signal for a recession down the line.

Our view that the yield curve inversion is different this time found resonance across various research teams at Morgan Stanley. In our collaborative note on yield curve inversion, our economics team highlighted strong economic fundamentals and alternative recession models signalling a low probability of recession. Our US bank analysts highlighted the case for continued loan growth for banks in the coming years even with some inversion. Our credit strategy team highlighted continued improvement in balance sheet leverage, strong liquidity and low defaults – not the hallmarks of late-cycle. Our REITs team notes the strong fundamentals for commercial real estate as well.

Can the curve keep inverting deeper without signalling a recession? The answer depends on how high markets can price the terminal rate. From a historical perspective many investors see 1994 as a template for this hiking cycle. In 1994, the terminal rate ended up 100-150bp above the Laubach-Williams estimate of the then neutral rate in that cycle. Investors currently see the long-run dot as the neutral rate – around 2.5% – and therefore markets could price a terminal rate100-150bp above neutral, at around 3.5-4.0%, and yet hope for a soft landing like in 1994.

Finally, could the Fed’s plans for its balance sheet limit curve inversion? The yield curve can steepen if the Fed considers selling Treasuries (not our base case), but the curve should not steepen due to quantitative tightening, where the Fed is merely allowing Treasuries to mature off its balance sheet. Contrary to popular perception, quantitative tightening (QT) is not the opposite of quantitative easing (QE). The ultimate impact of QT on the rates market depends on the US Treasury, not the Fed. And we think that the US Treasury will respond to QT by increasing short-term Treasury supply – more likely to flatten the curve than steepen it.

https://ift.tt/me2cXRh

from ZeroHedge News https://ift.tt/me2cXRh

via IFTTT

0 comments

Post a Comment