WTI Holds Gains Above $100 Despite Huge Crude Build

Oil prices rebounded today thanks to some lifting of China COVID restrictions, Putin's rising rhetoric, and OPEC comments regarding an inability to cover production losses from Russia (which dropped below 10mm b/d for the first time since Jul 2020). WTI (and Brent) both rebounded back above $100.

“The crude correction appears to be over as China begins to lift some of their lockdowns,”said Ed Moya, senior market analyst at Oanda.

“The energy market has now mostly priced in the coordinated strategic petroleum release and probably was overly pessimistic on how far China would stick to their strict lockdown and isolation measures.”

The Energy Information Administration added more bullish sentiment by lowering its forecast for U.S. crude output growth in 2022 and 2023 as shale producers grapple with higher production and labor costs.

For now, signs of demand destruction remain top of mind for energy traders...

API

-

Crude +7.757mm (+300k exp) - biggest build since March 2021

-

Cushing +375k

-

Gasoline -5.053mm (-800k exp)

-

Distillates -4.961mm (-1.5mm exp)

After last week's surprise crude build, expectations were for another small increase in stocks but instead API reported a huge 7.757mm crude build. This was balanced with major inventory draws in products...

Source: Bloomberg

WTI hovered just below $101 ahead of the API data and shrugged off the big build (offset by product draws we assume)

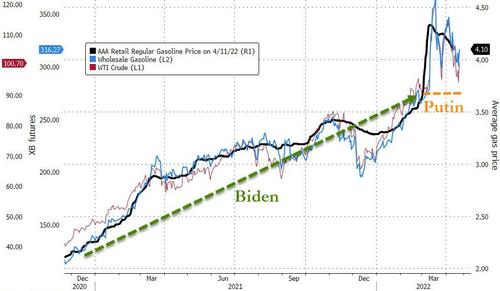

The irony of a 7% surge in oil prices on the day that Biden lifted ethanol restrictions in an effort to lower gas costs for the average joe is not lost on us...

Today's rally in crude suggests the price of gas is unlikely to fall much further for now.

https://ift.tt/viKR1de

from ZeroHedge News https://ift.tt/viKR1de

via IFTTT

0 comments

Post a Comment