Brent Tops $122 After EU Agrees On "Partial" Ban Of Russian Oil

After days of leaks, late on Sunday Bloomberg confirmed that European Union leaders agreed to pursue a partial ban on Russian oil, setting the stage the way for a sixth package of sanctions to punish Russia and its president, Vladimir Putin, for the invasion of Ukraine...

I welcome the #EUCO agreement tonight on oil sanctions against Russia.

— Ursula von der Leyen (@vonderleyen) May 30, 2022

This will effectively cut around 90% of oil imports from Russia to the EU by the end of the year.

... with some member states reportedly already pushing for a seventh EU sanctions package... although considering that Russian oil exports have hit record highs ever since the Ukraine war erupted, one wonders if this round of "sanctions" will be just as worthless as all the previous ones.

Some member states are already pushing for a seventh EU sanctions package.

— Naomi O'Leary (@NaomiOhReally) May 30, 2022

Discussions move tomorrow onto potential global food crisis, and defence.

The sanctions - as previewed last week - would ban the purchase of crude oil and petroleum products from Russia delivered to member states by sea but include a temporary exemption for pipeline crude (at the insistence of Hungary and German), European Council President Charles Michel said late Monday during a summit in Brussels.

“This immediately covers more than 2/3 of oil imports from Russia, cutting a huge source of financing for its war machine,” Michel said in a tweet. “Maximum pressure on Russia to end the war.”

#Unity

— Charles Michel (@eucopresident) May 30, 2022

Agreement to ban export of Russian oil to the EU.

This immediately covers more than 2/3 of oil imports from Russia, cutting a huge source of financing for its war machine.

Maximum pressure on Russia to end the war.

#EUCO

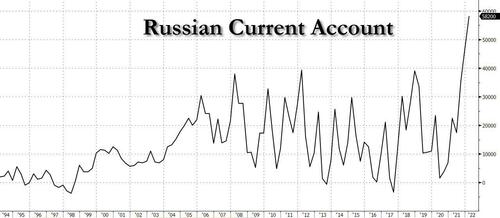

Of course, that's just propaganda for the idiot masses: as we have shown previously, it is thanks to Europe's laughable "sanctions", that Russian oil revenues have soared by 50%, hitting a record high, and sending Russia's current account to all time highs.

Officials and diplomats still have to agree on the technical details and the sanctions must be formally adopted by all 27 nations. As we reported previously, Hungary, which will continue to receive Russian oil via pipeline, had been blocking an embargo for the past month as it sought assurances its energy supplies wouldn’t be disrupted.

Of course, if one actually reads the fine print, the latest round of "sanctions" is even more laughable then the previous ones: the European Commission has proposed to ban crude oil six months from inaction, while refined petroleum products would be halted in eight months, which of course is ridiculous as the Ukraine war will be long over by then. Meanwhile, showing just how turn Europe actually remains, shipments of oil through the giant Druzhba pipeline to central Europe will be spared until a technical solution is found that satisfies the energy needs of Hungary and other landlocked nations.

Seaborne supplies account for about two-thirds of Russian oil imports, and once in place, the measure would cost Putin up to $10 billion a year in lost export revenue, according to Bloomberg calculations. That’s because the ban would force Russia to sell its crude at a discount to Asia, where it’s already changing hands at about $34 a barrel cheaper than the price of Brent futures. Of course, while Russia will quickly compensate for that discount once the price of spot Brent rises by - say - $10, it will be Europeans who end up with exploding gas bills.

The latest "sanctions" package also proposes another softball ban on insurance related to shipping oil to third countries... which is also absolutely toothless as it won’t take effect until six months after the adoption of the measures, from the previously proposed three-month transition. That adds to a longer list of concessions since the proposal was originally put forward by the EU’s executive arm in May, all meant to appease German while appearing to act tough on Russia.

It gets even funnier: some countries will also have a longer transition for the seaborne oil ban. For Bulgaria, a transition period until June or December 2024 is envisioned, while Croatia could get an exemption for imports of vacuum gas oil, which is used to make products including gasoline and butane.

The EU’s efforts to limit price spikes and Russia’s ability to divert its oil exports in the event of a European embargo had already been watered down in earlier negotiation rounds after a plan to ban tankers from transporting oil to third countries was abandoned.

A plan to ban Russians from purchasing real estate in the EU was dropped from the deal, according to a person familiar with the negotiations. Haggling over the terms of the EU’s oil embargo also led other member states to seek exemptions.

Meanwhile, as Europe's revels in the laughable pomp of yet another toothless round of sanctions, Russia - the wolrld's 2nd largest exporter of oil (and perhaps 1st if Saudis are having a bad month), shipped about 720,000 barrels a day of crude to European refineries through its main pipeline to the region last year. That compares with seaborne volumes of 1.57 million barrels a day from its Baltic, Black Sea and Arctic ports.

According to Bloomberg, some of the other measures in the proposed EU sanctions package include:

- Cutting three more Russian banks off the SWIFT international payments system, including Russia’s largest lender Sberbank.

- Banning the ability to provide consulting services to Russian companies and trade in a number of chemicals.

- Sanctioning Alina Kabaeva, a former Olympic gymnast who is “closely associated” with Putin, according to an EU document; and Patriarch Kirill, who heads the Russian Orthodox Church and has been a vocal supporter of the Russian president and the war in Ukraine. Hungary, however, is opposed to sanctioning Kirill, the people said.

- Sanctioning dozens of military personnel, including those deemed responsible for reported war crimes in Bucha, as well as companies providing equipment, supplies and services to the Russian armed forces.

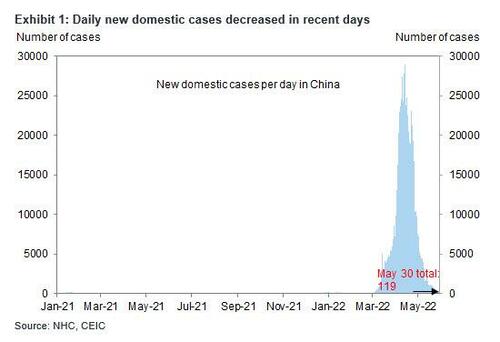

In any case, between Europe's surprising ability to agree on something, even if it is yet another symbolic and theatrical round of "sanctions", and China effectively "defeating" covid over the past week...

... which has resulted in the end of lockdown measures in Shanghai and Beijing, Brent topped $122 and WTI was trading above $117.

One can only imagine where oil would be trading if Biden hadn't taken the political decision to drain the US Strategic Petroleum Reserve just so dems had even a glimmer of a chance come November...

https://ift.tt/IpdE0kq

from ZeroHedge News https://ift.tt/IpdE0kq

via IFTTT

0 comments

Post a Comment