Oil Spikes Near Post-Putin Highs, Gasoline's At Record-Highs Ahead Of Driving Season

President Biden has a problem...

Having admitted in March that actions taken by the United States government “to inflict further pain on [Russia President Vladimir Putin]” would “cost us as well, in the United States," it appears the American public is growing less and less enthralled at the 'cost' of 'democracy' in a country 5700 miles away.

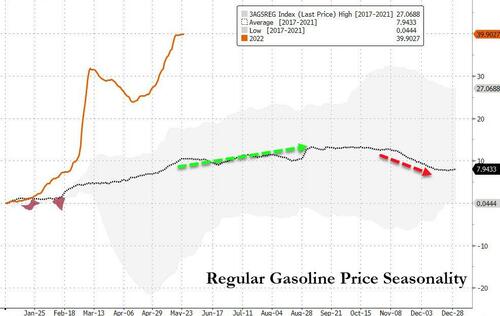

The U.S. driving season is about to begin, and with gasoline prices already at all-time high levels, consumers are increasingly worried about the affordability of one of the most inelastic items every household has to buy.

President Biden's cunning SPR plan has backfired with WTI prices now hitting $115, soaring back towards post-Putin highs as China lockdowns ease and more strategically based on the longer-term under-investment in the energy industry on the back of government regulations and the ESG virtue-signaling debacle...

As Bloomberg reports, the market is crying out for the kinds of crude oils that underpin the two main futures contracts.

Physical traders - especially in Europe - are paying huge premiums to get low-in-sulfur, low-in-density barrels to replace lost supply from Russia. That’s also evident in time-spreads. The most immediate oil futures contracts are now at big premiums to those a month later. It’s a sign, with the northern hemisphere driving season at hand, that traders view the market as tight. US crude futures for immediate delivery traded at about $2.90 a barrel above those for delivery a month later. Brent crude’s equivalent traded as high as $3.20 on Thursday, the highest since March.

To be sure, some of the moves in the futures market are also being driven by lack of participation. Volatility has pushed several traders to the sidelines over the past couple of months.

Volumes this week are also under pressure because of the US Memorial Day holiday weekend and the Queen’s Jubilee celebrations in the UK.

The U.S. driving season is about to begin, and gasoline prices are near all-time high levels... and that means wholesale gasoline prices, and thus pump prices are heading higher...

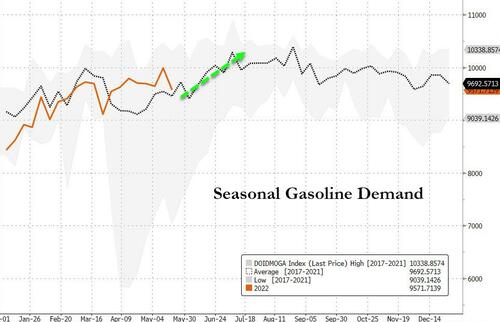

So far there has been no demand destruction, and the start of the summer driving season means demand will rise...

According to Patrick De Haan, head of petroleum analysis for fuel-savings app GasBuddy, we are likely to see “a 7 to 10% rise in gasoline demand today vs week ago as travelers start to hit the road for Memorial Day weekend. Under that would be soft, anything above 15% would be surprising.”

Notably, while much has been made of the rise in wages, the average American worker can now only buy 7 gallons of Regular gas per hour worked (less than half what he could buy in May 2020, and the lowest buying power since 2014)...

And seasonally, pump prices also set to rise further...

Americans seem to be increasingly viewing fighting Russia as not worth the cost Biden mentioned in his March 8 speech. Will many politicians in Washington, DC soon come around as well?

https://ift.tt/cPs9mE0

from ZeroHedge News https://ift.tt/cPs9mE0

via IFTTT

0 comments

Post a Comment