Hedge Fund Billionaire Warns Biden's Green Policies Could Spark "Train Wreck" For Natural Gas

Another US billionaire in the oil/gas industry (or in commodity markets) blamed the Biden administration's energy policies for soaring fuel costs and said it would magnify the current crisis.

John Arnold, former Enron trader and hedge fund manager, known as the "king of natural gas," unleashed a tweetstorm Tuesday directed at Biden for the worsening supply outlook that sent natgas futures to 13-year highs.

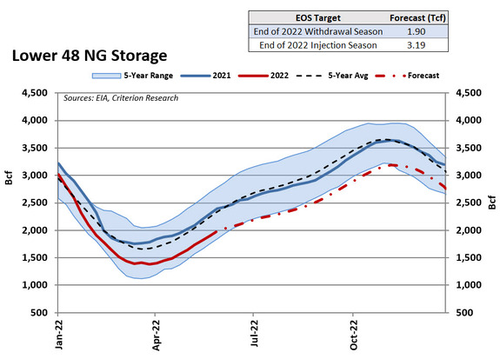

US Natgas supplies are trending below a 5-year mean.

He said the federal government should invoke the Defense Production Act to spur increased production, or prices could rise even more and cause economic turmoil.

Government has invoked the Defense Production Act at least 6 times since 2020 when a shortage has occurred for a strategic product. Natural gas today fits this description. Rather than responding with helpful policies, gov’t helped create the shortage & is making things worse. 1/

— John Arnold (@JohnArnoldFndtn) June 7, 2022

Arnold said natgas prices are up 300%, reaching record highs in shale gas areas, though with a flood in new supplies, regulatory woes have capped growth.

NG prices are up 3x in past year, reaching record highs in the shale gas era. Previously, the market has responded with a flood of new supplies. But the regulatory state has effectively capped growth in the largest and most prolific gas region in the US. 2/

— John Arnold (@JohnArnoldFndtn) June 7, 2022

graph via @sheetalrbn pic.twitter.com/2MiQmwBcfz

He said gas production in Appalachia (Marcellus + Utica) is one-third of US gas production and has massive reserves, though environmental regulations have delayed new pipeline development. "Gas is only useful if it can be piped," he said.

Appalachia (Marcellus + Utica) represents 1/3 of US gas production & huge reserves, but gas is only useful if it can be piped. Takeaway capacity is effectively maxed-out today. The region needs new pipelines, but environmental regs have killed or delayed all 4 recent projects. 3/

— John Arnold (@JohnArnoldFndtn) June 7, 2022

Mountain Valley Pipeline is a 2 bcf/d project taking Marcellus gas to Virginia. It received federal permits in 2017, began construction in 2018, and was expected to come into service in 2019. Despite being 92% complete, numerous court challenges have halted construction. 4/

— John Arnold (@JohnArnoldFndtn) June 7, 2022

Now $3 bln over budget, the pipe will now come on in late 2023 at earliest. But analysts fear it may never be completed and it’s become a financial disaster for the developers. Without new pipe, a region that grew production from 0 to 34 bcf/d in 14 years cannot grow further. 5/

— John Arnold (@JohnArnoldFndtn) June 7, 2022

Adding to the regulator chaos unleashed by the Biden administration to restrict American energy, Arnold points out an NYTimes article explaining how "Biden made it even harder to acquire permits by restoring state and tribal rights to veto energy infrastructure."

"Without the ability to build, demand destruction is the only way to balance the market," he warned. Noting, "if Appalachian supplies have permanently plateaued, we're looking at structurally higher gas prices."

Arnold said soaring natgas prices would "affect utility bills, it raises the costs of most domestic manufacturing, especially intermediate goods like steel, glass, chemicals, fertilizer, & refining."

He then notes the troubling export issues of the US shipping LNG to European countries to help them transition from Russian gas supplies. He said if regulatory hurdles were lifted and new Appalachian production could be piped, then "we can both supply our allies and keep domestic gas prices low. If the most prolific gas field is essentially off-limits for growth, we cannot."

Arnold said Biden's regulatory mess has produced "$5 gasoline, $9 nat gas, $100+ kWh power."

If nothing changes, "this is a train wreck in slow motion," he warned.

The inability to build infrastructure is not due to lack of capital; it’s due to a reg state that makes development very hard. Solving that requires national prioritization. But we’re doing the opposite. Unless something changes soon, this is a train wreck in slow motion. 11/11

— John Arnold (@JohnArnoldFndtn) June 7, 2022

Arnold's tweetstorm comes one day after New York City billionaire and oil refiner John Catsimatidis said Biden needs to "open up the spigots" as Americans are crushed by energy inflation. He also pointed out the president has an "obsession" with hurting America's energy independence, explaining if energy production doesn't increase, the fuel crisis "will worsen."

If Biden doesn't change his energy policies and prices at the pump and power bills and food prices continue to rise ahead of the midterm elections this fall, Republicans could win back the House.

https://ift.tt/zVR3DjK

from ZeroHedge News https://ift.tt/zVR3DjK

via IFTTT

0 comments

Post a Comment