JPMorgan Now Sees Fed Hiking 75bps On Wednesday, Sees "Risk" Of 100bps

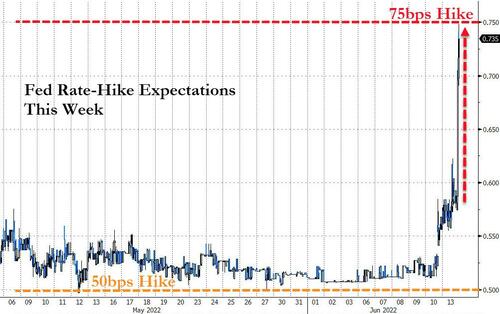

While few on Wall Street took the 75bps hike forecasts by the likes of Barclays, Jefferies and Nomura seriously until this afternoon, all that changed when the WSJ "fed whisperer" floated that a 75bps rate hike is actually all too possible, sending odds of a 75bps hike on Wednesday to a certainty from 35% earlier.

Never one to be ahead of the curve, but also never willing to be too far behind it, moments after the WSJ report, JPM's chief economist Michael Feroli just changed his forecast, and has joined the uberhawkish bandwagon, now also calling for a 75bps rate hike and warning that "the true surprise would actually be hiking 100bp, something we think is a non-trivial risk."

From his note published just ahead of the close:

Two developments since the May CPI report reinforce the case for a more hawkish FOMC meeting on Wednesday, in our view.

First, the startling rise in the longer-term inflation expectations in the University of Michigan’s consumer sentiment survey could imply a higher level of the nominal neutral interest rate. [ZH: something we first discussed last October, in "Fed Losing Control As Consumers' Inflation Expectations Hit New All Time High"; we are happy to see that Wall Street has caught up to us with its usual 6-9 month delay]

Second, according to the WSJ this afternoon, the Committee will not go into tomorrow’s two-day meeting constrained by their previous guidance that a 50bp meeting “would likely be appropriate.”

As such, JPmorgan now looks "for a 75bp hike on Wednesday" and adds that "to the extent today’s report about Fed officials considering “surprising markets with a larger-than-expected 0.75pp interest rate increase” helps reinforce expectations for such a move, one might wonder whether the true surprise would actually be hiking 100bp, something we think is a non-trivial risk." After this week, JPM still looks for two more 50bp hikes in July and September before the Committee slows to a 25bp hike per-meeting pace until reaching terminal funds at 3.25-3.50% early next year.

And while some correctly point out that such an additional 25 bps rate hike will do nothing to inflation near-term, "so the only reason to do 75 bps is "shock" value. Here's the rub: there's lots of "shock" in markets already. Better not to pile it on..."

Lots of people now switching their call to a 75 bps Fed hike this week. That additional 25 bps will do nothing to inflation near-term, so the only reason to do 75 bps is "shock" value. Here's the rub: there's lots of "shock" in markets already. Better not to pile it on... pic.twitter.com/dS4QyU9m7q

— Robin Brooks (@RobinBrooksIIF) June 13, 2022

.... we will counter that the Fed should certainly pile on, because the more shock now, and the faster the Fed crashes global markets and send the global economy into a recession and/or depression, the more the Fed will have to unshock in a few weeks when it realizes the mess it has made, which is also why careers will be made and lost in finance between today and when the Fed taps out in a few weeks, for those who correctly predict the magnitude and timing of what may be the Fed's final dovish relent...

https://ift.tt/uLf6xUO

from ZeroHedge News https://ift.tt/uLf6xUO

via IFTTT

0 comments

Post a Comment