The Handbook For Debt-Soaked Nations: Lie, Print, Inflate, & Finger-Point

Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below we consider the classic (and oh-so predictable) tactics of debt-soaked nations facing a showdown (corner) between tanking markets and ripping inflation.

Ultimately, I see a stagflationary end-game in which both occur, but for the near-term, prepare for more inflation, as it’s the option all debt-soaked sovereigns are eternally forced to take.

The Cruelest Month

T.S. Elliot famously described April as the cruelest month, but the recent (and ever-unfolding) events of May seem far crueler.

As we have warned from the very onset of this otherwise avoidable war in Ukraine, the backfiring of Western sanctions against Putin (de-dollarization, inflationary tailwinds and increasingly discredited central banks) were not only plain to foresee, but placed the West in an almost comical (yet tragic) scenario in which nations like Germany find themselves sending weapons to the Ukraine while simultaneously sending Rubles to Putin.

How did the world become so hypocritical, dishonest, cornered and silly?

(Cold) Economic Realism vs. (Empty) Moral Posturing

As George Washington observed in a 1770’s moment of Realpolitik candor: “Nations have no permanent friends nor permanent enemies, just permanent interests.”

Turning to 2022, the self-interested reality of Western reliance on Russian energy has made their front-page virtue signaling a bit less virtuous…

Such cold realism explains why Italian Prime Minster Draghi realistically confessed as early as May 11 that EU companies could pay for Russian gas in Rubles in the very same week German Chancellor Olaf Scholz realistically opposed any immediate halting of oil imports from Russia.

Meanwhile, by May 12, the headlines revealed that Russian oil revenues had increased YoY by 50% despite the Western “boycott.”

An equally realistic Japan, like Germany, will take its time to phase-out its dependence on Russian energy, as it, like Germany, recognizes that an immediate G-7 boycott of Russian oil and gas amounts to little more than an energy suicide pact.

Nothing But Bad Options for the West

Depending on escalation or de-escalation in the Ukraine, the energy-thirsty nations of the West have to prepare for varying scenarios and solutions, none of which are very good.

There’s even talk of nationalizing energy companies in Germany, which would be painful for the EUR and a tailwind for the USD. Then again, and as warned elsewhere, all failing economic systems inevitably default to more centralized controls/powers.

No shocker there.

Other headline options, of course, include the “taper-talk” of raising rates, inducing a recession and thus crippling demand to fight the inflation which the central banks themselves created yet blame instead (i.e., finger-point) on Covid and Russia.

This horrible QT option would be fatal to debt levels (and hence credit defaults) in debt-soaked countries like Japan and the US.

Most likely, central banks will be forced to return (pivot) to their equally horrible (and inflationary) money printers.

Why?

Because if un-supported bonds crash, yields (and hence rates) rise and debt obligations (i.e., Uncle Sam’s and Wall Street’s IOU’s) become unpayable.

Then it’s party over for the post-08 “everything bubble.”

Full stop.

That, or nations could pursue the option of a complete ban of Russian energy purchases.

But that too would be a direct catalyst to a recession, tanking bonds and, again, would simply require central banks to create even more fiat money out of thin air.

Of course, another option is a peace settlement in Ukraine—which I’ll address when and if that occurs, and it still may.

The Only “Viable Option”? More Fake Money

Based on current conditions, it’s more realistic that Western central banks will be forced in late 2022 to turn to more rather than less money printing to control yields (and rates), which just means more not less inflation, including in oil prices, which ironically, is a tailwind for Putin.

If this QE option becomes real, it will serve as a tailwind for risk assets as well as precious metals and even, perhaps BTC.

Over-Valued Markets Are Reverting

Meanwhile, the former hedge-funder in me can’t help but notice tanking Sharpe ratios and piercing equity support lines.

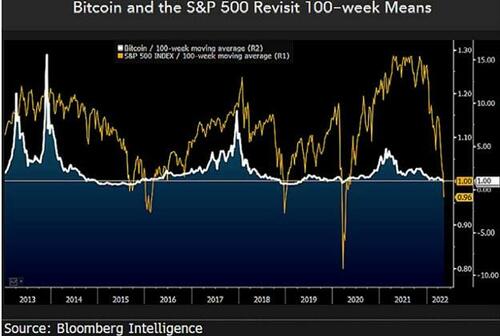

In May, for example, the S&P and BTC were doing what we’ve also been warning—namely reverting to their (crappiest) means and falling below 100 week moving average lines. In short: Scary stuff.

If markets see further tanking, I would (and still do) expect the Fed in particular and other central banks in general to pivot toward more QE.

But what if I’m wrong? That’s certainly possible too.

The Hawkish Option? Could It Work?

If you listen, for example, to squawking heads like Neel Kashkari at the Minnesota Fed, this former super-dove (like Lael Brainard) is now talking full-on hawkish, calling for more rate hikes (i.e., tightening not easing) to strengthen the USD and fight Putin with a stronger currency (i.e., USD) rather than a military gun.

But as I’ve equally warned, such a “Kashkari-like” move just puts a bullet into the heart of a totally Fed-driven US market and economy, neither of which can mathematically survive rising rates when their debt levels outpace GDP levels by well over 100%.

Stated more simply, I just don’t see any good scenarios left for the West, and I see nothing in Kashkari’s (or Brainard’s) QE to QT bravado but more chest-puffing concomitant to genuine brain shrinking.

The West, I’ll repeat, has no good options left.

China In a Pinch

But this by no means suggests that warm and fuzzy nations like Russia or China are skipping, hand-in-hand, through the roses.

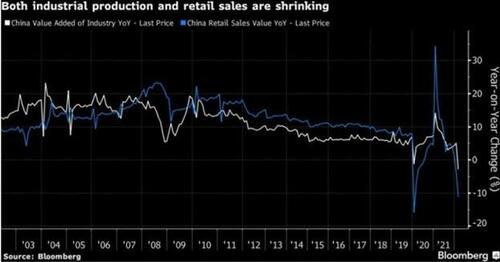

China’s so-called “zero Covid” ruse is nothing more than a classic tyranny lockdown. Now, its Pavlovian-controlled society and economy is feeling the pinch of tanking industrial production and retail sales.

Far more alarming, foreigners have been selling Chinese bonds at a rate of $7B per month, a fact so embarrassing to China that it’s doing what all dictatorships (including the US) do whenever the facts are too bad confess, namely: Stop reporting them.

Needless to say, falling bonds means rising rates for China, and just like the over-indebted nations in the West, China can’t afford rising rates and a stronger CNY.

Thus, it’s likely they too will need to come up with some printed or other money fast to support its unloved bonds.

China: Selling Treasuries to Support Its Own Bonds

One way for China to find quick cash is to sell off chunks of the over $1T in US Treasuries it owns, which would be a real sting to the already fragile U.S. bond market, forcing even more printing from Uncle Sam to “fill the gap” and support UST’s while Beijing tries to support its own CGB’s (Chinese Govt Bonds) with funds once allocated toward Treasuries.

See how the debt merry-go-round in a world of broke sovereign is deeply interconnected, a veritable global ticking timebomb of mutually assured (economic) destruction?

See how more rather than less money printing by just about every major (and bankrupt) sovereign is all but inevitable to pay for unpayable debts?

As the great macro economist, Forest Gump, observed: “Stupid is as stupid does.”

China Holding the US Hostage

And if Chinese bond problems weren’t already scary enough, it’s further worth noting that the Chinese Communist Party is requiring its elites to shed all U.S. assets as a response to the Putin sanctions.

A former official from the People’s Bank of China is already pushing for such a sell-off.

Folks: That’s a very scary threat in a West-vs. East financial war that is heating up as I type this.

Although data out of China is anything but reliable, it’s reasonable to assume that the Chinese own somewhere in the neighborhood of $50T worth of USD assets (as per DTI info recently shared by Luke Gromen).

If such numbers are even half correct, China is essentially holding the U.S. markets hostage.

That is, any potential and major sell-off in USD assets owned by the Chinese would radically alter global capital flows and send already fragile US bonds down, and hence yields and rates up, a domino-effect which crushes markets and economies faster than a knife through butter.

The Worst Macros I’ve Ever Seen

Fluctuating macro risks like these are just beyond anything I’ve seen before.

Wherever I look, from unprecedented debt-soaked cancers, cornered (hubris-infected) central banks and back-firing Western sanctions to financial brinkmanship out of China (and Russia), all I see are credit markets facing a last stand as fatal (and fated) as an overly-arrogant Custer at Little Big Horn.

Given these converging risks, I must again repeat that any Fed tightening into such a perfect debt and liquidity storm seems nothing short of impossible and/or insane.

Bluntly (and I’m always blunt), I see no way around more mouse-click liquidity in the West, and hence more inflationary, currency-debasing policies down the road, which are of course longer-term tailwinds for precious metals and far-sighted gold owners.

Why so certain?

It all boils down to liquidity.

The Realpolitik of Liquidity

In a post-08 and entirely artificially-supported securities market and debt bubble, the only rotten wind beneath the wings of these unprecedented and over-valued asset classes is instant liquidity (i.e., cash flow) created out of thin air by a central bank near you.

Keep in mind, moreover, that every market crisis is at root a liquidity crisis. Everyone. Every time.

And as for liquidity in the U.S., the news is anything but good.

As a recent Bloomberg article revealed, U.S. stock and bond liquidity today is looking as bad as it did in 2020, just before markets tanked and the Fed was forced to print more fiat (i.e., fake) money in one year than in all the QE combined since the Great Financial Crisis of 2008.

At the same time, Venture Capital funds are now finding it harder and harder to raise capital for increasingly un-loved tech start-ups.

Even more alarming, junk bond issuers are seeing less and less takers as investors lose faith in a dying (and drying) bond market.

The CDS Red Flag

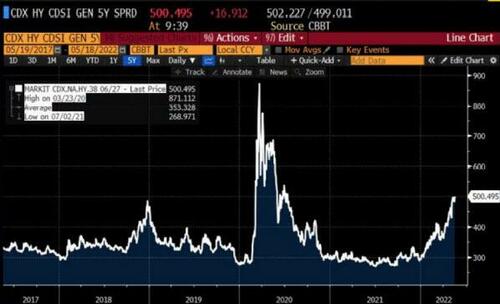

As a result, hedge funds and informed investors are doing today what they were doing just before the 2008 markets tanked, namely: Buying more insurance against tanking credit markets.

This “insurance,” in case you’ve forgotten, comes in the form of what the fancy lads call “Credit Default Swaps,” or “CDS,” and as the chart below confirms, that CDS index is slowly climbing toward 2020 levels:

NO Good Scenarios Left but the Shadow Mandate

As Mohamed El-Erian observed, and as I’ve said above and elsewhere, the Fed simply has no good scenarios left.

It can tighten its monetary policy and send the economy and markets into recessionary tailspin, or it can pivot from QT to more QE and send inflation toward the moon.

Given my strong opinion that the Fed’s true (and shadow) mandate is supporting the bond market rather those ordinary Janes and Joes already drowning under an inflationary flood on Main Street, my opinion is that the Fed will eventually opt toward more inflation (i.e., more “liquidity) rather than allow a tanking US Treasury market.

Furthermore, and as previously stated in prior reports, the Fed, facing the greatest debt burdens in US history, needs inflation as a way of “inflating away” the very debt crisis it created since patient-zero Alan Greenspansat in the Eccles Building.

To repeat: The Fed will publicly claim to combat inflation, while privately seeking more of the same.

Conspiracy Theory or Just Business as Usual?

This may seem like a conspiracy theory to the Fed faithful, but in fact, such veiled yet intentional inflationism is nothing more than a deliberate policy of negative real rates (i.e., inflation outpacing interest rates) which is the oldest trick in the handbook of debt-soaked nations.

In short, one man’s “conspiracy theory,” is nothing more than another nation’s confirmed history of consistently desperate (and pro-inflationary) sovereign monetary policy…

In sum, my view of more QE, more deliberate inflation and more currency-debasement (and hence longer-term gold tailwinds) stems from the lessons of history, the self-interest of Realpolitik and the cold reality of basic bath (i.e., negative real rates).

Somehow, the world still believes in the magical central bank theory of solving a debt crisis with more debt and more printed money.

Insane?

Yep.

As Mark Twain observed, “History may not repeat itself, but it often rhymes.” From where I sit today, there’s a great deal of inflationary “rhyming” all around us.

https://ift.tt/MYh508P

from ZeroHedge News https://ift.tt/MYh508P

via IFTTT

0 comments

Post a Comment