WTI Holds At Day's Low After Crude Inventory Draw

Oil prices pumped (after OPEC+ rejected WSJ's comments on Russia yesterday and cut its estimate for global year-end over-supply) and dumped to end the day near their lows after the Biden administration said it still hopes to engage with Saudi Arabia. Markets took the headline as a concrete step by the administration to actively fight energy costs, traders said.

“Meaningful progress probably takes time to come to fruition but headlines around progress will keep some sort of a governor on crude rallies,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management

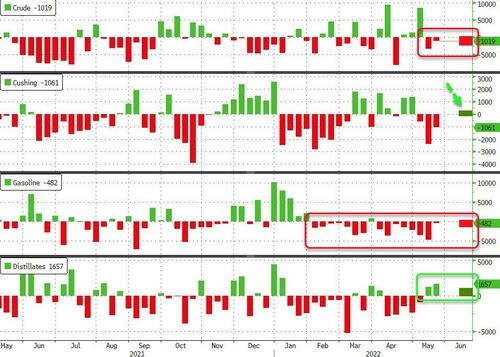

Traders were predicting a drop in crude oil inventories, but an increase in gasoline and distillate stockpiles.

API

-

Crude -1.181mm (-67k exp)

-

Cushing +177k

-

Gasoline -256k

-

Distillates +858k

US crude stocks fell for the 3rd straight week, with a bigger than expected draw last week. Interestingly,. Distillates saw their 3rd straight weekly build...

Source: Bloomberg

WTI was hovering around $114.75 ahead of the API print, unchanged on the day and didn't move after the data hit.

“Oil markets are a dead cert to tighten further following EU’s ban on Russian oil,” PVM Oil Associates analyst Stephen Brennock said in a note.

“This, in turn, should ensure further upside in oil prices in the second half of this year. The Russian oil embargo is finally over the line, but more price pain is on the horizon for the EU and its Western partners”

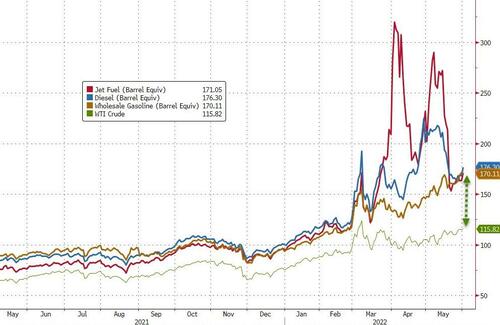

The 3-2-1 crack, which approximates turning crude into gasoline and diesel, soared to a new record high of $55.26 today...

As Bloomberg's Javier Blas noted earlier this suggests the refined products markets continue to lead (where's the demand destruction?), encouraging higher refinery runs.

Additionally, Dennis Kissler, senior vice president of trading at BOK Financial said that “the fuel fundamentals of diesel and gasoline is whats going to keep crude supported at least into the driving season of July and that’s the major catalyst for crude."

https://ift.tt/JUFfX8u

from ZeroHedge News https://ift.tt/JUFfX8u

via IFTTT

0 comments

Post a Comment