Money Does Matter: The End Of The Gold Standard Led To A Lower Standard Of Living

Authored by André Marques via The Mises Institute,

On August 15, 1971, Richard Nixon announced that the US dollar (USD) would no longer be redeemable in gold. This was supposed to be temporary. And yet, fifty-one years later, here we are. The gold standard was gradually destroyed in the twentieth century.

Now people are experiencing the consequences: less purchasing power, more economic cycles, and a weaker economy.

In the chapter 4 of his book What Has Government Done to Our Money?, Murray Rothbard goes over the steps the government took to end the gold standard over the twentieth century, from the end of the classical gold standard to the closing of the gold window in 1971.

The Classical Gold Standard (1815–1914)

The classical gold standard tended to prevent the government from running budget deficits and going into debt, as it could not easily create inflation. In 1913, the Federal Reserve (Fed) was born. When the US entered the World War I, US dollars were printed at an excess of the gold reserves. At this point, the US got off the classical gold standard and this money printing contributed to the depression of 1920–21.

The Gold Exchange Standard (1926–31)

In this regime, the USD and the pound sterling (GBP) were the two currencies of reference (“key currencies”). The US went back to the classical gold standard (converting USD into gold). GBP and other currencies were not convertible into gold (except for large bars). The Great Britain converted GBP to USD and the other European countries converted their currencies to GBP. So, the Great Britain inflated GBP and the other European countries did the same with their respective currencies (a “pyramiding” of GBP on USD and of other European currencies on GBP). Consequently, as Rothbard stated:

Britain and Europe were permitted to inflate unchecked, and British deficits could pile up unrestrained by the market discipline of the gold standard…. Britain was able to induce the United States to inflate dollars so as not to lose many dollar reserves or gold to the United States. As sterling balances piled up in France, the United States, and elsewhere, the slightest loss of confidence in the … inflationary structure was bound to lead to general collapse. This is precisely what happened in 1931; the failure of inflated banks throughout Europe, and the attempt of “hard money” France to cash in its sterling balances for gold, led Britain to go off the gold standard completely. Britain was soon followed by the other countries of Europe.

Fluctuating Fiat Currencies (1931–45)

In 1933–34 the US abandoned the classical gold standard once again. The USD was defined as 1/35 of an ounce of gold and only foreign governments and central banks could convert it into gold. So, there was a certain link to gold, but the US was in a floating exchange rate regime. As Rothbard stated, by cutting the ties to gold, this regime

leave[s] the absolute control of each national currency in the hands of its … government [which can] allow its currency to fluctuate freely with respect to all other fiat currencies … [The flaw] is to hand total control of the money supply to [the government], and then to … expect that it will refrain from using that power.

the disastrous experience of … the 1930s world of fiat paper and economic warfare, led the United States authorities to [aim] the restoration of a viable international monetary order

Bretton Woods and the New Gold Exchange Standard (1945–68)

Thus, enter the Bretton Woods system (conceived and implemented by the US at a conference in Bretton Woods, New Hampshire in 1944, and ratified by the US Congress in 1945). It was similar to the gold exchange standard, but with the USD being the only “key currency,” priced at $35 an ounce of gold and being redeemable in gold only by foreign governments and central banks.

However, this system eventually met its end. The US inflated the USD (“pyramided” it on its gold reserves), and other governments held USD as their reserves and “pyramided” their currencies on those dollars. And throughout the 1960s, the US constantly inflated the dollar in absolute terms and relative to Europe and Japan. This decade was marked by the “War on Poverty,” the Vietnam War, and space programs.

To finance all this, the US started running large budget deficits, with the Fed monetizing the debt (expanding the money supply). However, the Western European countries that had adopted more solid monetary policies (Western Germany, Switzerland, France and Italy), started to oppose the obligation to accumulate dollars. Europe began to redeem dollars in gold, and the Bretton Woods system began to collapse in 1968 (ending in 1971, when Nixon suspended the redemption of the USD in gold).

The Closing of the Gold Window and the Rise of the Floating Exchange Rate Regime (1971–?)

In order to keep the redemption of the USD in gold, the US government had two options:

-

Cut spending and taxes to reduce the budget deficit. The supply of money would decrease, and the USD would appreciate, which would allow prices to fall to levels that would be consistent with an ounce of gold at $35 and restore demand for the currency.

-

Dollar devaluation. This would mean that the price of an ounce of gold would have to rise to a level that would be consistent with the supply of USD and the higher prices for goods and services. But this would require the government to reduce the budget deficit to prevent future devaluations.

Both options were inconvenient for the government. Thus, in February 1973, after two devaluations of the USD that raised the price of an ounce of gold to $42.22, the closing of the gold window became permanent. Therefore, the USD returned to the floating exchange rate regime (as in 1931–45, but with no link to gold).

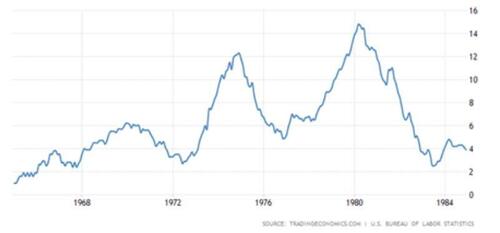

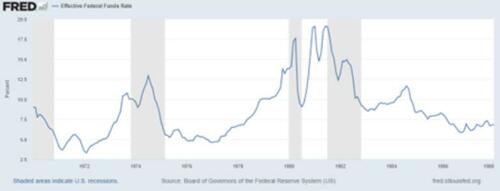

As a result, the USD devalued and the 1970s were marked by stagflation. In 1980, the price of an ounce of gold was $850. The price of oil rose from just under $3 a barrel in 1970 to just under $40 in 1980. The Consumer Price Index (CPI) was over 14 percent in 1980 (chart 1). It was only in the early 1980s that the CPI began to decline, when Paul Volcker, Fed chairman at the time, raised the federal funds rate to almost 20 percent (chart 2).

Chart 1: Consumer Price Index (1965–85)

Source: Trading Economics; author’s own elaboration.

Chart 2: Federal Funds Rate (1970–88)

Source: FRED; author’s own elaboration.

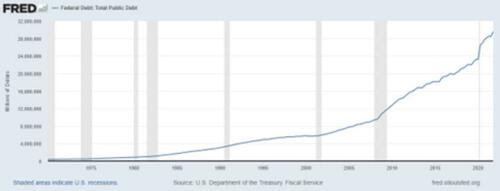

However, in 1980, the US federal debt was “only” $930.2 billion (chart 3). Thus, it was possible to significantly increase interest rates without causing major impacts on the economy. Today, the federal debt is above $30.5 trillion. The Fed can’t raise rates without crashing the economy. The US has gone from being the world’s biggest creditor in the early 1970s to the world’s biggest debtor today (the US has more debt than all other governments in the world combined).

Chart 3: Federal Debt for the United States (1970–2021)

Source: FRED; author’s own elaboration.

As the federal funds rate rose, the USD appreciated and there was a restoration of confidence in the currency. This (along with the fact that the US dollar was already the currency in which oil and other commodities were priced) allowed the USD to remain the main world reserve currency. And this, along with the fact that the USD has been unbacked since 1971, has allowed the US to inflate it over time, destroying its value. As of August 3, 2022, the ounce of gold costs $1765:

Chart 4: Price of Gold (In US Dollars)

Price of 1 Kg - 1Kg = 2.20462 Pounds (Left Axis); Price of an Ounce (Right Axis).

Source: goldprice.org; author’s own elaboration.

Conclusion

The consequences of the end of the gold standard began to be felt in the 1970s.

The devaluation of the USD substantially reduced Americans’ real wages.

Before 1970, usually only one member of a family was able to support it.

From the 1970s onwards, this began to change to the point where today this is only possible for wealthier people. Despite all the technological advancements, the standard of living today is lower than in the 1950s and the 1960s, as today, in order to live and to buy things they want or need, people need to work a lot more (and even go into debt).

If the USD had not been devalued since 1913 (or even if it had been appreciated, which is what tends to occur when there is no monetary expansion), the standard of living would be much higher today.

https://ift.tt/mDy27H6

from ZeroHedge News https://ift.tt/mDy27H6

via IFTTT

0 comments

Post a Comment