Peter Schiff: Washington Goes Full Orwellian

An audacious communications campaign from Democrats in Washington is currently underway that is attempting to convince the public that:

As strange as these claims sound to anyone with even the most casual grasp of reality, it is a testament to the post-factual world we now occupy that the Biden Administration is able to attempt, let alone succeed in, putting out such monumental fantasies.

The campaign began late in July when the Biden team attempted to redefine the word “recession.” While the left has always tried to redefine words (think “racism” or “gender”), it has never attempted it so spontaneously with such a technical definition. Typically, they let new definitions germinate in academia or policy think tanks before trotting them out for public consumption. That was the playbook that helped change the meaning of the word “inflation” (from its original understanding as an expansion of the money supply, to its current definition tied solely to rising prices). But the inflation campaign unfolded over decades and did not require the public to completely surrender its critical capacities.

I’ve been publicly commenting and writing about the economy for almost 30 years (and talking about it for essentially my entire six decades on the planet). Over that time, the technical definition of “recession” has never been in dispute. Of course, I’ve had many arguments over what caused any given recession, why recessions may be necessary to purge an economy from excesses and malinvestments caused by artificially low interest rates, what government responses should be to recessions, or why things were better or worse than a particular political party claimed them to be. But in that time, I never encountered anyone who quibbled with the accepted technical definition of “recession” as two consecutive quarters of negative GDP growth. What would be the point? Recessions affected both political parties. Why change a definition when the original definition may suit you down the road?

But that’s what the Biden Administration did when they claimed that the Second Quarter GDP Report, which showed a .9% annualized decline in GDP, following a 1.6% annualized decline in the First Quarter (Bureau of Economic Analysis), did not mean we were in a recession.

What? That’s been the textbook definition for…like forever. If Biden wanted to put a happy spin on the data, which is what sitting Presidents do, he could have said, “while technically it’s a recession, the current period shows many signs of strength that are not typical in recessions, leading us to believe we are in much better shape than the GDP headlines suggest, and that the recession will be shallow and over quickly.” I would have disagreed with that, but it’s fair game. But his approach wasn’t just to move the goalposts, it was to take them down entirely.

What’s even worse is that the very next day after the Biden Administration first floated its idea that “two negative quarters are not a recession,” the point was repeated by Fed Chairman Jerome Powell at his FOMC press conference on July 27. If nothing else, this proves just how ridiculous claims of “Fed independence” have been over the years. Economists like to claim that the Fed acts independent of political control. Would they have us believe the Fed spontaneously changed its definition of recession precisely after the administration did? Clearly, the Fed is taking its marching orders from the White House.

The sad part is that outside the typical sources of right-of-center news, the media just ran with the new definition. My favorite was the Associated Press headline that ran after the GDP numbers were announced, “U.S. Economy Shrinks for a Second Quarter, Raising Recession Fear.” (7/28/22) Up until two seconds ago that would have been reported as the official start of a recession, not something that would simply “raise fears,” of a future eventuality. This redefinition of terms would have been impossible when journalistic standards were higher and institutional memory more entrenched.

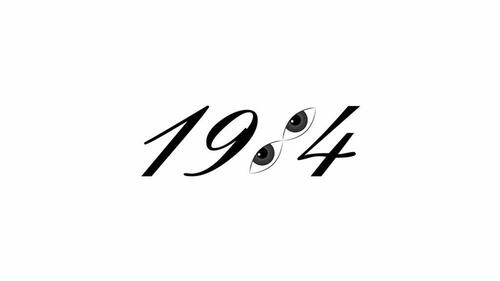

In George Orwell’s 1984, the totalitarian State of Oceania, where the action takes place, is always at war with another empire. Sometimes against Eurasia, and sometimes against Eastasia. But when the antagonists switched positions, as they often did, it served the government’s interest that the public forget that any other enemy ever existed. It required citizens to say, “We have always been at war with Eurasia,” even if that war just started yesterday. In the same vein, a recession has never been defined as two consecutive quarters of negative growth!

Following up on this easy rhetorical victory, the Biden team decided to keep the ball rolling by claiming that there was “zero inflation in America in July.” That may come as a surprise to a select group of Americans, say those who have shopped at stores in the past month, but the claim went largely uncriticized in the press.

To tell this whopper, Biden had to talk only about month-over-month inflation, and ignore the year-over-year data, which still shows a hefty 8.5% inflation rate in July (down slightly from the prior month). (U.S. Bureau of Labor Statistics) In all my years following economic news, I can say with extreme certainty that I never saw anyone hold up a month-over-month number as proof of anything. So yes, gas prices came down in July, possibly as a result of the release of millions of barrels of oil in the U.S. Strategic Reserve (though food, rent, and service prices continued their relentless rise). But oil prices could very well be up in September. Should we expect Biden to place great weight on that eventuality as well? Don’t hold your breath. In reality, after so many months of blistering price increases, a cooler month should be expected. The trend lines remain unbroken.

This “zero inflation” claim, repeated by Administration spokespeople dozens of times, is the kind of huge lie that would have elicited waves of head-smacking coverage during the Trump Administration. But Biden is getting a pass, he’s even being congratulated for his rhetorical boldness and courage in standing up to the “right-wing spin machine.”

But the best piece of doublethink comes with the Democratic Party’s passage of the 2022 “Inflation Reduction Act.” In the long history of misnamed pieces of legislation, this title might be the most egregious. Nothing in the gargantuan Bill was conceived with the aim of reducing inflation and nothing in the Bill will actually accomplish that goal. In truth, many of the plan’s provisions will make inflation even worse.

On some level, you must admire the audacity. The Democrats took a bunch of terrible ideas that they couldn’t pass in the Build Back Better Bill (either in the original $3 trillion version or the slimmed down $1.3 trillion version) and jammed it into a new package which they rebranded the Inflation Reduction Act. It didn’t bother them that all the elements of the Bill were conceived before inflation was considered a major national priority and were not designed with inflation reduction in mind. They know that inflation is a high priority to voters, so they want to look like they are doing something about it.

The Bill, which will pass both Congressional houses without a single Republican vote, proposes $764 billion of new revenue (including new taxes and greater enforcement of existing tax law, and savings resulting from lower prescription drug prices paid by Medicare) and $517 billion in new spending, with the difference going toward Federal deficit reduction. Unfortunately, the variety of healthcare, environmental and social welfare spending, combined with new taxes and beefed-up IRS enforcement, will hamstring the country’s economic vitality, and tend to increase both budget deficits and inflation. And as a result, the plan will do far more harm than good. Let’s look at the contents:

The Bill looks to raise revenue by:

$265 Billion – Allowing Medicare more leverage in negotiating lower drug prices paid to pharmaceutical companies. This is the government’s primary example of the Bill’s anti-inflationary bona fides as it intends to lower costs for consumers. But this type of price control has a very poor track record in fighting inflation. The government will mandate lower prices, which may limit supply of current drugs and discourage the research and development of new drugs. The savings will likely be far smaller than the government expects.

$222 Billion – Minimum 15% corporate tax for companies with more than $1 billion in annual income. As with all such provisions, this policy does not take into account how corporations will alter their structures and practices to avoid the tax. As a result, the take will be lower than the government expects. Also, companies will deal with higher tax and accounting burdens by reducing output, raising prices, and cutting salaries. This is not anti-inflationary. Worse, money that is paid in taxes is not available to finance capital investment. The result will be a reduction in supply, putting greater upward pressure on prices.

$204 Billion – Increased tax revenue through greater enforcement. – This is the most controversial aspect of the Bill. This nightmarish provision more than doubles the size of the Internal Revenue Service and adds 87,000 new agents specifically to increase the number of taxpayer audits. While the Biden administration is pretending that the agents will only go after the ultra-wealthy and the large corporations (who are limited in number and who can afford to hire accountants and lawyers), in truth the typical target will likely be small businesses and members of the burgeoning “gig” economy. The added fear of IRS scrutiny will cause these business owners to spend more time and money on accounting and legal fees, devote less time and money into growing their businesses, and invest less in increasing capacity. All of this will cut into output and profits, thereby putting upward pressure on prices and downward pressure on wages. This will not help curb inflation.

$74 billion – Imposition of a 1% excise tax on stock share buybacks. This provision is likely the least destructive of the revenue provisions, but it will do nothing to lower inflation. However, any money a corporation pays in taxes is money it no longer has for capital investment. So, this reduces supply, the opposite of what is needed to fight inflation.

The Bill will spend new money on:

$369 Billion – Energy Security and Climate Change – This is the boondoggle portion of the Bill where the government will shower funding on a variety of Democrats’ Climate Change pet projects. My feeling is that most of these investments will be on inefficient energy sources that the public doesn’t want, and which are unable to meet our energy needs. While the Bill does have a few provisions that will encourage domestic fossil fuel production, most of these programs will mandate the use of more expensive and less efficient energy. Misallocation of resources will make inflation worse by limiting the supply of energy and increasing its cost.

$64 Billion – A three-year extension on subsidies for Affordable Care Act health insurance premiums. Originally offered through the 2021 Covid-inspired American Rescue Plan, this extension is just another step backwards toward a permanent entitlement of subsidized health care. This will do nothing to actually lower the cost of health care, but simply change who gets the bill. It is not anti-inflationary. If anything, it will have the opposite effect, as the more involved government gets into any industry, the less efficient it becomes, and increasing the cost of its goods or services.

$80 billion on IRS Funding – This is the spending that will supposedly enable the government to collect $200 billion in revenue, so the net benefit to the Treasury is $120 billion. But the government will be spending real money to go after hoped-for money. The resulting numbers may be far less equitable for the government and provide massive anxiety to taxpayers.

So, there you have it, the government apparently takes inflation head-on. Except that it doesn’t. The best way to fight inflation is to reduce government spending, thereby leaving more investment capital in the private sector, and to reduce regulations, allowing businesses to increase the supply of goods and services so that prices can fall.

Instead, we are currently in an environment where government policies are artificially suppressing labor force participation and piling new taxes and regulation on businesses, all the while keeping the floodgates of fiscal stimulus wide open. This is a recipe for higher, not lower, prices.

It is not accidental that earlier this month the Labor Department reported that worker productivity fell 2.5% from a year earlier, the largest yearly decline since 1948. At the same time, despite deceptively low rates of unemployment, the actual number of people in the labor force continues to shrink. These trends come as a direct result of misguided government policies and regulations that disincentivize work and increase the burdens on business. A shrinking and less productive labor force does not lead to the expansion of the supply of goods and services needed to bring down inflation. The provisions in the Bill will add to these inflationary problems.

Also, the continuation of deficit spending far more than pre-pandemic levels means the Fed will come under increased political pressure to monetize the shortfall. That pressure will become particularly intense once the recession we are pretending does not exist gets much worse. Since quantitative easing is just a euphemism for inflation, a bill to increase deficit spending is a bill to increase inflation.

Given the drift of the data and of government messages, I wouldn’t be surprised if we are soon told that any “quantitative” attempt to measure inflation is misguided, and that the phenomenon can only be understood in qualitative subjective terms. How we feel about the products and services we are buying means far more than what we are actually paying. Just wait, it’s going to happen.

* * *

To order your copy of Peter Schiff’s latest book, The Real Crash (Fully Revised and Updated): America’s Coming Bankruptcy – How to Save Yourself and Your Country, click here. For an in-depth analysis of this and other investment topics, subscribe to Peter Schiff’s Global Investor newsletter. CLICK HERE for your free subscription.

https://ift.tt/hBPeEI4

from ZeroHedge News https://ift.tt/hBPeEI4

via IFTTT

0 comments

Post a Comment