Buying Or Renting? The Old Question Is Back

Op-ed by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Every young person moving into adulthood faces the great question of whether to buy or rent their primary residence. That question just became much more complicated.

The ratio between the two just expanded to the greatest gap since 2008, and it does not favor buying. Mortgage rates have made buying completely unaffordable even for those who can get a mortgage. That’s why housing demand has suddenly fallen off a cliff.

The Mortgage Bankers Association reports that before lockdowns, median mortgage payments and asking rents were equal at $1,200. The choice was really about making the best choice to fit with career plans and duration of residency. Since lockdowns, rents have risen 10 percent to $1,314 while mortgage payments have risen 58 percent to $1,893. Now it is a different matter. It is about figuring out how to avoid being pillaged.

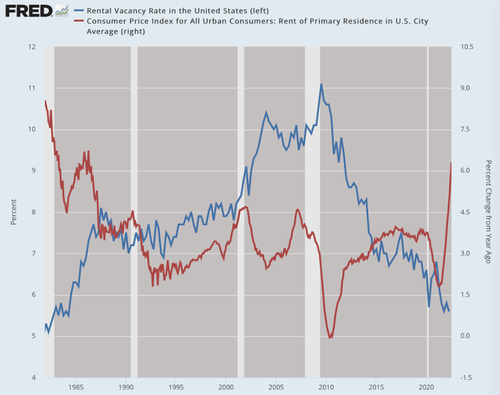

Maybe the answer seems to favor renting. But not so fast: rental vacancies are now lower as a percentage of overall units on the market than they have been since 1983. That means it’s not so easy to get a place to live. The sheer number of applications means that renters can be extremely fussy about whom they accept or reject. A sketchy job history, an uncertain living situation, a ding on your credit report can all lead to a turndown. Plus the terms can be egregious: long leases, huge upfront payments, and strict terms for breaking them.

Meanwhile, we’ve not seen this much upward price pressure on rents in nearly 40 years.

But put yourself out there in the home-buyer’s market and prepare yourself for sticker shock. The median home price has doubled since 2007. And it’s not just the price of homes. It’s the stringent credit conditions plus stunning mortgage rates that mean paying far more for far less. Once you add in the homeowners association fees, plus property taxes, it starts to feel utterly crazy, to say nothing of maintenance.

Just since January, the number of homes sold in the United States has fallen 26 percent. One might suppose that this would lead to dramatic downward price pressure. But that’s not what happened in an economy with unrelenting currency devaluation. Prices have softened, to be sure, but we won’t see a crash like 2008. That’s because the purchasing power of money in general is falling.

The inflation virus strikes in ways that are impossible to predict. Housing has cooled and so has jet fuel. There are no bargains in housing but you can fly coast to coast now for about $150. September flights from New York to Miami are at rock-bottom prices not seen in decades. This is because airlines have so tightly managed bookings that even small changes in consumer demand reflect very quickly in wonderful bargains.

So while the flights are cheap, the hotels, food, and entertainment once you get to your destination are not. And this is why so many consumers today are rethinking travel plans.

But staying home is no great shakes either because electricity and other utility bills are right now absorbing the highest levels of inflationary energy. Real-time year-over-year increases are running 14.6 percent. Those prices hit renters and buyers equally.

So much for the old saw that buying a home is an investment while renting is just throwing money away. In today’s market, the opposite seems true. The more you save by renting instead of buying is money that you can invest.

Of course it would be nice to have a good investment at hand. Nearly half of American households have nothing left after paying the bills for investment. Saving rates keep falling and have hit 5 percent. And credit card debt is rising. Among those who can afford to invest, getting a return above inflation is nearly impossible.

The Fed seems determined to deliver unrelenting bad news to the stock market, even regarding bear markets as a sign of success. This is because current Fed policy isn’t really about sponging up the liquidity it dumped by the many trillions during 2020 and 2021.

Instead it is about cooling off economic output, which these aging Keynesians believe bears the main responsibility for inflation. That means orchestrating something approximating a recession. The White House is on notice that this is happening and is preparing every manner of messaging to get people not to notice that they are getting poorer by the day.

Meanwhile, the latest employment report offers only more confusion. More jobs, yes, but labor force participation is still stuck far below pre-lockdown levels. Worker to population levels are the same. The unemployment rate is ticking up, nowhere near alarming levels but the trend is only going to get worse over the months as we all settle into the reality that the recession is real.

Indeed, as I’ve argued, the recession never really went away!

Read more here...

https://ift.tt/cbYHxq0

from ZeroHedge News https://ift.tt/cbYHxq0

via IFTTT

0 comments

Post a Comment