Dead-Cat-Bounce Finds Extra Life With Late-Day Panic-Buying

After yesterday's bloodbath, there was some hope for bounce overnight, but sellers pressured each dead-cat-bounce and PPI didn't have enough juice to spark any panic-buying from algos (or manufacture a gamma squeeze) until the last few minutes.

We saw a big appear as Europe's cash markets opened (but that faded into the early US session). Then we saw some chaotic trading after PPI and the US cash open which lifted stocks (Nasdaq was up 1% around the European close), but that all went sideways in the afternoon with the S&P, Dow, and Russell 2000 all into the red. Then, with about 15 minutes left in the day, everything was panic-bid lifting the S&P and Small Caps green (with Nasdaq leading) while The Dowdesperately clung to unchanged...

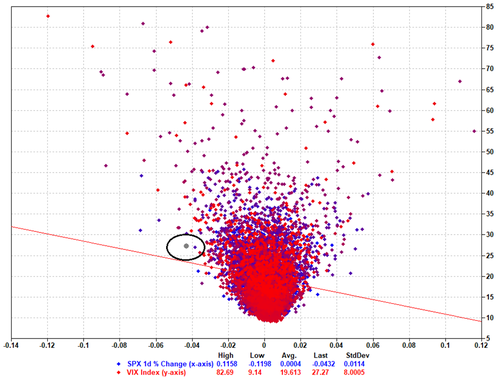

And before we leave equity land, one thing that got a lot people's attention yesterday was VIX.

Yesterday was the first time in history that the S&P sold off more than -4% and the VIX closed below 30 as can be seen in the chart below from Lee Coppersmith...

However, we suspect the lack of huge spike in VIX was due to the massive call-buying that occurred in the 24-36 hours ahead of the CPI Print (which pushed VIX up alongside stocks). So, when the unexpected collapse happened, those aggressive call-buyers turned sellers and provided some pressure downwards on implied volatility...

Source: Bloomberg

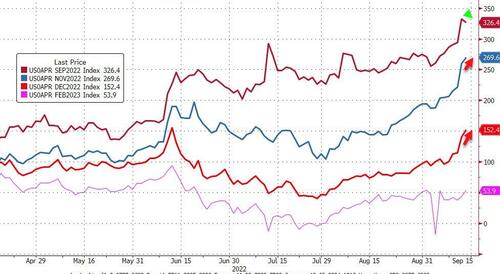

On the rates side of the market, expectations for a 100bps hike in September slipped modestly (now 26%) while the odds of a 75bps hike in November rose to 70% (and 50% chance of 50bps in December too)...

Source: Bloomberg

Overall, the market is pricing in a 'tighter' Fed but we note that while The Fed's terminal rate has soared, so has the belief that The Fed will slash rates soon after - presumably in the face of the recession they induce...

Source: Bloomberg

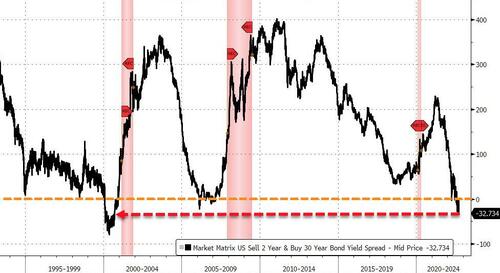

Treasury yields were mixed today - after yesterday's bloodbath - with long-end yields dropping almost 3bps (erasing yesterday's spike) while the short-end yields jumped further (2Y +3bps)...

Source: Bloomberg

All of which flattened the yield curve to its most inverted since 2000...

Source: Bloomberg

The dollar faded back very modestly from yesterday's spike...

Source: Bloomberg

Gold extended yesterday's losses - tumbling back below $1700 spot. Will we bounce again this time?

Source: Bloomberg

WTI Crude rallied up to $90 intraday before fading back...

Finally, as Charlie McElligott warned earlier, an impulsive surge higher in “Real Rates” means a rate-of-change shock in the “Cost of Capital,” and that risks slamming the brakes on the US economy via punitive borrowing costs on both Corporates and Consumers, which spills over into lower demand for goods and services...

All of which means equities face a valuation 'death blow' from the double-whammy of multiple destruction (from higher rates), AND lower earnings (from economic slowdown).

Source: Bloomberg

And tonight is Ethereum's 'Merge' and who knows what will happen to the price of the second largest cryptocurrency. Today saw it stabilize around $1600 after yesterday's crypto carnage...

Source: Bloomberg

Is the Merge a 'sell the news' event or the start of a new adoption path?

https://ift.tt/kV4Le6t

from ZeroHedge News https://ift.tt/kV4Le6t

via IFTTT

0 comments

Post a Comment