Hedge Fund CIO: "Illiquidity Is The New Leverage And Flows Are More Important Than Fundamentals"

By Eric Peters, CIO of One River Asset Management

La Haine

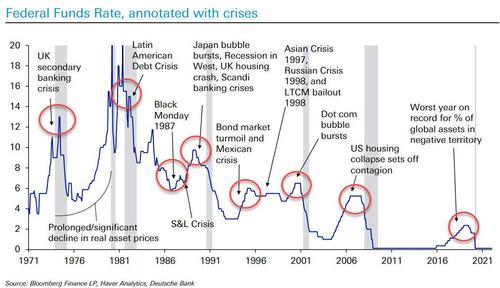

"Illiquidity is the new leverage and flows are more important than fundamentals,” said the CIO, one of our industry’s great thinkers. “This has been our framework for considering vulnerabilities in the post-2008 world,” he said. “Following the GFC, an intended consequence of successive rounds of quantitative easing was a shift of systemic risk from banks to the asset management industry,” he explained, the Fed’s $9trln balance sheet now bloated beyond comprehension, quantitative tightening accelerating, rates rising at an unprecedented pace.

"Asset managers do not have flexible balance sheets -- they buy assets when they get inflows and sell assets when they have outflows," continued the CIO, sitting high atop a prodigious pile, amassed through decades of navigating monetary mischief, financial crises, bull markets, bears. “For over a decade, QE expanded balance sheets and asset managers have only experienced inflows. In contrast, banks - if they have sufficient capital - can take on risk when others are selling assets. They can choose to flex their balance sheets."

"This shift of fragility from leverage in banks to liquidity in asset managers has occurred in tandem with a move to higher allocations to risky assets because of very low, or negative, interest rates," continued the CIO. “Now, central banks are fighting an inflation problem they underestimated. They are forced to sharply tighten monetary policy and need to tighten financial conditions in the form of falling asset prices. The key is that the process be orderly, which it has been thus far. No dislocation yet. So far, so good."

“The first half of 2022 was a discount rate shock,” he said. “From here, as short rates march higher, investors will allocate away from risky and into risk-free assets.” Outflows expose the liquidity mismatch between the liquidity terms offered to the investor and the actual liquidity of the underlying investments. “The authorities and markets implicitly assume liquidity is plentiful and market behavior will remain orderly. We have been questioning that assumption and examining what might cause a disorderly liquidation?”

“I think we see the answer,” said the CIO in response to his own question. “The liquidity available to financial markets is being pincered between the forces of:

- the Federal Reserve’s Reverse Repo Facility (RRP) facility, its interaction with central bank reserves and the level of interest rates,

- the inflating nominal economy’s need for more of the commercial banks’ aggregate balance sheet, and

- the reticence of commercial banks to expand their balance sheets because of regulatory pressure on them to be crisis proof in the face of an oncoming hurricane.”

“And these liquidity pressures are weaponized by poor trailing 6-month portfolio performance and rising real rates, creating a genuine threat that we may be on the brink of The Great Liquidation,” explained the CIO.

“La Haine is a French film,” he said, translating a passage for his unsophisticated American friend. “In it, a man falls from a 50-story building. The chap, as he falls, repeats something to himself constantly for reassurance: ‘So far so good… So far so good… So far so good.’ But the important thing is not the fall. It’s the landing.”

https://ift.tt/FfytXSv

from ZeroHedge News https://ift.tt/FfytXSv

via IFTTT

0 comments

Post a Comment