Here Comes Part Two Of Morgan Stanley's "Fire and Ice"

From Michael Wilson, Morgan Stanley chief US strategist

Fire and Ice Part Deux

At the risk of stating the obvious, 2022 has been a challenging year for stock investors of all stripes. The Russell 3000 is down approximately 16% (total return) year to date (YTD), and while Russell 3000 Growth has underperformed significantly (-22%), it’s been no picnic for value investors either (-9%). Only Energy and Utilities are up, and just 24% of all stocks in the Russell 3000 are in positive territory for the year. To put that into context, in 2008 48% of Russell 3000 stocks were up on the year as we entered the month of September. Suffice it to say, this year has been historically bad for stocks, but that is not a sufficient reason to be bullish.

As bad as it’s been for stocks, it’s been even worse for bonds on a risk-adjusted basis. More specifically, 20-year Treasury bonds are down 24% YTD and the Barclays AGG index is off by 11%. Finally, commodities have been a mixed bag too, with most commodities down on the year despite heightened inflationary concerns. To wit, the CRB RIND index, which measures the spot prices of a wide range of commodities, is down 7% YTD. Cash, on the other hand, is no longer trash, especially if one has been able to take advantage of higher front-end rates.

So, what’s going on? In our view, asset markets are behaving right in line with the fire and ice narrative we laid out a year ago. In short, after ignoring the warning signs from inflation last year, and thinking the Fed would ignore them forever, asset markets quickly woke up and discounted the Fed’s late but historically hawkish pivot to address it. Indeed, very rarely has the Fed tightened policy so quickly. Truth be told, as one of the more hawkish strategists on the Street last December, I never would have bet the Fed would be doing multiple 75bp hikes this year, but here we are. Don’t fight the Fed.

While the June low for stocks and bonds was dramatic, we’ve consistently been in the camp that it wasn’t THE low for the S&P 500 in this bear market. Having said that, we are more confident it was the low for long-term Treasuries in view of the Fed’s aggressive action that has yet to fully play out in the real economy. It may also have been the low for the average stock, given how bad the breadth was at that time and the magnitude of the decline in certain stocks. Our more pessimistic view on the major index is based on analysis that indicates all of the 31% de-rating in the forward S&P 500 P/E that occurred from December to June was due to higher rates. We know this because the equity risk premium (ERP) was flat during this period. Meanwhile, forward NTM EPS estimates for the S&P 500 have come down by only 1.5% and P/Es are now 9% higher. With rates about 25bp below the June highs, the ERP has fallen once again, to just 280bp. This makes little sense in a normal environment but especially given the significant slowdown and earnings cuts we think are still to come.

With the Fed emphatically dashing hopes for a dovish pivot, we think that asset markets may be entering fire and ice part deux.

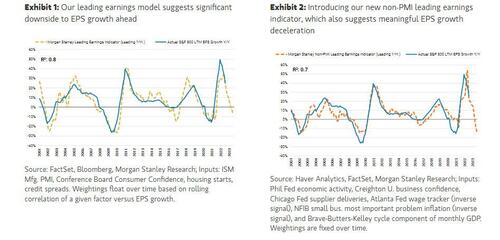

In contrast with part one, this time the decline in stocks will come mostly via a higher ERP and lower earnings rather than higher rates. Our leading earnings models are all flashing red for the S&P 500, and we have high confidence that the decline in NTM S&P 500 EPS forecasts is far from over.

In short, part deux will be more icy than fiery, the opposite of 1H22. That’s not to say rates don’t matter – they do – and we expect bonds to perform better than stocks in this icier scenario.

If Friday marked a short-term low for long-duration bonds (high in yields), the S&P 500 and many stocks could get some relief again as rates come down prior to the next round of earnings cuts. However, make no mistake, as the weather turns chilly this fall, so will growth, which will weigh mightily on stocks given the paltry ERP investors are getting paid to take this risk.

https://ift.tt/nlDu07C

from ZeroHedge News https://ift.tt/nlDu07C

via IFTTT

0 comments

Post a Comment