Mission Completed, But Mission Impossible Ahead

Today, the ECB hiked rates by 75bps, taking the deposit rate in Europe positive for the first time in a decade. That, according to DB's Jim Reid, was "mission completed."

The problem, however, as the next few charts from DB show is that "mission impossible" lies ahead.

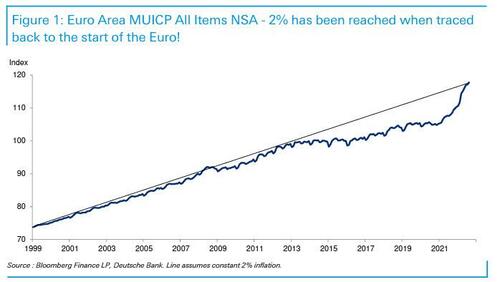

The first chart is a fun one that DB’s Robin Winkler pointed out to Reid: it shows that with last week’s higher-than-expected flash inflation print, the ECB has now hit its inflation target when traced back to the start of the Euro in 1999 as inflation has now compounded to exactly 2% per year since.

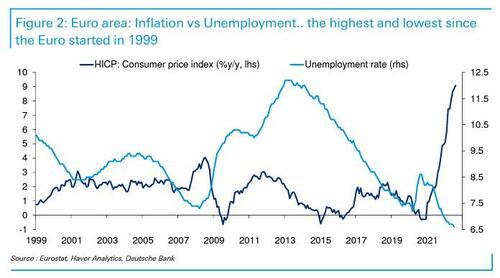

Obviously, the context of how we got there will not give the council much comfort and as the second chart shows the difficulties they face are unenviable, especially in the face of an energy crisis and war on their doorstep. Inflation is the highest since the Euro started but unemployment is the lowest.

The latter is good news but hints that the labor market in Europe is just as tight as in the US. So, it's hard for the ECB to just assume inflation is a transitory energy phenomenon and they therefore need to raise rates to ease the pressure on core inflation and wages to help ensure a self-fulfilling cycle doesn’t materialize.

That's why both the ECB and the Fed are now praying and hoping that a recession strikes soon, because the longer it takes for the economy to contract and the longer financial conditions have to be restrictive, the greater the pain and fallout once the hammer finally does hit, and the greater the monetary stimulus that will be required to reverse the damage that is being currently inflicted by central banks.

https://ift.tt/COX0x74

from ZeroHedge News https://ift.tt/COX0x74

via IFTTT

0 comments

Post a Comment