Stock Squeeze Continues As Bonds & The Dollar Dump Ahead Of CPI

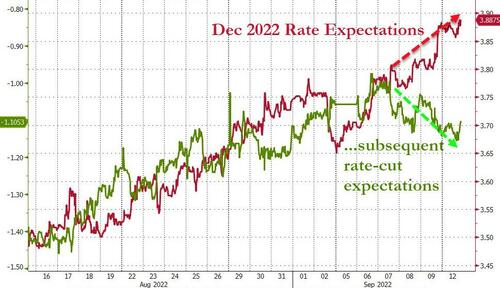

Ahead of tomorrow's CPI - which everyone and their pet rabbit seems to believe will confirm 'peak inflation' and a Fed Pivot - market expectations for rate-hikes continue to rise (hawkishly), however, market expectations for rate-cuts next year are recently shifting higher (dovishly)...

Source: Bloomberg

Stocks didn't care though as the squeeze continued - most-shorted stocks are now up over 14% from Wednesday's open...

Source: Bloomberg

Futures gapped higher at the open overnight, then faded; then surged again at the EU cash open, then faded; then ripped higher at the US open, then faded back; then squeezed into the US cash close. Small Caps and Nasdaq outperformed on the day, Dow lagged...

Notably, VIX rose along with stocks today as it seems like everyone is leveraging up into tomorrow's CPI print with call-buying dominating put unwinds...

Source: Bloomberg

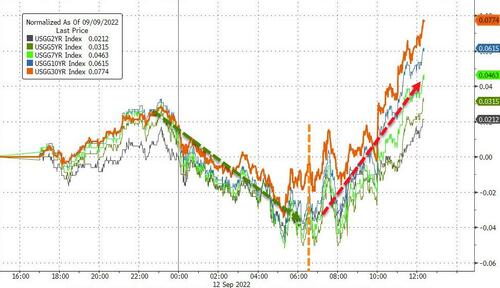

Overnight gains in bonds evaporated as the US session started (some heavy IG calendar), with sellers ripping yields higher and the 30Y underperforming...

Source: Bloomberg

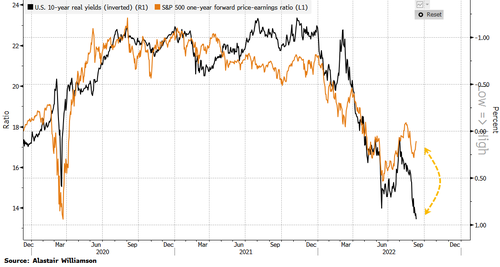

Either real yields need to tumble or equity valuations do...

Source: Bloomberg

The dollar dropped to 10-day lows today (back to Powell's J-Hole speech levels)...

Source: Bloomberg

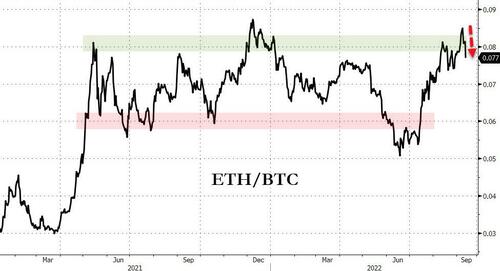

Bitcoin surged back to $22,500 today but Ethereum underperformed (after recent huge outperformance) ahead of 'The Merge'...

Source: Bloomberg

Oil prices were higher overnight then chopped sideways during the US session...

Gold also managed gains today, nearing $1750 intraday before selling off after Europe closed...

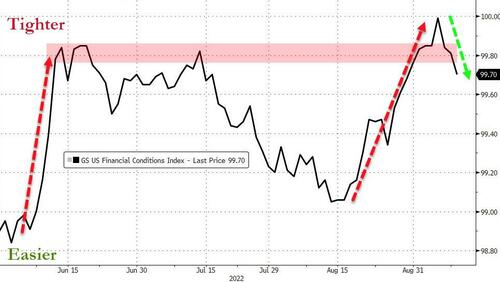

Finally, we note that as stocks have rallied recently, financial conditions have eased notably back from recent tights...

Source: Bloomberg

How long will Powell allow this 'easing' to last before he unleashes his hawkish hounds once again to slap equity bulls in the face?

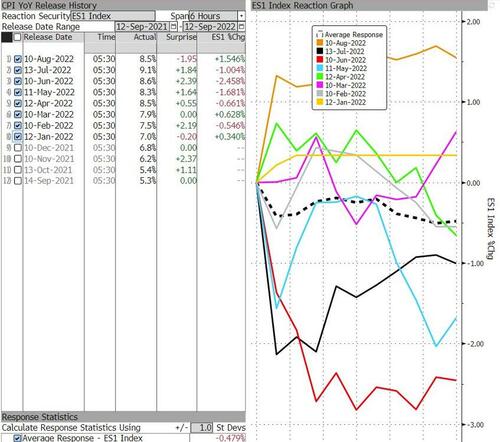

One more thing - so far this year, the S&P 500 has averaged a 0.5% loss on CPI release days (5 losing days and 3 winning)...

https://ift.tt/19iYLWk

from ZeroHedge News https://ift.tt/19iYLWk

via IFTTT

0 comments

Post a Comment