Stocks, Bonds, & Bullion Bid; Dollar Skids... Despite Fed Hawk-nado

Despite a pre-market hawkish story by Fed-Whisperer Timiraos on 75bps in September, and a super hawkish address from Fed Vice Chair Lael Brainard around lunchtime, US equities accelerated gains because of the dozens of hawkish comments she said (get inflation down is main focus, will take months to judge inflation trend, more pain to come, etc), she added one comment that warned of potential for 'over-tightening' - desperate much?

"We are in this for as long as it takes to get inflation down."

Stocks didn't care that the Atlanta Fed slashing its GDP outlook.

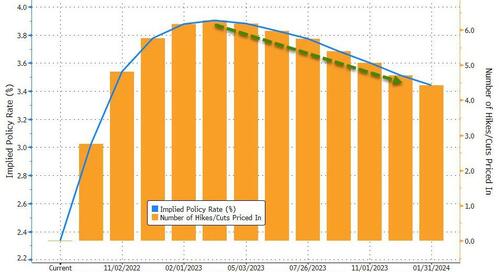

Stocks didn't care that Cleveland Fed President Loretta Mester confirmed that the economy will experience slow economic growth this year and next (and we note that the market is still pricing rate-cuts next year)...

Source: Bloomberg

AAPL's product day helped send shares of the tech giant higher and that dragged the major indices higher.

Source: Bloomberg

The Beige Book was its usual 'beige' self with some comments on weak growth and troubled households - which apparently was the catalyst late-day gains.

Aside from that we also had hawkish comments from Fed's Barr (inflation's "far too high") and Collins (inflation's "simply too high").

All of that sent the odds of a 75bps hike in September up to 90%...

Source: Bloomberg

“The market is starting realize that this Fed is going to keep tightening financial conditions,” said George Goncalves, head of US macro strategy at MUFG Securities Americas Inc.

“It’s a little chicken-and-egg, but if the market is pricing in more of a 75-basis-point hike, the Fed should take it.”

Inflation data will need to arrive well below forecasts to stop the Fed from “tightening expeditiously,” he said.

Stocks didn't care about anything today aside from ending the worst losing streak in six years. Nasdaq was up over 2% today and S&P almost 2%...

"For the last several weeks, the market read positive economic news as bad news, because it meant further tightening from the Fed," said Art Hogan, chief market strategist at B. Riley FBR Inc. "That counterintuitive reaction can only last for so long -- today investors are realizing they overreacted."

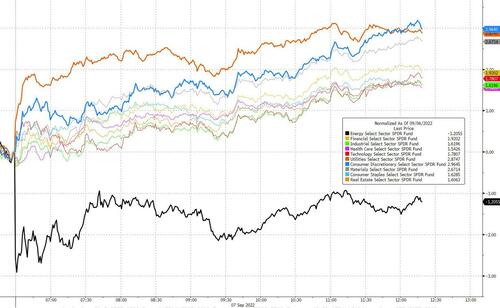

The fact that Utes and Discretionary stocks rallied - anchored to disparate themes like growth and rates - suggests this was nothing but a bear market rally again. Energy was the laggard...

Source: Bloomberg

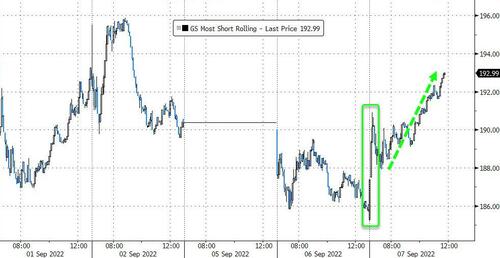

And the fact that "most shorted" stocks screamed higher today adds to that feeling...

Source: Bloomberg

As Goldman's Chris Hussey asks and answers:

Why might this be a bear market rally and not the beginning of a new bull market?

We don't think we've yet met the conditions for a decisive market trough. Low valuations are a necessary, although not sufficient, condition for a market recovery, and without an inflection in inflation and in interest rates, negative positioning, and the worst point in the economic cycle, we think this is not the start of a new bull market, but a bear market rally.

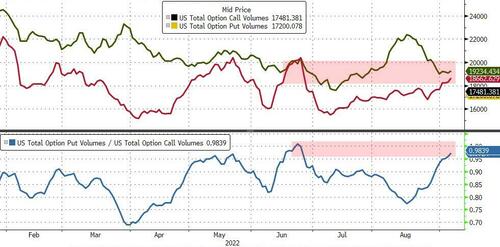

Also - put volume have soared back up to a key level relatrive to call volumes, that happens to match the low-bounce levels from mid-June...

Source: Bloomberg

Stocks are still down around 6% from Powell's Jackson Hole speech...

US Treasuries were bid today, erasing most of yesterday's losses (after a heavy IG calendar) leaving yields up only around 5-6bps from Friday...

Source: Bloomberg

We note that the 2Y yield stalled and fell back below the mid June highs today...

Source: Bloomberg

The dollar dived after 8 strong days higher...

Source: Bloomberg

Bitcoin bounced back above $19,000 are getting monkeyhammered yesterday...

Source: Bloomberg

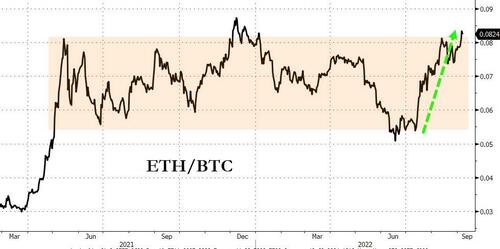

Ethereum has been quietly outperforming bitcoin in recent weeks...

Source: Bloomberg

Ironically, amid all the talk of inflation, Putin's threats, and India's rejection of Yellen's price cap, oil prices plunged on what looks like global recession fear capitulation, with WTI back below Putin-invasion levels. Additionally, WTI 'death crossed' today...

US NatGas prices plunged again to one month lows...

Gold bounced off $1700 once again...

Finally, we note the S&P 500 bounced off its medium-term trendline again but remains below the key 4,000 level...

As BofA noted, along with Goldman, and Michael Burry, "the bottom is not in yet."

https://ift.tt/Ew2F3vL

from ZeroHedge News https://ift.tt/Ew2F3vL

via IFTTT

0 comments

Post a Comment