When The Tide Turns, Brace For A Face-Ripping Yen Rally

As discussed earlier, the yen (and the yuan, and the euro, and pretty much every non-USD currency) is in the midst of a steep sell-off, but - as Bloomberg's Simon White warns - when the trend turns, underlying processes are primed to see it rise significantly.

As we pointed out this afternoon, the Japanese currency is on course for its weakest annual performance versus the dollar since at least the 1960s...

... and as White notes, on the surface the reason is simple: the Federal Reserve is raising rates aggressively while the Bank of Japan is keeping them ultra-low. But the underlying processes are less obvious

Understanding the yen means understanding capital flows. Japan is a net capital exporter, which means the capital flows of domestic investors, rather than foreign investors, are the dominant long-term driver of the currency.

Momentum is driving the yen now, but its fall this year likely has two principal underlying drivers:

- Japanese investors have been buying more foreign equities

- Rising energy prices are leading to more capital outflow

Yield differentials are having little direct impact. The rise in US short-term yields relative to long-term ones has made FX-hedged USTs unattractive to Japanese investors.

Instead, the Japanese have ramped up net purchases of foreign equities. Unlike debt, equity purchases tend to be unhedged or underhedged, meaning the flow is yen-negative.

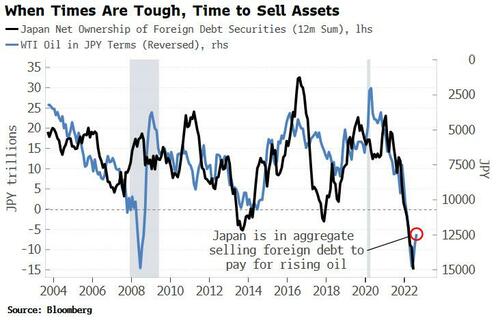

Rising energy prices are also leaning on the yen. In normal times, when energy prices are more contained, a weaker yen boosts exports and therefore Japanese growth. But growth is not picking up. Exports have risen, but imports have climbed even more, meaning the trade balance is now in deficit.

With not enough dollars from exports to pay for more expensive energy, in aggregate Japan is selling foreign assets -- mainly debt securities -- to get dollars. As debt is more likely to be FX hedged, unwinding the hedge is yen-negative as there is no offsetting capital flow back into Japan.

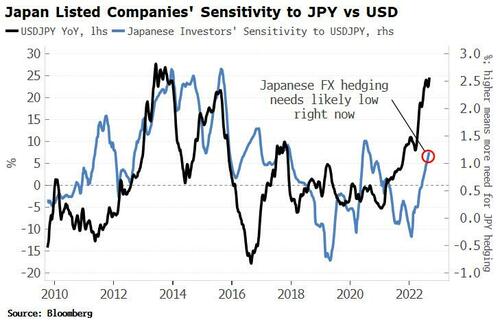

Normally a large yen-stabilizing flow would come from Japanese investors FX hedging their international portfolios, but it doesn’t look like this is happening. The chart below shows Japan listed-companies’ FX-hedging sensitivity is low right now. Simply put, if the trend in the yen is bolstering your returns, why stand in the way of it?

Moreover, foreigners have been largely absent from Japanese asset markets. Also, tourism has slumped. Japan has been all but closed to foreigners since the pandemic, taking the net annual travel surplus of over $50 billion in 2019 to almost zero now.

But here’s the thing about the yen -- it’s like a catapult. The more it’s stretched, the greater its propensity to rebound.

Japan is the world’s largest net creditor. Rather than triggering a capital outflow, any domestic shock in Japan tends to trigger net inflows as capital is repatriated. With a net international investment position (NIIP) of almost $3.5 trillion, the amount of capital returning is potentially vast, with a powerful strengthening effect on the yen.

The yen’s slide is slowing growth, making a real-growth shock more likely, especially as there are signs inflation is moving to a higher and unstable regime. Furthermore, the risk is increasing the government or central bank intervenes to stabilize the currency, or the BoJ abandons or loosens its cap for 10-year JGB yields.

Any of those would trigger a reversal in the yen that could very quickly become self-reinforcing. Firms would be more inclined to reset FX hedges if they thought the yen’s trend had reversed. Foreign assets would be sold for yen as capital would be returned home.

Demand for dollars to pay for energy would decline. Foreigners would be more inclined to buy Japanese assets if they thought the currency was on an upward trend. And as the border is gradually opened up, there will be plenty of pent-up demand for cheap Japanese holidays and business travel.

The yen after such a catalyst could very quickly change direction and rally hard. Suddenly, USDJPY at 120 looks more likely than USDJPY at 160. Options currently imply the second is seven times more probable than the first by the end of the year. As contrarian trades go, they don’t get much more compelling than a stronger yen.

https://ift.tt/9GsbIe0

from ZeroHedge News https://ift.tt/9GsbIe0

via IFTTT

0 comments

Post a Comment