How Bernanke Broke The World

Authored by Porter Stansberry via Porter & Company,

-

THE BIGGEST BUBBLE IN HISTORY DEFLATES

-

YOUR STANDARD OF LIVING IS GOING TO FALL IN HALF

Soon, you’ll wake up to hear reports on CNBC and Twitter about ATM machines not working across the country.

JPMorgan Chase CEO Jamie Dimon will appear on CNBC, to explain that for the good of the country, his bank and all the other banks in the country are buying long-dated Treasury bonds. And, to protect America, it’s important that we all take a pause and stop withdrawing cash from the system, which means a “temporary” shutdown of other banking operations for a week or two.

It will happen. It’s unavoidable.

A couple of interesting facts…

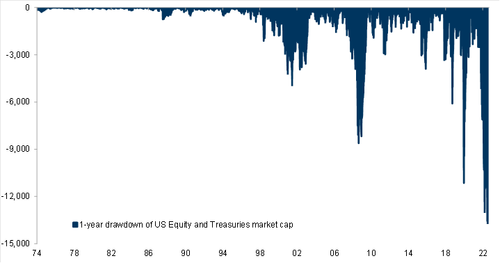

The price of U.S. Treasury bonds is collapsing. Since the end of July, the 10-year Treasury rate has risen sharply, from a yield of 2.65% to over 4.3% now. There haven’t been bigger losses in the U.S. Treasury bond market, EVER.

[ZH: The 1-year drawdown of US Equity and Treasury Market Cap is $14 Trillion, the largest draw that we have ever seen in absolute terms...]

Signs of inflation are fading, and the American economy is obviously heading into a severe recession.

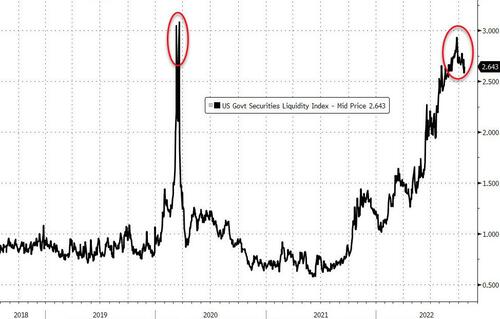

But rather than stabilizing – which is what usually happens – the selloff in longer-dated U.S. Treasury securities is intensifying, and liquidity is at its lowest levels since March 2020.

That suggests that the market doesn’t trust the dollar anymore. And that means the entire system is at risk.

Payback’s A Witch

The sell-off in long-dated Treasuries isn’t because of last year’s inflation. It’s because the market knows that the U.S. Treasury cannot possibly afford a real rate of interest on its massive $31 trillion in debt.

Think about it: this year’s increase in Social Security benefits payments is 8.7%. At even half that rate of inflation, a 2% real yield on a 10-year U.S. Treasury bond would be well above 6%. If the U.S. government has to pay anything like that rate of interest to roll over its debts (average duration is 5 years) in the coming years, it is already bankrupt.

There are $24 trillion worth of publicly traded U.S. Treasury securities. At 6% interest, that’s $1.4 trillion a year in payments. That’s roughly 40% of total federal tax receipts.

This same kind of panic struck last month in the long-dated bonds of Great Britain. Now, along with big declines in long-dated U.S. sovereign bonds, the Japanese yen is falling apart, and the Swiss National Bank is suddenly accessing currency swap loan facilities from the Federal Reserve.

Most worryingly, liquidity is disappearing in the U.S. Treasury market, the most liquid financial market in the world. Analysts at Bank of America wrote yesterday that “the [U.S. Treasury] market is fragile and potentially one shock away from functioning challenges.” That’s broker-speak for “we’re in uncharted territory here.”

We are on the cusp of a complete panic in the world’s bond markets. Like we explained last week, a global “Minsky Moment” is looming.

We think this crisis will be the largest the world has seen since World War II. That brought the end of sterling’s role as the world’s reserve currency. This will end the U.S. dollar’s reign as the world’s reserve currency.

What’s next is going to be incredibly painful. Most of the developed world is going to see its standard of living decline 30% to 50% over the next 4-6 years. There’s going to be a lot of anger and a lot of violence.

It’s worth remembering how we got here.

Lies, Damned Lies, And Printing Presses

I’m talking about Ben Bernanke. As the Chairman of the Federal Reserve from 2006-2014, he decided in the aftermath of the Global Financial Crisis that the banking system had to be saved, by any means necessary. To finance the massive losses – which were over $10 trillion in the U.S. alone – the world’s central banks began printing money and buying government bonds to finance massive bailouts.

Like squirrels watching a bank robbery, the members of the Nobel Committee – which recently awarded Bernanke the prize in economics – saw everything that happened and knew nothing about what it meant.

Printing money doesn’t cure economic problems: it simply skews who pays for them.

Printing trillions to paper over the financial system’s losses moved the egregious errors of Bank of America, Bear Stearns, Lehman Brothers, Goldman Sachs, AIG, Fannie Mae and Freddie Mac, General Electric, General Motors and others from their balance sheets, onto the balance sheet of the U.S. Treasury and the Federal Reserve.

Morally these actions are repugnant – much like requiring that taxpayers finance hundreds of billions’ worth of second-rate college educations for 10 million lazy, underachieving students – but on a vastly bigger scale.

The real problem isn’t financial. Printing money changes societies by giving the government virtually unlimited amounts of power. That warps the ambitions of politicians and gives socialists unlimited budgets. People soon believe every problem can be solved by the government and the printing press. Trade-offs are no longer required. Costs are no longer relevant. In this kind of environment, no problem is too big to solve through politics and the central bank. And if there isn’t a crisis, then one will soon be invented.

And, sure enough, as soon as the U.S. central bank began to sell assets and return to “normal” policies in 2018 and 2019, a new, even bigger crisis was “found.”

A novel coronavirus. Never mind that coronaviruses appear all the time and that most people will get and survive the flu a half dozen times in their lives… this time the world went completely nuts.

Everything was shut down for two years – except politics. Trillions were spent on vaccines – vaccines that don’t prevent you from getting Covid or from transmitting Covid. It was definitely a government vaccine: it cost trillions, everyone was forced to use it, and it didn’t work.

Nothing else worked during the Covid lockdown either. Kids don’t learn at home. Employees don’t work at home. Flimsy surgical masks don’t prevent you from contracting or spreading Covid – they don’t work, but they were required too. Fauci wore two masks, everywhere. He received four different shots of the “vaccine.” Guess who got Covid anyway?

Worst of all, the government spent unlimited sums of money on things like the ridiculous “paycheck protection program,” which might as well have been called “Fraud on a Federal Scale For You.”

The lie that we could print over the mortgage losses led directly to the lie that wearing a paper mask can stop a virus. Or that a vaccine created in a few weeks and tested only on a handful of people could stop a coronavirus that constantly mutates. With a printing press, there’s no problem that appears too big for the government to handle.

But, much like the “vaccine” and the paper masks, the printing press is just a lie too.

Altogether, the world’s central banks have printed over $25 trillion over the last 12 years.

In the United States, the printing was equal to more than 30% of our GDP. In the Eurozone, the printing was twice as large – over 60% of GDP. In Japan, the printing has been equal to over 100% of GDP.

You can think of these figures as being the size of the mirage we’ve been living in.

Reality looms.

Time to Opt-Out of “Money” Entirely

Our advice? Do everything you can to avoid holding the currency or the bonds of bankrupt western nations that have been trying to print their way to prosperity. And most importantly, do not let the current rally in the U.S. dollar fool you.

Yes, it’s the basis of the current monetary standard and, as such, in a crisis it is where all the banks will hide. It could continue to strengthen for several more weeks or months. But it has no more legitimacy than the euro or the yen. And it is only a matter of time – maybe only hours – before it will begin printing again, trying to keep the system from coming apart at the seams. Maybe it will work – but only after the value of the dollar (and the rest of the paper money) has fallen by 50% or more.

What will survive this crisis? Energy. Bitcoin. Land. Timber. Critical metals, like copper. High-quality, capital efficient businesses that aren’t in debt.

What will fail? Anything that has to refinance debt in the next 5-7 years.

https://ift.tt/d8rjLsE

from ZeroHedge News https://ift.tt/d8rjLsE

via IFTTT

0 comments

Post a Comment