Stocks Soar On Big Negative Delta Squeeze (Or Because "Our Economy Is Strong As Hell"?)

Stocks soared today. Take your pick why:

1) "Our economy is the strongest ever"

Joe Biden saying, “Our economy is strong as hell,” while eating an ice cream cone is so tone deaf and out of touch to what Americans actually see in their lives that it feels like the Democrats are intentionally tanking the election. pic.twitter.com/blkc4omdhd

— Clay Travis (@ClayTravis) October 16, 2022

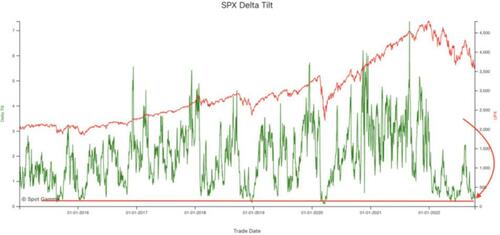

2) A massive negative delta squeeze...

As SpotGamma detailed earlier, indicators suggests markets are at “max put” positioning. One of the prime metrics for this is our Delta Tilt indicator, which shows that the ratio of put delta: call delta is at lows that has been related to stock bottoms...

Over the weekend, we pointed out that Friday's bloodbathery was dominated by hedge fund shorting, setting the market up for a major squeeze higher... yet again...

The overall Prime book saw the largest notional net selling in 4 months (-2.1 SDs), driven by short sales outpacing long buys nearly 5 to 1 – this week’s notional short sales ranks in the 94th percentile vs. the past year.

Setting the market up for the negative delta squeeze...

Here comes the delta steamroller https://t.co/j3Ccap1ki9

— zerohedge (@zerohedge) October 16, 2022

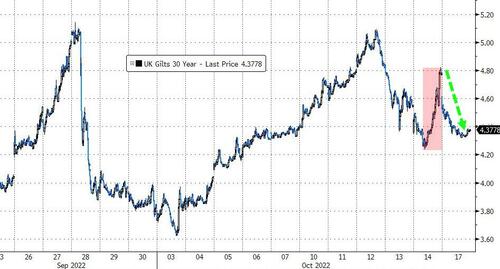

The day started off positively with the UK's new chancellor reversing all the scariest bits of Liz Truss' budget plan. Gilts were bid...

Source: Bloomberg

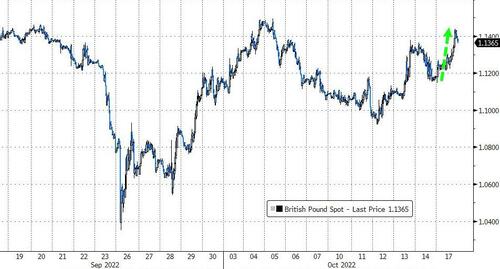

BRITCOIN rallied...

Source: Bloomberg

And all was well in the world once more... and the UK pension crisis is over, right?

“The UK LDI industry is the first casualty of the end of the ‘money for nothing’ era -- the first dead fish to float to the surface as rising central bank interest rates act like dynamite fishing in global asset markets,” Paul Marshall, co-founder of $62 billion investment firm Marshall Wace, said in a letter sent to clients this month.

US Futures rallied non-stop from their Sunday night open (as we warned they might after the extravaganza of shorting that occurred last week), and when the cash markets opened, the short squeeze accelerated hard, sending Nasdaq up over 3.5% (its best day since July 27th). The Dow rallied 2% at its highs and the S&P was up over 2.5%...

Notably, only The Dow is back in the green since before the payrolls print on 10/7...

"Most Shorted" stocks face-ripped at the open but notably that was it, the squeeze was over...

Source: Bloomberg

VIX fell back to a 30 handle today...

BofA's results today sent it soaring higher while Morgan Stanley remains the laggard. Goldman is flat ahead of tomorrow's earnings...

Source: Bloomberg

Bonds were also bid early on but as the equity market opened, yields started to rise. By the close, the 30Y yield was up 2bps but the short-end remained bid (2Y -4bps)...

Source: Bloomberg

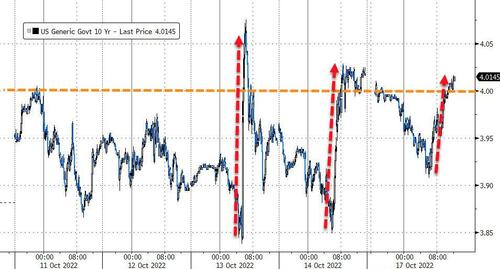

10Y yields bounced back above 4.00% later in the day however...

Source: Bloomberg

The 30Y yield also pushed back above 4.00% (above Friday's high yield) back to its highest since Aug 2011...

Source: Bloomberg

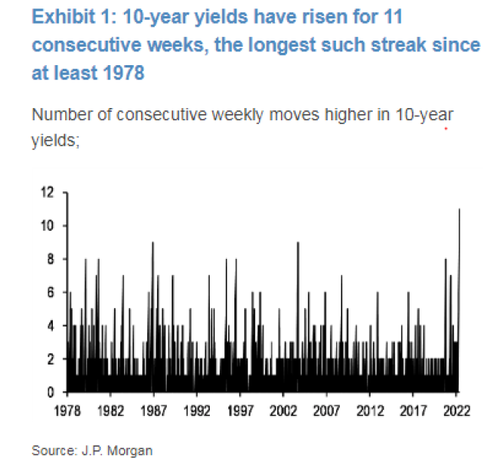

As a reminder, bond yields have already risen 11 straight weeks - the longest such streak since at least 1978...

Rate-trajectory expectations were basically unchanged on the day...

Source: Bloomberg

The dollar dived back down towards pre-payrolls levels today...

Source: Bloomberg

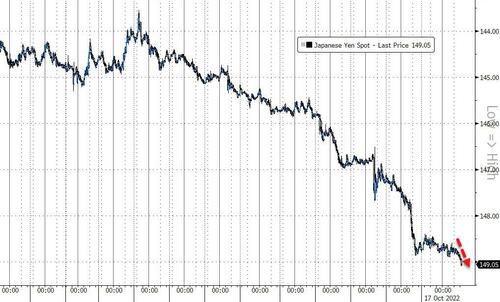

Despite the dollar weakness, JPY tumbled back above 149/USD...

Source: Bloomberg

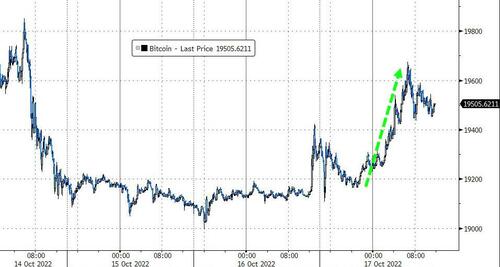

Bitcoin rallied back above $19,500 today...

Source: Bloomberg

Gold followed a similar path to bonds today, rallying overnight and then reversing at the US equity open...

Oil prices chopped around today with modest early gains giving way to a red close, but WTI traded in a narrow range around $86...

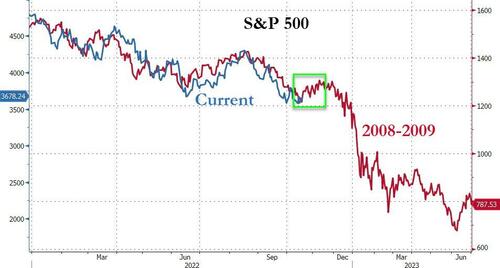

Finally, the question is whether this bounce can be sustained (on the back of an unwind of last week's epic negative delta). The 2008 analog appears to support that thesis... at least until the Nov FOMC meeting...

Source: Bloomberg

But, “this isn’t a Pollyanna moment,” said Robert Teeter, a managing director of Silvercrest Asset Management. “Inflation clearly remains a problem until proven otherwise, and disappointing earnings, particularly from consumer facing-companies, could trigger another rough stretch, with recession fears at the fore.”

https://ift.tt/9kD4Ycf

from ZeroHedge News https://ift.tt/9kD4Ycf

via IFTTT

0 comments

Post a Comment