"Approaching A Near-Term Ceiling" - SpotGamma On Market Positioning Into The FOMC

By SpotGamma

Summary:

Into the FOMC meeting and minutes Feb 1st, we believe the market is approaching a near term ceiling and downside opportunity exists in individual names which have recently been high performing or speculative (by buying put spreads).

Rationale for ceiling:

- We believe the market has front-run a policy shift by the Fed

- We have near term resistance at 4100 at our Call Wall with peak resistance at 4200

- With current IV levels being low, and also under equivalent measures of realized vol, there is reduced fuel for a squeeze

Full note on implied volatility compression here.

Downside opportunity:

- Specific names like ARKK and TSLA have had very strong recent runs

- The entire QQQ complex is up 10% in January, fueled by short-covering and 0DTE options

Additional Context:

Implied volatility compression (1 month IV < 30 day Realized Vol) in the SPX has been a signal that has marked equity market tops over the past year. This IV compression is in play now after huge rallies in equities, particularly in “speculative” names like ARKK (+29% in January) and in tech (QQQ +10% in January). We believe that much of the force behind this rally was driven by the combination of short covering and ultra-short dated trading activity like 0DTE.

Along with sharp moves higher in tech, we’d also highlight that “value” stocks are back to all time highs.

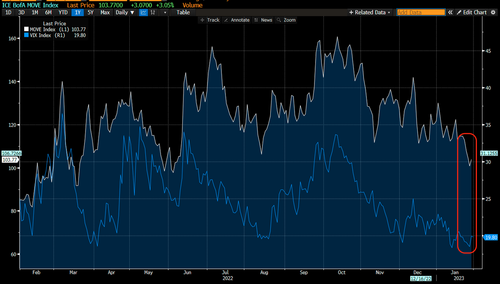

Last week, IV further compressed as strong treasury auctions led to the MOVE index collapsing, which likely persuaded the VIX to touch 1 year lows of 18 on Friday. Note, too, the MOVE Index is now at 100 - the same level it was into the August highs. It was then at Jackson Hole wherein a hawkish Powell marked a major interim high.

Linked to this, its clear that put demand is reflecting a much more sanguine environment ahead.

Our conclusion here is that if markets want higher out of FOMC, there may be a fairly limited rally due to the sharp moves already made YTD. At the end of the day, interest rates are ~4% higher than 1 year ago which should reduce equity valuations year over year, making upside over 4300 uncompelling.

We also believe that traders are positioned to expect this bullish impulse out of FOMC, which can drain upside momentum. We therefore think that the best risk/reward positioning here into FOMC is to own puts/put spreads in the speculative/tech names which have rallied the most YTD. Any neutral to negative sentiment from the FOMC would likely hit those names asymmetrically.

More from Spotgamma here

https://ift.tt/xGz5pJS

from ZeroHedge News https://ift.tt/xGz5pJS

via IFTTT

0 comments

Post a Comment