The Beginning Of The End Of The Credit Cycle

Authored by Simon White, Bloomberg macro strategist,

The credit cycle is turning, which points to wider credit spreads, increasing loan-losses at banks, and rising equity volatility.

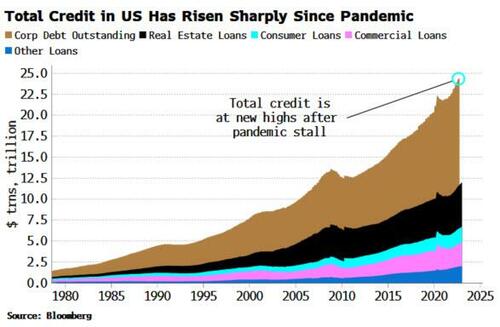

Credit has exploded higher since the pandemic. But all good things must come to an end, with credit busts typically following close on the heels of credit booms. Cracks are now emerging in lending markets as the sharpest monetary policy tightening in decades begins to bite.

The recent expansion in credit was across the board, from leveraged and private loans to corporate debt and bank loans. There was a brief retracement as some of the fiscal support extended to private lending was withdrawn after lockdowns were eased. But with monetary policy still extremely loose, credit took off again, soon making new highs.

Rapid expansions in credit are rarely a good thing as the quality of lending tends to deteriorate, ultimately leading to a bust as many loans go bad at once. This cycle has been no different, with more loans made at lower spreads, with fewer protections for lenders, and to lower-rated borrowers.

But after the feast comes the famine. The credit cycle operates in a well-defined sequence: first lending conditions tighten, then demand for loans falls, followed by a fall in loan supply. Loan delinquencies then increase as it is harder to get new credit, followed by a rise in charge-off rates as losses are realized. Finally, bankruptcies and defaults rise as loan losses lead to insolvencies.

Lending conditions have been tightening since October, based on the Fed’s Senior Loan Officer Survey for banks. This is leading to demand for loans falling, which in turn points to weaker loan growth.

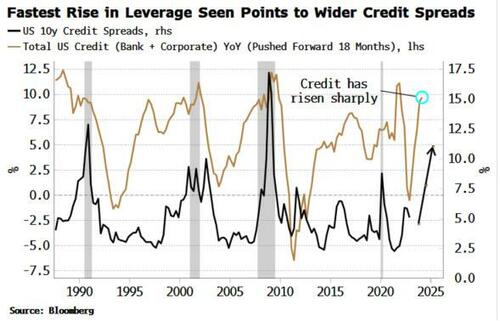

This tightening in conditions is not confined to bank lending - we are also seeing it in corporate debt, which dwarfs banks loans in size by about eight times. Credit spreads have widened markedly since the Fed has been raising rates.

I expect this trend to continue given the extraordinarily rapid rise in leverage since the depths of the pandemic. As the chart below shows, leverage leads credit spreads by about 18 months. This is because the bad lending that inevitably occurs during credit booms leads to stress on firms’ capital structures as old loans cannot be rolled due to tighter and pricier new lending.

Thus, despite the tightening in credit spreads seen in recent months, they are likely to begin widening again.

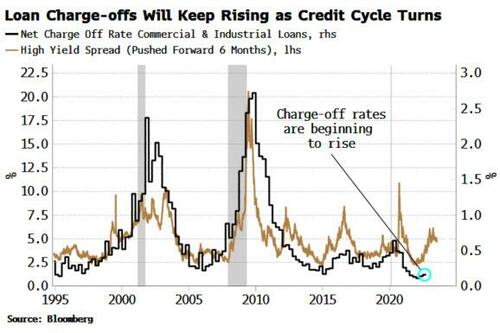

The most lagging parts of the credit cycle are delinquencies, charge-off rates and bankruptcies.

These peak during or after the recession, but begin rising before it. Delinquencies are slowly rising across loan categories, including credit cards, auto loans and mortgages.

Charge-off rates are beginning to climb as well. Wider credit spreads are a leading indicator for the further rise in loan charge-offs banks will soon see.

Lenders, including Bank of America and JPMorgan, have been increasing loan-loss provisions in preparation for a downturn or a recession. Still, loan-loss provisions for US banks remain more reflective of a zero-interest rate world, and are below where they were in the 1990s, a period with significantly above-zero rates similar to today. Banks are at risk from being underprepared for a potentially deep recession.

Cracks are also beginning to emerge in some of the most speculative parts of credit markets, such as leveraged loans. While a tiny sector compared to corporate credit, it is a harbinger for overall sentiment. Leveraged loans to junk-rated firms have been getting downgraded at the fastest pace since the pandemic, according to Citi, while leveraged-loan holders have a high sensitivity to rising rates due to floating-rate repayments and less hedging.

Weaker credit markets and wider credit spreads will also lead to higher equity volatility. The VIX has been missing in action this past year. After hitting 39 last January, it has remained below this level all through 2022 to now, despite one of the worst bear markets in over a decade.

A reduction in equity positioning leading to a reduced need for deep out-of-the-money downside protection is likely part of the reason, but that will change in a credit downturn and recession. Equity is just the thin sliver of capital between a company’s assets and liabilities, and when the capital structure comes under strain due to bad loans, the equity gets stressed leading to rise in equity volatility.

Loan and corporate-debt issuance has slowed this year compared to last, but the penny has not yet dropped that the credit cycle is on the cusp of turning, and could deteriorate significantly in the coming quarters - turbocharged by an impending recession. As always in markets, pay attention to what is going to happen, not what is happening, and prepare accordingly.

https://ift.tt/DQgJW7n

from ZeroHedge News https://ift.tt/DQgJW7n

via IFTTT

0 comments

Post a Comment